- Home

- Profit and Loss

Profit and Loss Statement

A profit and loss statement is the number one report for any business including sole proprietors and the self-employed, because it shows the results of income minus expenses.

Is it making a profit or a loss? Is it earning more income than spending on expenses?

This statement is a business report taken out of the bookkeeping records for a period of time such as one month or one year.

The profit or loss result is a major factor in calculating how much tax to pay to the government.

This report is only as good and accurate as the data input to the bookkeeping system.

You can either click on the quick image links below for extra information, or scroll down to read about the basics.

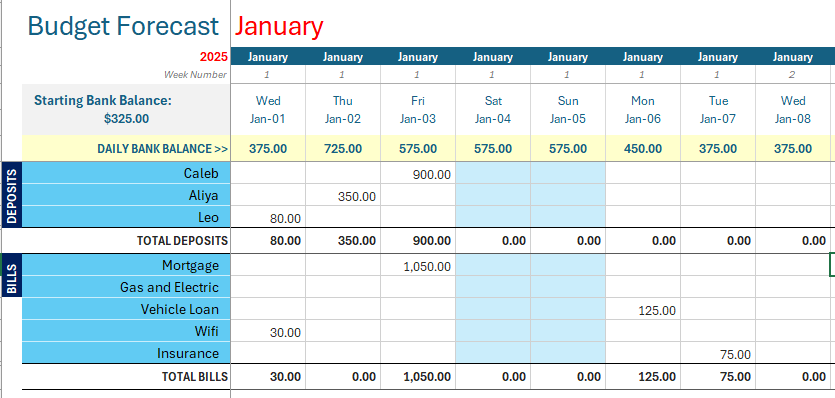

Click above button to get our most popular Excel Template for easy bookkeeping! It's free.

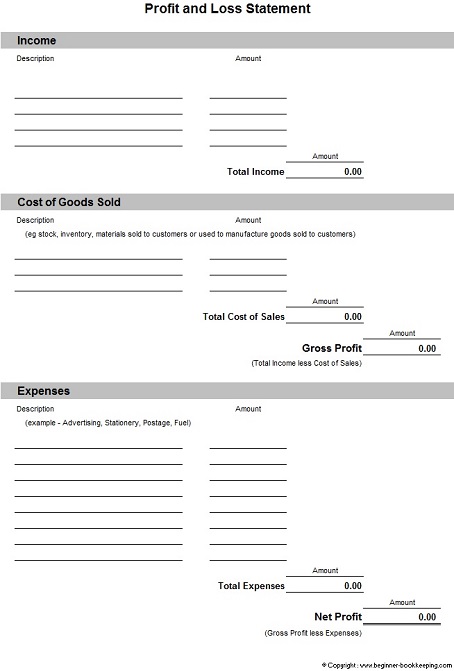

Click or tap the download for a free profit and loss template form in excel, that can be fully customized, and looks like the sample below (until you customize it!!).

Sample Profit and Loss Statement

Other names for a profit and loss Statement

The statement lists the Income and Expenses, which is why it also goes by the name of:

- Income and Expense Report, or

- Income Statement, and

- It is also known as the Statement of Financial Performance.

What information is found on a profit and loss report

The following information is found on a profit and loss statement :-

- All the Income

- All the cost of goods sold (also known as Cost of Sales)

- All the deductible business expenses

- The accounting profit or loss result

what information is not found on the income statement

It does not have the following information:-

- Assets

- Liabilities

- Equity

…..these details are included on another report - the Balance Sheet.

How often should a profit and loss report be produced

The profit and loss statement can be produced weekly, monthly, six monthly or annually, or even for one day!

However, preparing this report once a month is the most recommended and usual time frame for keeping an eye on how the business is doing.

It can be based on accrual figures or cash figures.

This report is used for a number of purposes some of which are listed below.

What is a Profit and Loss Report used for?

To Calculate Tax

If a net profit is earned, this figure will be used towards calculating the Income Tax payable to the government.

This is done at the end of every financial year (every 12 months).

If the year end result is a loss, there will usually be no income tax to pay because losses are tax deductible but they are not so good for the day to day running of the business as it means the cash flow will be tight and it will be difficult to cover expenses.

For Loan applications

If the business is applying for a financial loan, the loan provider (like a bank) will want to see the applicant's Profit and Loss Statement to analyze if loaning money to the business is a viable step.

To check the cost of goods sold

To help the bookkeeper pin-point if the business is recouping its cost of goods sold. i.e. is the business on-charging to customers all the direct costs it incurred to complete a job?

Analyze Business Trading Trends

A chart of monthly summary figures taken from the Profit and Loss statement is useful for showing the trends of business trading, such as the rise and fall of income and expenses.

This gives the owner an opportunity to analyze the activities of the business and investigate why, for example, income in one month was much lower than another month which leads to the next point.....

...As an aid to improving business operations

To help business management work out ways of improving business operations such as where to cut down on expenses.

the profit and loss statement accuracy

As mentioned above, this report is based on all income and expenses which are earned or spent by a business.

The accuracy of this statement is only as good as the entries that are made into the bookkeeping system by the bookkeeper or owner. This is why it is important to:

- know what type of expenses can be included as deductible expenses (ones that reduce tax payable) - claiming personal expenses as business ones is not acceptable

- enter all money earned so that the business is not under-declaring income - doing so means you pay less tax but you can be penalized by the tax department if they find out

- ensure balance sheet type payments go on the balance sheet and not the profit and loss statement - such as loan repayments, personal expenses, asset purchases

- process a reconciliation for each bank account, credit card or online payment system like Paypal, at least once a month to ensure that all payment transactions are captured and included in the accounts

Back to Top: Profit and Loss Statement

Facebook Comments

Leave me a comment in the box below.