- Home

- Business Bookkeeping Software

Business Bookkeeping Software

Updated December 2024

Pinpointing the best business bookkeeping software for your small business can be overwhelming with all the options out there.

Some of the most popular options available to use are Xero, QuickBooks and FreshBooks.

Below, I have prepared a comparison of Xero, QuickBooks and FreshBooks summarizing their different plans, and there are some tips to help you choose which one you would like to use.

Further down the page I discuss free software options that are great for small businesses on a budget.

All prices are in USD and correct as of December 2024.

These providers sometimes offer special discounts. Click on the blue buttons below to take you to their websites and see what discounts they currently offer - the prices I have listed below in red are before the discounts.

I may earn a small commission only from FreshBooks at no extra cost to you - see my Affiliate Disclosure

Note : you can start with cheaper options and upgrade to the more expensive plans as your business grows.

Xero

Try all plans free for 30 days

Xero Early - $20/mo

Send 20 invoices and quotes

Enter 5 bills

Connect your bank

Reconcile bank transactions

Capture bills and receipts

View financial reports

See the Xero Accounting Software channel on You Tube for Customer Stories.

Xero Growing- $47/mo

All Early features, plus:

Unlimited invoices and bills

Bulk reconcile transactions

Xero Established - $80/mo

All 'Growing' features, plus:

Multi-currency

Track Projects

Claim expenses

Xero Analytics

Gusto Payroll - connect your Gusto account to Xero for all plans.

QuickBooks

Try all plans free for 30 days

QB Solopreneur - $20/mo

This does not show on the button above but can be found here.

Send/track simple invoices

Maximize schedule C deductions

Calculate quarterly estimated tax

Mileage Tracking

QB Simple Start - $35/mo

Free guided setup

Track income/Expenses

Connect banks & credit cards

Maximize tax deductions

Send invoices and estimates

Receive payments

Manage 1099 Contractors

Track sales tax

View general reports

Connect a sales channel like Amazon.

See QuickBooks customer stories on their website.

QB Essentials - $65/mo

All Simple Start features, plus:

Manage Bills

Track employee time for invoicing and projects

Connect 3 sales channels

Includes 3 users.

QB Plus - $99/mo

All Essentials features, plus:

Inventory

Project profitability

Connect all sales channels

Includes 5 users

QB Advanced- $235/mo

All the above plus:

Employee expenses

Custom access controls

Premium apps

Workflow automation

24/7 support & training

Better analysis and reporting

Includes 25 users

FreshBooks

Try all plans free for 30 days

FeshBooks Lite - $19/mo

Send estimates and invoices

Up to 5 clients

Get paid with Credit Cards and Bank Transfers

Reports for easy tax time

See FreshBooks customer case studies on their website.

FreshBooks Plus - $33/mo

All Lite features, plus:

Send estimates, proposals and invoices

50 clients

Recurring bills

Capture receipt data

Financial/Accounting Reports

Invite your Accountant

FreshBooks Premium - $60/mo

All Plus features, plus:

Unlimited clients

Capture bills

Track project profitability

Customize email templates

FreshBooks Add-ons for all above plans:

Team Members $11/mo per user

Advanced Payments $20/mo

Gusto Payroll - connect your Gusto account to FreshBooks

FreshBooks Customize

Contact them to customize your plan.

Xero and FreshBooks do not have desktop versions of their software. QuickBooks is moving away from Desktop but still have these available as of Aug 2023:

QuickBooks Desktop

Enterprise starting at $1,922/year

History of xero

Xero was released in 2007 by New Zealander Rod Drury and has grown at a phenomenal rate. It has taken the international accounting scene by storm with its innovative cloud software. Xero can be used in most countries.

history of quckBooks

In 1983, Intuit (founded by Scott Cook and Tom Proulx in America) released a program called Quicken for individuals to manage their personal finances, and in the late 90’s, early 2000’s they released QuickBooks for small to medium business accounting. They also came out with Turbo Tax for preparation and online filing of taxes. QuickBooks can be used anywhere in the world.

history of freshBooks

FreshBooks business invoicing software was developed about 20 years ago by a businessman looking for a smarter way to invoice customers after he accidentally wrote-over a customer invoice in his spread sheeting software.

What started as simple invoicing software has grown into fully functioning but easy to use bookkeeping/accounting software. More than 30 million people in over 160 countries have used FreshBooks.

which business bookkeeping software should You choose?

All this information is great, but you might still be sitting there thinking “yeah, how does this all help me to choose just one”!! Read on for more help deciding.

Make a list of what your business needs out of a bookkeeping package. Below is a basic list to help you.

Tick the ones that apply to you and then compare with each software brand to see which brand is a good fit and a price that your business can afford.

Below are some suggestions of which software to consider.

Requirements and Suggestions

Sales

Do you need to issue more than a handful of sales invoices and track customer payments?

- Use QB Self Employed | Simple Start

- Xero Growing

- FreshBooks Plus

Purchases

Do you want to enter and track your bills and payments? (plus sales mentioned above)

- Use QB Essentials

- Xero Early | Growing

- FreshBooks Plus

Income and Expenses

Do you just want a simple income and expense tracking option without the first two mentioned above?

- Use QB Self Employed | Simple Start

- Xero Early or

- FreshBooks Lite

Inventory or Point of Sale

Do you sell stock and want to track your inventory purchased, sold and stock on hand?

- Use QuickBooks or Xero with add-on apps

- here is what FreshBooks says about inventory

Size

Is your business very tiny with very few banking transactions, or requirement of sales invoicing, or do you work on the side and need help with tax calculations?

