- Home

- Day to Day Bookkeeping

- What is Sales Tax

What is sales tax

Sales tax is a consumption tax imposed by the government or tax authorities on the sale of goods and services. It is levied on products consumed which differentiates it from income tax that is levied on earnings.

Knowing exactly how much sales tax to apply and when to apply it can be tricky for business first-timers, but it is essential for a small business to process sales tax correctly for the purpose of:

- being compliant with the governing tax authorities

- portraying a professional image to customers

- accurate financial accounts

So, What is sales tax?

Simply put, sales tax is a percentage of the selling price added to the selling price.

It is primarily the consumer (customer) who bears the cost of the sales tax

The business making the sale manages the calculation and collection of sales tax.

Sales tax is charged at the point of purchase, so when your customer makes a purchase from your business, you will calculate the sales tax and include it on the sales invoice to them.

Your customer pays sales tax to you, you pay it on to the tax authorities.

It is a pass-through tax which means that your business collects it from the consumer on behalf of the tax authorities, and at the required time you will pay it to those tax authorities.

It isn’t coming out of your pocket as a business owner, but it is your responsibility to manage it.

Keeping a good budget will help you to avoid spending the sales tax you collect so that those funds are available when it’s time to remit the sales tax.

What is Sales Tax Used For?

Sales tax is a revenue for your state or country.

By law, you have to collect, manage and report on sales tax, and if you are late with paying it to them you will have to pay penalties.

Though the government doesn’t pay you to do this task for them, you should ultimately benefit from what they do with the funds such as:

- investing it in public services like education, transportation, and public safety, and

- maintaining and improving the infrastructure and services within a state or country.

different types of sales tax

Sales Tax versus Value Added Tax (VAT) and Goods and Services Tax (GST)

Sales tax is a single stage tax applied only at the final sale to the consumer.

The USA uses single stage tax, and each state governs their own sales tax rates and rules. There is no sales tax at a national level.

VAT and GST are multi-stage taxes. The sales tax is collected at each stage of the production process where value is added, and then finally to the consumer who has to also pay VAT or GST.

Countries like the UK and South Africa use VAT.

Others like Canada, Australia and New Zealand use GST.

GST and VAT are basically the same in characteristic as each other and only differ in the way the country using them sets the rules and the rates.

In most cases, the businesses in these countries can claim back the VAT or GST paid by them on purchases for the business.

sales tax rates

In the USA: every state has their own sales tax rates, and these rates will differ based on the type of product sold and are affected by factors such as whether or not the business has a nexus in the state, or if the buyer is required to pay sales tax, if certain exemptions apply and so on.

Here are some sales tax resources for small businesses in the US

Other Countries: Most countries use the same broad-based sales tax rates on a national level no matter the type of product or the region – for example all across Australia the GST rate is 10%. All across New Zealand GST is 15%.

In the UK, the standard VAT rate is 20%, with another reduced rate of 5% on some products.

In Canada, some regions have a GST of 5% and a provincial tax (PST) of either 7% or 6%; and some regions use a harmonized tax (HST) of 15%

You can do an internet search specific to sales tax for your region to find sales tax resources for your business.

How to calculate sales tax

The sales tax calculation is straightforward for everybody.

First, identify the applicable sales tax rate for your location.

Then, multiply this rate by the selling price of the goods or services.

Here is an example for better understanding:

If you sell a product that costs $112 and the sales tax rate is 8%, the sales tax would be $8.96:

Product Price: $112

Sales Tax Rate: 8%

Sales Tax: $112 x 8% = $8.96

Total Cost to Customer: $112 + $8.96 = $120.96

Accounting for Sales Tax

It’s important for you to seamlessly integrate the process of collecting, recording, and remitting sales tax into your regular business operations.

Using modern accounting software can help automate and speed up much of this process, ensuring accuracy and compliance assurance.

If your business runs an accounts receivable system, find out if your business must pay sales tax by date of sale (sale basis) or by date of payment received (cash basis).

How to "Do" Sales Tax

The bookkeeping process for charging and collecting sales tax goes something like this:

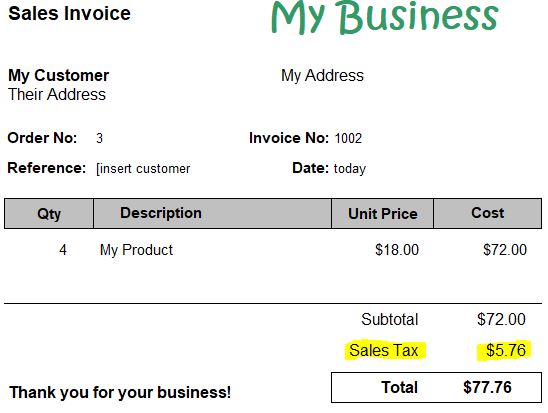

Sales Invoices: Issue a full sales invoice to the customer, clearly itemizing the sales tax as a separate line to show how much tax the customer is being charged. Note: There is usually no need to display the percentage of sales tax. The example invoice below shows the sales tax using an 8% rate.

