- Home

- Receipt Forms

Free Receipt Forms

Downloadable, printable, easy to use.

These free receipt forms and templates are for business or personal use and are suitable for any bookkeeper, business owner, landlord or seller who has to give a receipt to a customer or tenant.

The Excel and Word versions are fully customizable so you can adapt them to your particular situation.

You can print the PDF templates to fill in with your own handwriting. Not all receipts have blank PDF’s because some don’t lend themselves well to a blank format.

Receipt Definition:

A receipt is the written proof that a person or business has received a specified amount of cash for payment of goods or services provided.

The following terms are used a lot so you need to remember them:-

PAYER – person or business paying the cash

PAYEE – person or business receiving the cash

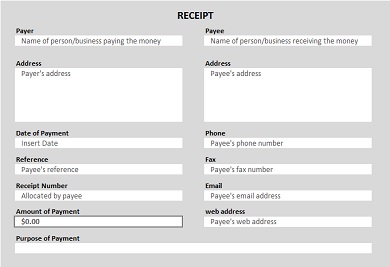

free Printable Receipt

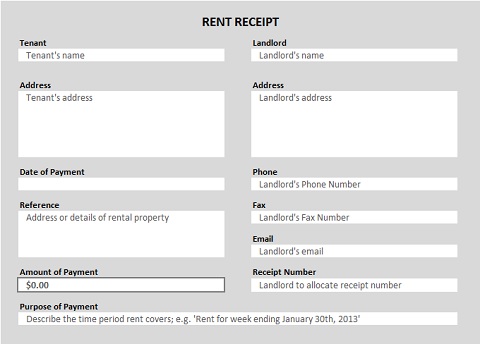

Rent Receipt Template

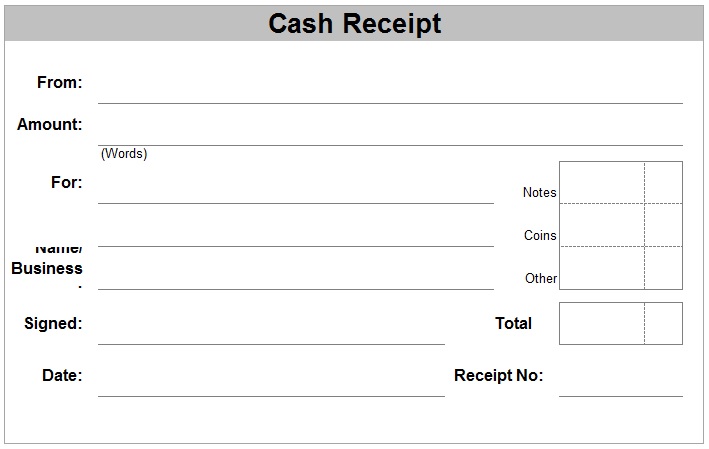

Cash Receipt Template

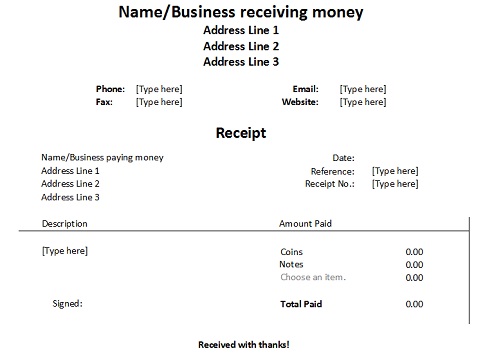

Word Receipt Template

When Should Free Receipt Forms be Issued?

1. Receipts are For cash payments

When a customer pays cash it should be counted and the amount verified/ Then the receipt can and should be written up and handed to the payer - immediately if possible.

This provides proof of payment and is considered an accounting source document.

It should not be necessary to do receipts for the following types of payment:-

- Cheques/Checks: This is because a cheque/check has to be written in the name of the payee. When the payee deposits it to their bank, the amount is withdrawn from the payer’s bank account. This cheque/check withdrawal is proof of their payment.

- Direct Bank Payments: A direct bank payment can only go from the payer’s bank account to the bank account of the payee they have entered in their bank system and in the exact amount the payer has typed in. The payment shows up on the bank statement, which is a proof of payment.

However, there is no fixed rule about this so receipts can be issued for bank transfers and cheques/checks if that’s what you want to do.

In fact, it is a good idea to do one if there has been some problem in the past and the payer needs reassurance from the payee that their cheque/check or bank payment has actually been received.

2. Issuing a receipt in place of customer statements

Receipts can be issued to customers if your business does not issue statements to customers.

Usually, a statement tells a customer what invoices they owe and which ones they have paid, but if you are not issuing statements of account, a receipt can be sent to the customer as a way of letting them know that you have received their payment.

You can utilize any of our free receipt forms for this purpose.

Who Should Issue Receipts?

Usually, the payee should issue a receipt but if the payee is unable to do one, the payer can prepare it and get the payee to sign it at the time the cash is handed over.

Handling/Filing the Receipt

In the bookkeeping records, the payee should keep copies of the receipts they have issued and file them in the banking folder, or attached to the paid sales invoices.

The payer should keep the receipts they are given in their bills or banking folder. There is nothing to stop a seller from one day coming back to the buyer and demanding payment if a receipt was never issued to prove that payment was already made.

This is especially true for tenants who pay cash to a landlord (even if you know and trust the landlord because people can forget things easily).

I was personally stung by this problem in my early 20's where I had to pay a month’s rent again because I had no proof that I had paid already and the landlord apparently could not remember my original payment. I refused to pay with cash after that! Lesson learned.

Receipt Format

The receipt format should contain as much information about the payment as possible to make it a complete document that can hold up in a legal situation.

If you browse through our various free receipt forms you will learn what basic details need to be included.

Interesting Fact - Receipts are being used less and less as people move to bank cards and other forms of electronic payment. We just might become a cashless society one day due to the fact that cash gets lost and stolen, it’s not always convenient to carry around, it can be awkward making sure the right change is available etc.

In the meantime, make the most of these free receipt forms!