- Use Xero Early | Growing

- QB Self-Employed | Simple Start

- FreshBooks Lite

Final tips for choosing the best business bookkeeping software

These are all very good, well established, award-winning, international software options so you won’t be making a bad decision no matter which one you choose.

You could sign up for the free 30 days trial on the two you like the most and use that time to explore them all, practice entering data on their demo/dummy companies if they have one, check out their help and support pages and videos, and generally see which one you get a good feel for.

If you have an accountant, you could get their advice, but you need to know that if they are partnered with just one of these brands, they may only promote that one brand to you. Which is fine because it means they will (or should) know the software inside and out and may be able to provide you with a Partner price (meaning you could get that software cheaper than what you would get it yourself) and good support – but this will depend on the type of Accountant you have.

If you don’t want to pay for bookkeeping software, go check out the free options available, see further down this page (I only recommend the best ones I can find) or if you want to work within Microsoft Excel to do your basic bookkeeping, check out my Excel templates.

why to choose paid Business bookkeeping software over free software?

You will get a software that is specifically tailored to your country which is helpful when you have to for example track sales tax and want to use a software that produces a report that matches the one required by your local government for you to file with them.

For example, if you are in Australia or New Zealand you may find it better to use Xero or MYOB which are well streamlined for BAS or GST and can optionally link to the government portals for filing of sales tax returns.

It's also good if you have payroll to process alongside your normal day to day bookkeeping and want the payroll data to be automatically updated within the accounts.

Free business bookkeeping software

These are genuine, free programs that any small business, sole trader, or student can use.

Click on graphic below which will take you to our page of free software downloads

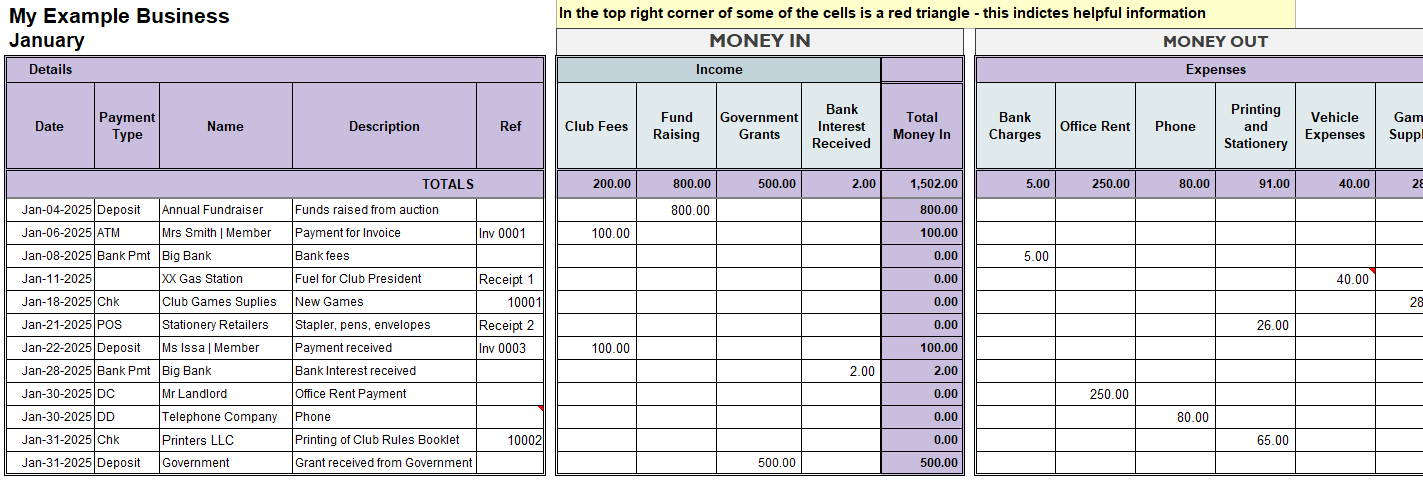

Simple Business Bookkeeping Software

(Cash Book)

If your business is simple and has a low number of business

transactions then you could manage your bookkeeping in spreadsheet

software, avoiding the need to purchase an actual bookkeeping program.

Click the thumbnail below to go to a downloadable excel cash book.

Your bookkeeping system can be a simple cash book which is easy to set up in software like Excel or OpenOffice.

If you own a computer then the chances are you already have Excel.

If you do not have Excel you can download OpenOffice or use Google Docs (Sheets).

What constitutes a small business with few transactions? One example is a rental property owner with a handful of houses or less who needs to record things like:-

- Rental payments received

- Repairs and maintenance expenses

- Mortgage payments

General Ledger Accounting Software

If you know anything about the double entry bookkeeping system and debits and credits then you may like to try a general ledger program.

General ledger accounting software makes it obvious that you are using a double entry method because you have to enter the debits and credits yourself.

It is an excellent way to learn the double entry system.

Standard business bookkeeping software programs use the double entry system but because it operates as part of the 'background' calculations many bookkeepers and administrators do not know it's there or even what double entry bookkeeping is even though they use it every day!

Our free software page details a general ledger program.

Web Accounting Software

Another term for this is 'cloud accounting' or 'cloud computing'.

It simply means you log into an online bookkeeping program from your web browser and maintain the company records there.

Benefits of keeping your books online are:-

- There is no

need to download bookkeeping software onto your hard drive.

- No need to worry about constant backups in case your hard drive crashes.

- Everything is kept online,

backed up on the providers servers, automatically updated with

improvements and if your computer crashes you know your information is

safe, because it's online.

- You can access your records from any computer, making it easy to access when you are traveling.

Check out more information about bookkeeping in the cloud.

Facebook Comments

Leave me a comment in the box below.