- Home

- Business Budget

Business Budget

A business budget is a financial plan that business owners include in their toolkit for managing the money of their business to help keep the business thriving.

Click above button to get our most popular Excel Template for easy bookkeeping! It's free.

Business Budget Definition and Example

The budget is a list of estimated expenses on which the business plans to spend its earnings.

The plan can be made for just one month and re-used every month.

Or laid-out in a sheet showing 12 full months for the financial year.

The budget is simply a guide or suggestion as to what the business thinks it will spend in a month, from month-to-month.

The budget does not in itself physically limit business expenditure. The owners or managers can easily spend less or more than the amounts laid out in the budget because it’s just a guide.

It’s not as though the budget is given to the bank who then controls the amount of money the business can spend from its bank account - although it would not be surprising if this can be soon implemented with the advent of digital money and blockchain accounting.

The spending limitations come in to play when a regular review is done to compare actual spending against the budget and then decisions and procedures implemented to curtail overspending.

A budget includes:

- a list of expenses/payments that the business must make to keep operating

- a note of income the business earns from its sales activities.

Setting up a business budget encourages the business owner to become familiar with all the different types of expenses the business may encounter.

It also gives them the opportunity, at every review, to analyze how the business is actually performing monetarily in comparison to the budget.

A start-up business will be expected to include some budget estimates when developing a business plan.

Here are some phrases you may have heard and their definition:

'Blowing out the budget': costs have gone far beyond what was in the planned budget

'Sticking with the budget': to make an intentional effort not to overspend and thus blow out the budget

'Keeping within budget': the costs are within the maximum amount budgeted due to the efforts of sticking with the budget

'The budget is tight': the income only just covers the regular costs making it difficult to pay for increases to current ones, or unexpected costs, or desirable projects.

Defining 'budgeted amounts' and 'actual amounts'

The budgeted amounts are:

- payments that the business expects to make to vendors/suppliers.

- usually estimated although there may be some that are a fixed, regular cost.

The actual amounts are:

- payments that actually occurred and paid into or out of the business bank account.

Example of Budgeted vs actual:

- a business estimates they will pay $50.00 this month on a phone bill and that is what is in the budget – this is the budgeted figure

- the phone provider sends the bill through for $53.20 and this amount is deducted from the business bank account on the due date – this is the actual figure

- the result is that the business spent $3.20 more than budgeted

Budgeted figures usually include account totals from accounts found on:

the Profit and Loss Report (income and expenses and COGS)

and from the Balance Sheet (assets, liabilities or equity).

How Budgets Can be helpful

A budget enables a business to closely monitor their monthly costs and calculate how much income they will need to cover those costs.

Having a list of costs can help the owner to pause and think about whether certain purchases are necessary, and to see what affect those purchases could have on the future finances of the business.

This in turn makes it easier for the owner to make good spending decisions to keep the business operating at a profit instead of overspending and landing in financial hardship with big debt.

For example, if a large purchase is vital for the business to thrive, the owner can figure out how to cover the cost – like organizing a loan and then fitting in the repayments to the budget in regular monthly instalments.

It may also prompt the owner to think of new ways to increase revenue streams if it looks like current income will not be enough to cover the expected expenses.

The owner can also look at big payments through the year (such as an income tax payments) and calculate how much they need to save from now until then to cover that expected cost.

For the larger company a budget can be broken down between different departments such as office and workshop

