- Home

- Double Entry Bookkeeping

- Trial Balance

What is a Trial Balance

What is a trial balance?

- It is an accounting report with two columns that falls in line with the accounting equation

- It displays the totals of every bookkeeping ledger account

- Each total is shown in its position of either a debit or a credit

- The debit column and the credit column are totaled up

- Both totals must balance, in other words, be exactly the same as each other

Click above button to get our most popular Excel Template for easy bookkeeping! It's free.

How to know if an account should be a debit or a credit

As mentioned above, the accounts have to fall in line with the accounting equation.

Which means having an understanding of debits and credits.

Remembering which column each account balance goes in comes with practice.

In the meantime, here is a debits and credits cheat sheet you can print out and pin by your computer.

The one that increases the account is the one that indicates what column it should go in as demonstrated in the table below.

Assets = Debit Column

Liabilities = Credit Column

Equity = Credit Column

Income = Credit Column

Expenses = Debit Column

What is a Trial Balance Used For?

- A trial balance is used by accountants to confirm the accuracy of the accounts at the end of the financial year, before and after special adjustments

- A business needs it when they change to new bookkeeping software

Trial Balance Example

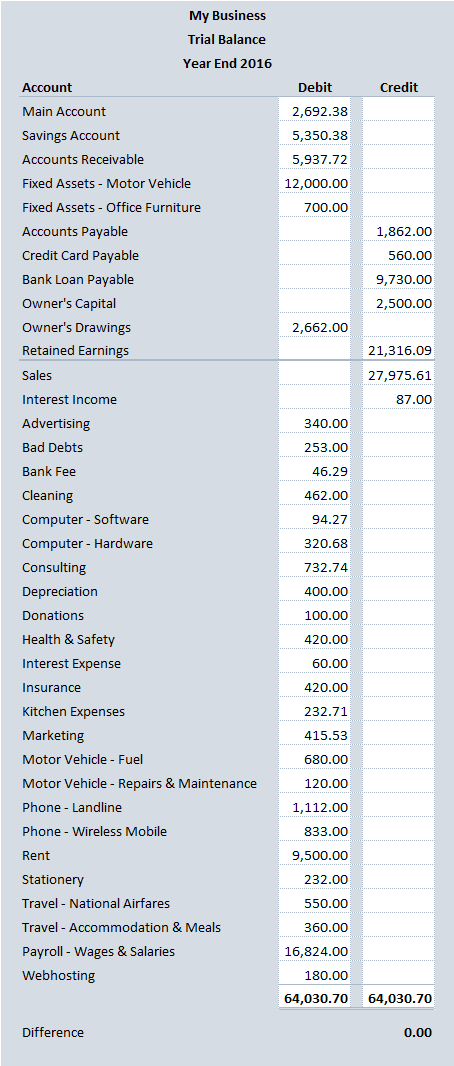

What is a Trial Balance Example

What is a Trial Balance ExampleTrial balance for the Year End

The above trial balance example is for the end of the financial year.

It has all the figures for the full year of trading.

The debit column and credit column add up to the same total of $64,030.70, making the difference $0.00 - which means it is in balance.

What order are trial balance accounts in?

All the accounts above the solid line (just below retained earnings) are:

- Assets, Liabilities and Equity, which are found on a balance sheet report

- Called permanent accounts because the figures build up (accumulate) over the years

All the accounts below that line (starting with sales) are:

- Income and Expenses which are found on an income statement also called a Profit and Loss Report (this would include cost of sales too except there are none of those in this example)

- Called temporary accounts because the balances are cleared out taking them to 0.00 for the new financial year

Free Trial Balance Template: Excel

Free Trial Balance Template: PDF

What is a Trial Balance Adjusted/Unadjusted Report

The above example is the unadjusted report.

This means it is the report printed and saved before the accountant has prepared the annual financial statements and tax returns.

Any adjustments that the Accountant makes are done with journal entries.

What adjustments does an accountant make?

- Any errors made by the bookkeeper through the year are corrected

- Changes are made so the business gets the best possible income tax benefits

- The temporary accounts are cleared

The trial balance will be prepared again to make sure the accounts balance after the adjustments are done – the adjusted report.

In modern bookkeeping software like Xero you won’t find the words adjusted and unadjusted – it applies more to manual bookkeeping.

So, even though adjustments are made in the software, the trial balance report will simply be called Trial Balance. There is no Adjusted/Unadjusted Trial Balance.

How do you know then that the final adjustments have been made?

The temporary accounts will be empty. Reminder: the temporary accounts are the Income and Expense accounts.

Trial Balance for New Software

- When a business decides to track their accounts in new bookkeeping software, because the old software is no longer satisfactory, the Trial Balance will be used to transfer the data to the new software. How so?

- In the old software the books need to be balanced to the final date that the business decides to finish using the old software.

TIP: the best time for this is the end of the financial year.

Doing it mid-year is not ideal because it means the detailed transactions for the year are split over two systems – a pain for reporting on!

There are two options:

a. Print the Trial Balance report at that last date in the old software and manually enter the figures into the new software using the same date, or

b. export the Trial Balance from the old software to a CSV document and import the CSV document into the new software, same date details as a. above.

Note: You will not be transferring detailed transactions from all the previous years of trading into the new software.

It just isn’t going to happen unless you are happy wasting many, many hours and $$ doing the books all over again for the past several months or years in the new system (seriously, why would you, unless you had a disaster with your computer and lost everything because of no backups), so you need to keep backups and print-outs of all the information from the old software giving you data to refer back to when required.

The fantastic feature with online software options is that they backup everything for you and make it easy in many cases to transfer data from one program to another.

In the new software, you should only have the opening balances as taken off the trial balance from the old software.

What to do with no trial balance for new software

If your business is brand new, and you haven’t kept any kind of bookkeeping records yet, you don’t need a trial balance to start off your books in new software. Good news, eh!

If you have been keeping bookkeeping records already manually or in some sort of software, you will need:

- a balance sheet and

- a profit and loss report

from which you can pull all totals and put into a Trial Balance in the debit and credit format – hopefully you can get it to balance.

If you don’t have a balance sheet or income statement, give your cashbook to an experienced bookkeeper or accountant who can prepare this all for you. Expect questions from them to aid them in preparing accurate reports.

Or you can prepare your own balance sheet and income statement, and finally a trial balance.

Facebook Comments

Leave me a comment in the box below.