- Home

- What is Sales Tax

- How is Sales Tax Calculated

How is sales tax calculated

introduction: how is sales tax calculated

How is sales tax calculated on products or services?

The formulas involved in calculating sales tax are simple.

The calculations are made by converting percentages to decimals, then to multipliers.

This small guide goes through the mathematical calculations involved in reaching sales tax amounts, with practical examples and common errors to avoid.

Using bookkeeping software will avoid sales tax calculating issues, but it is good to understand the basic math formulas behind the process.

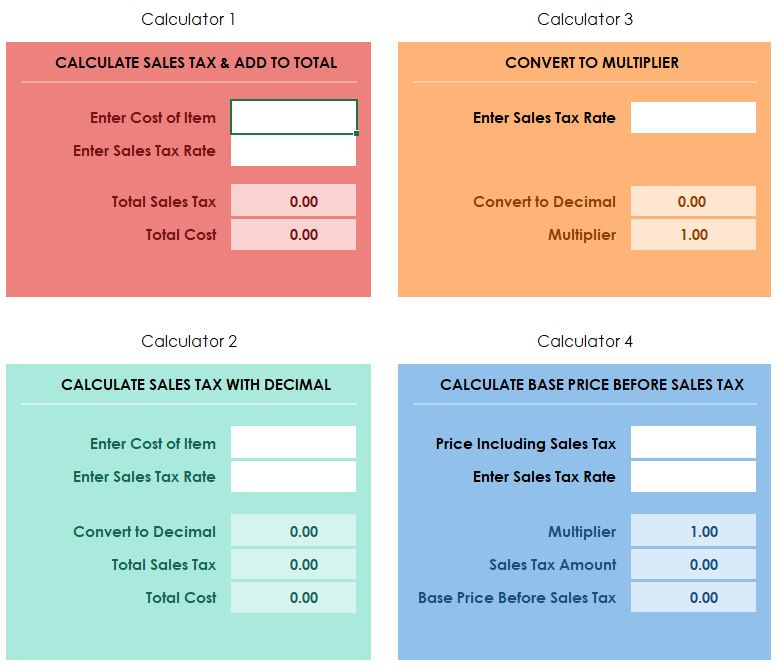

You can download our free sales tax calculators in Excel to work along with our examples or to make your own computations:

basic formula for calculating sales tax

The basic formula for calculating sales tax is:

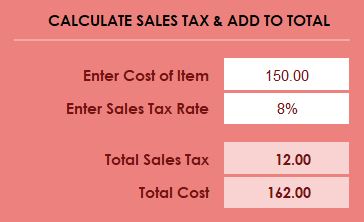

Formula: Cost of Item x Sales Tax Rate = Sales Tax Amount

Example: $150 x 8% = $12.00

$150 is the original base cost of the item, 8% is the sales tax rate and $12 is the sales tax.

The next step is to add $12 to $150 to get the total cost of $162.

Here is an example using the Excel calculator, which you can download for free above:

How is Sales Tax Calculated in Excel

How is Sales Tax Calculated in Excelconverting percentage rates to decimals

Sales tax rates are shown as percentages to make them easy to understand.

Percentages are a familiar way for us to think about proportions and rates.

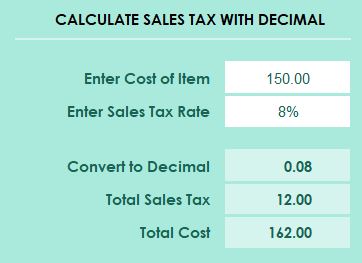

However, when it comes to making the sales tax calculations, the percentages are converted to decimals to facilitate the mathematical operations, the practical way to perform accurate and consistent calculations.

Calculation Example

Convert the 8% into a decimal and multiply by the original price to get the sales tax amount:

- Convert percentage to decimal: 8% : 8/100 = 0.08

- Multiply the base price by the decimal: 0.08 x $150 = $12

- Add the sales tax to the original price: $12 + $150 = $162

How is Sales Tax Calculated With Decimals

How is Sales Tax Calculated With Decimalsapplying a sales tax multiplier

A sales tax multiplier will allow you to quickly calculate the final amount a customer will pay.

This formula involves adding 1 to the decimal.

Formula: Decimal Rate + 1 x Cost of Item = Total Price

Using our example that we’ve been using throughout this page so far:

- Convert sales tax rate to decimal: 8% = 0.08

- Add 1 to the sales tax rate: 1 + 0.08 = 1.08

- Multiply to get the total price: 1.08 x $150 = $162

So, the total cost of the item, including sales tax, is $162.00.

The sales tax amount can then be worked out by subtracting $150 from $162 = $12

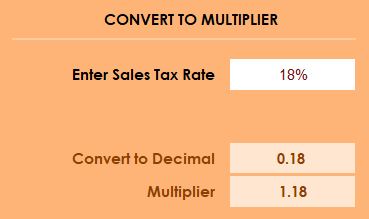

percentage rates converted to multipliers

When you are using the same sales tax percentage rate regularly for your business and region, you can memorize the multiplier, which is the sales tax decimal rate + 1.