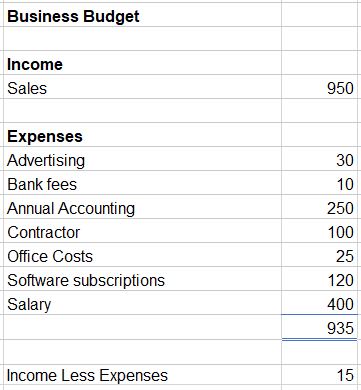

Example of Business Budget for 1 Month

Example of Business Budget for 1 MonthBusiness Budget Forecast

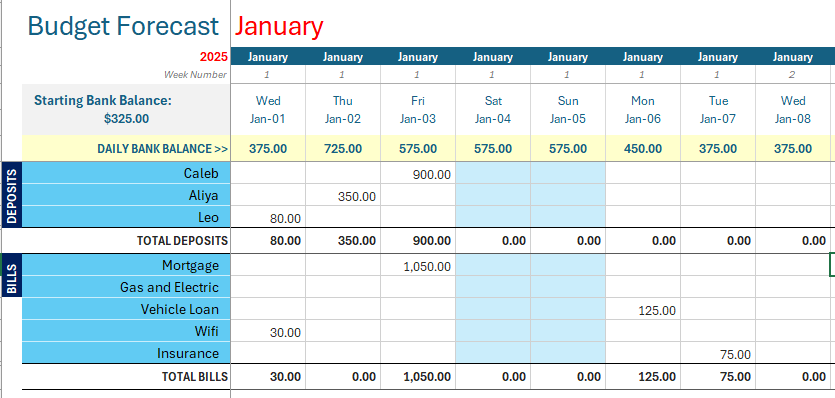

A budget that is made in advance for several months, involving costs that are estimated ahead of time by 12 months, is known as ‘forecasting’.

A forecast budget can help a business to develop a cash flow that indicates what the sources of income will be and where the money will go (i.e. what type of expenses).

The advantage of this is that adjustments can be made to business activities now to prepare for the later months where expenses will be higher than normal, or income will be lower than normal (like off-season time periods).

Forecasting a year’s worth of budget is highly recommended and is likely necessary when preparing a business plan.

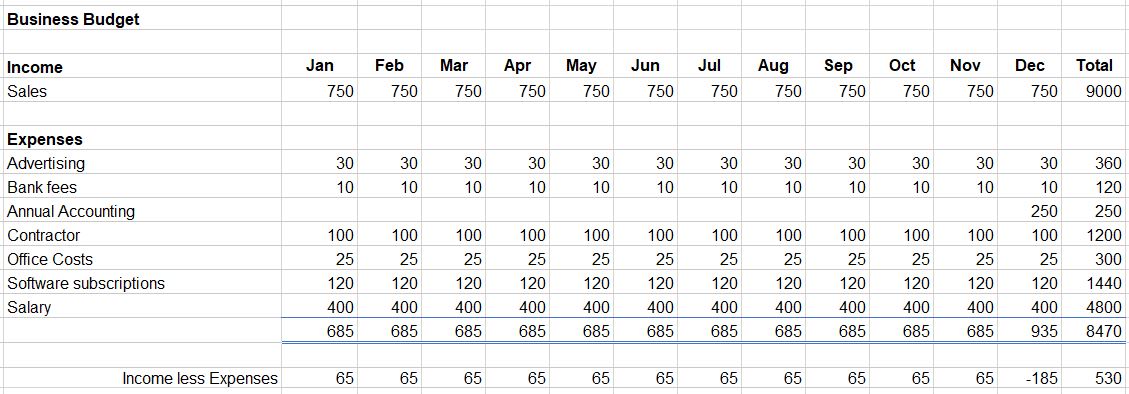

Example of Business Budget for 12 Months

Example of Business Budget for 12 Months

Where to prepare the budget

The budget can be prepared on a piece of paper, in an exercise book, or in a program like Excel or Google Sheets.

Your bookkeeping/ accounting software may have a budget feature you can access, or they may have a partner app that your monthly data can be exported to. If you have bookkeeping software, see what they recommend.

building a budget for business

For a new business, unless the owner already has experiential knowledge of what costs their type of business is in for, it may be hit-and-miss to correctly estimate the type of costs and amounts to put in the budget – so it involves a fair bit of guessing based on best estimates or speaking with professionals.

Professional bookkeepers/accountants with knowledge of different business types and their common expenses, can help prepare the budget for you. But if this is unaffordable for you right now, you at least can get a start on it and will have a basic foundation which can be improved upon as time goes by.

If doing it yourself, here are some basic steps to get started:

- These steps are a summary of the article Building a Business Budget

- Make one long list of all the names of the expenses that the business is expected to have through the financial year, in alphabetical order.

- Allocate an amount, based on your best “guestimate” to each expense.

- Do the same for income - usually a much shorter list with the main overall income types, maybe even just one line called Sales.

- Make a spreadsheet for the whole year, one column for each month and allocate the amounts into each month.

This is your Master budget.

Once this is completed the budget will be ready to manage.

I have been budgeting and cashflow forecasting in Microsoft Excel for my business for over ten years and have been personal budgeting and cashflow forecasting far longer than that.

I would be lost without my budgets and cashflow forecasts! I cannot imagine getting by financially without those systems in place.

Facebook Comments

Leave me a comment in the box below.