What is Sales Tax on a Sales Invoice

What is Sales Tax on a Sales InvoiceSales Tax Account Category: In your bookkeeping records, the sales tax is typically recorded in a liability account on the balance sheet since it is collected on behalf of the government and is owed to them until remitted. You might see this account named something like "Sales Tax Payable" on your balance sheet. Sales tax is not recorded as income on your profit and loss report because it isn’t your income.

Sales Tax Report: A sales tax report can be produced when you want it to show how much sales tax is collected and be detailed enough to show you the dates and products/services or customers.

Sales Tax Return: This is usually done on a monthly or quarterly basis, depending on the rules of your local tax authority and involves filing* a specific sales tax return. The information is taken off your records or sales tax report.

*”Filing” just means lodging your report with the authorities.

If you are subject to GST or VAT your reports and returns will also show the sales tax you paid on business purchases.

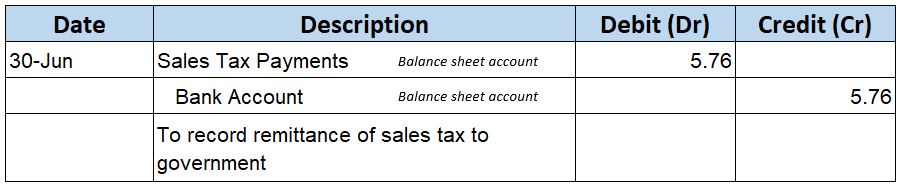

Sales Tax Payment: You will then remit the payment to the tax authorities by the due date; this will reduce the balance owing shown on your balance sheet.

Sales Tax Journal Entries Examples

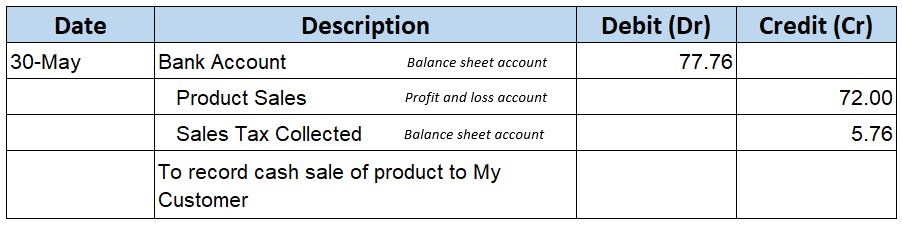

These journal examples are normally automated entries made by your bookkeeping software and you wouldn’t notice them unless you go looking for them in your software.

These journals are how the software moves the data from the sales invoice to the accounts from which reports are produced. Anyone learning manual bookkeeping will find these journals useful.

What is Sales Tax Journal Entry on a Sale

What is Sales Tax Journal Entry on a Sale Sales Tax Journal Entry for a Payment to the Tax Authorities

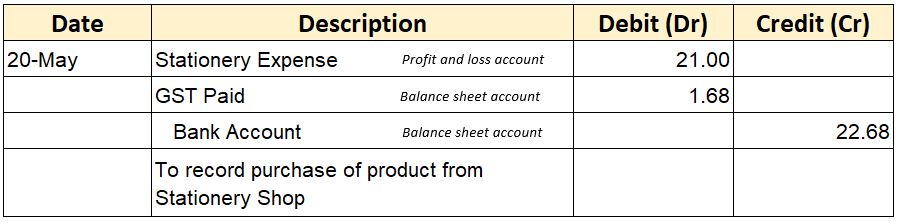

Sales Tax Journal Entry for a Payment to the Tax Authorities Sales Tax Journal Entry Example for GST on an Expense

Sales Tax Journal Entry Example for GST on an ExpenseWhat is Sales Tax - Tips for Small Business Owners.

For small business owners, understanding and managing sales tax can seem daunting. However, with the right tools and approaches, it can become a part of your routine that supports your business' financial health:

- Keep an eye out for any changes to sales tax rates and regulations in your region to save yourself from compliance issues and penalties. Sign up with your local authorities to receive notices about any sales tax changes.

- For transparency, and to keep good relations with customers, make sure that you specify whether or not your advertised selling prices include sales tax or not.

- Diarize key dates that apply to the regular deadlines for filing sales tax returns and paying the sales tax. Set reminders or alarms on your mobile phone so you don’t forget!

- Make the most of technology to assist you with the sales tax processes and save you tons of time. Many accounting and point-of-sale systems can automatically calculate sales tax based on current rates, reducing the risk of errors.

- Consult with a tax professional if you’re ever unsure about sales tax rates or specific sales tax rules. They can offer guidance tailored to your business location and industry, including what software would benefit you.

- Whether you're a small business owner, a bookkeeper, or just stepping into the world of business, understanding "What is Sales Tax" and managing it properly is a key component of growing your business and running a successful operation.

what is sales tax summary

Sales tax is a consumer tax charged at the point of sale to your customers. As a business owner or bookkeeper, it is your responsibility to find out how to calculate sales tax, what the percentage rates are in your location, to track how much sales tax you collect, to file a sales tax return and to pay the sales tax to your local tax authorities. Bookkeeping software can help you automate this process and diarizing key dates will help you stay on top of your obligations to avoid penalties.