Here is a quick list of percentage rates converted to decimals and then converted to the multiplier:

5% = 0.05 = 1.05

6% = 0.06 = 1.06

7% = 0.07 = 1.07

10% = 0.10 = 1.10

12% = 0.12 = 1.12

15% = 0.15 = 1.15

23% = 0.23 = 1.23

You can use our Excel calculator (free download further up this page) to find the decimal or multiplier for your own percentage rate:

Convert Percentages to Decimals/Multipliers

Convert Percentages to Decimals/Multipliersuse a Multiplier as a divisor to find original price

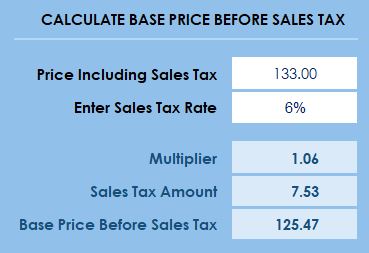

There may be situations when you have the total price but need to work backwards to find out what the original price was before sales tax was added, example:

- You receive an invoice with only a total and no original price or sales tax amount indicated

- You are preparing a buyer-created invoice and only know the total price

- You are preparing an invoice for a product that already includes sales tax and you need to know the base price and the sales tax portion for a customer.

Formula: Original Price = Total Price / Sales Tax Rate Multiplier

The multiplier becomes a divisor in this formula.

Example Calculation

In this example, the total price is $133 and the sales tax rate is 6%, the step-by-step calculations are:

- Convert the sales tax rate to a decimal: 6% becomes 0.06

- Add 1 to the sales tax rate: 1 + 0.06 = 1.06

- Divide the item price by the sales tax multiplier: $133 / 1.06 = $125.47. This is the base price excluding sales tax

- One further step to get the sales tax portion: $133 minus $125.47 = $7.53

Calculate Sales Tax from Total Price

Calculate Sales Tax from Total Pricecommon mistakes to avoid

Here are some common errors that can occur:

- Mis-converting percentages to decimals – adding or missing zeros

Example: 5% = 0.005 (too many zeros); or 5% = 0.50 (missing a zero): should be 0.05 - Incorrectly adding sales tax – adding sales tax to an amount that already includes sales tax.

Example: The total price is $46 including sales tax of $6 using a 15% sales tax rate - but the bookkeeper enters $46 as the original price and calculates $6.90 as the 15% rate, instead of using the correct formula of dividing the full price of $46 by the multiplier of 1.15 to get the original price of $40.

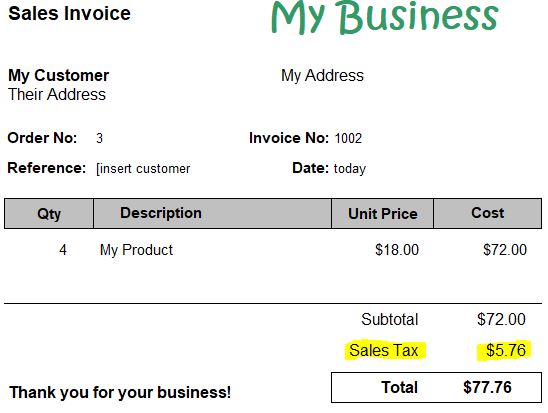

sales tax on an invoice

It’s important for sellers to properly display the base price before sales tax (subtotal), the sales tax amount, and the total price on sales invoices:

Examples of Calculating sales tax

Example 1:

Calculating sales tax for a $50 item with a 7% sales tax rate

- Convert percentage to decimal: 7%: 0.07

- Multiply price by decimal to get sales tax portion: $50 x 0.07 = $3.5

- Add sales tax amount to original price: $3.5 + $50 = $53.50

So, the total price is $53.50, and the sales tax amount is $3.50

Example 2:

Calculating sales tax for a $120 item with a 9.5% sales tax rate

- Convert percentage to decimal: 9.5%: 0.095

- Multiply price by decimal to get sales tax portion: $120 x 0.095 = $11.40

- Add sales tax amount to original price: $11.40 + $120 = $131.40

So, the total price is $131.40, and the sales tax amount is $11.40

Examples of finding the original price excluding sales tax

Example 1:

Finding the original price of a $108 item with an 8% sales tax rate:

- Calculate the multiplier: 8% = 1.08

- Divide the total price by the multiplier: $108 / 1.08 = $100

- Subtract the original price from the total price: $108 - $100 = $8

So, the original price is $100, and the sales tax amount is $8

Example 2: Finding the original price of a $165 item with a 10% sales tax rate:

- Calculate the multiplier: 10% = 1.10

- Divide the total price by the multiplier: $165 / 1.10 = $150

- Subtract the original price from the total price: $165 - $150 = $15

So, the original price is $150, and the sales tax amount is $15

summary: how is sales tax calculated?

With simple math formulas that convert the sales tax percentages into decimals or multipliers which are applied to the price either by multiplication or by division. Your bookkeeping software will automate this process but understanding the math will help you avoid common errors when producing sales invoices for customers. You can practice with the examples on this page by downloading our free sales tax calculator in Excel, which is also useful if you like using a manual bookkeeping system.