- Home

- Double Entry Bookkeeping

- Types of Bookkeeping Accounts

The Main types of bookkeeping accounts

Let’s acquaint you with the main types of bookkeeping accounts that are used in bookkeeping.

These accounts keep your income and expenses organized within your bookkeeping system to help you create reports that let you know how the business is doing, and what sort of taxes you will have to pay, and other good reasons.

the five most common types of Bookkeeping accounts

The five most common types of bookkeeping accounts are:

- Asset accounts

- Liability accounts

- Equity accounts

- Revenue accounts

- Expense accounts

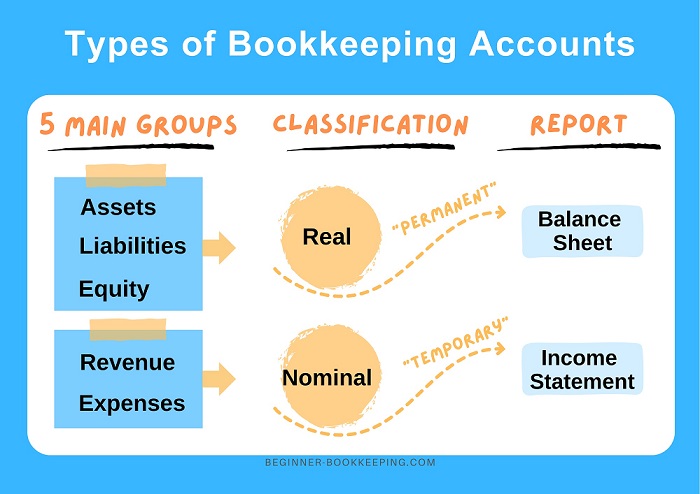

These five account categories can be further classified into:

- Real accounts

- Nominal accounts

Chart of Accounts - Before we dive in with more detail, I want to bring to your attention the term “chart of accounts”. This chart is a list detailing each account a business uses in its bookkeeping system. These accounts are all grouped into the above account categories. Consider the chart as a tool that outlines every single account you need for your small business bookkeeping. It gives a clear picture of how your company is spending and receiving money.

This record of accounts allows you to track:

- the source of your money

- what you spend the money on to operate your business

- the financial health of your business

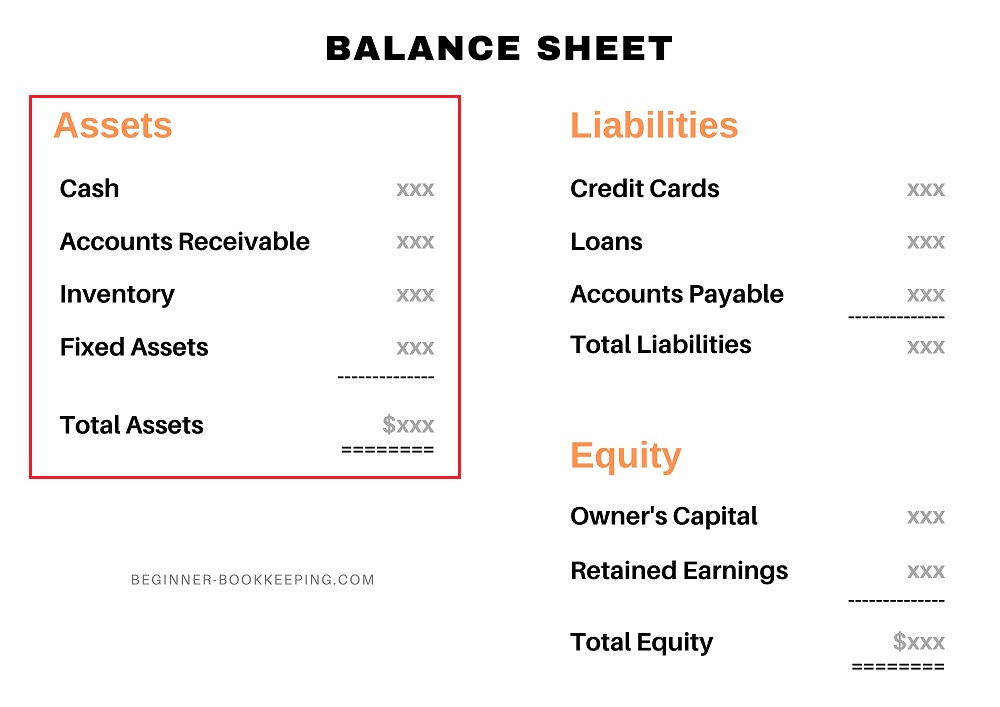

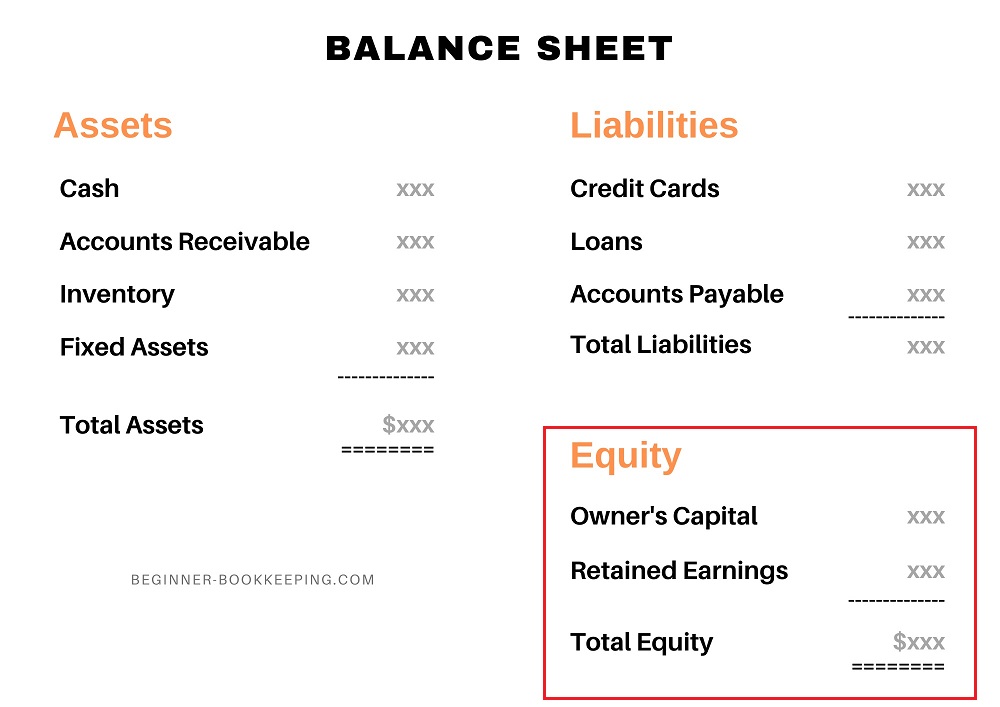

asset accounts

Assets are everything your business owns that have some value; they are worth something so have some benefit for you. Here are just a few main ones:

Cash: This is the most liquid asset which means it can be quickly converted into cash, such as the positive balance in your bank account.

Accounts Receivable: Money owed by customers to your business.

Inventory: Products or goods to be sold.

Fixed Assets: Long-term tangible (physical) items like buildings and equipment.

Recording the asset accounts correctly are key to determining your financial strength.

Asset Types of Bookkeeping Accounts

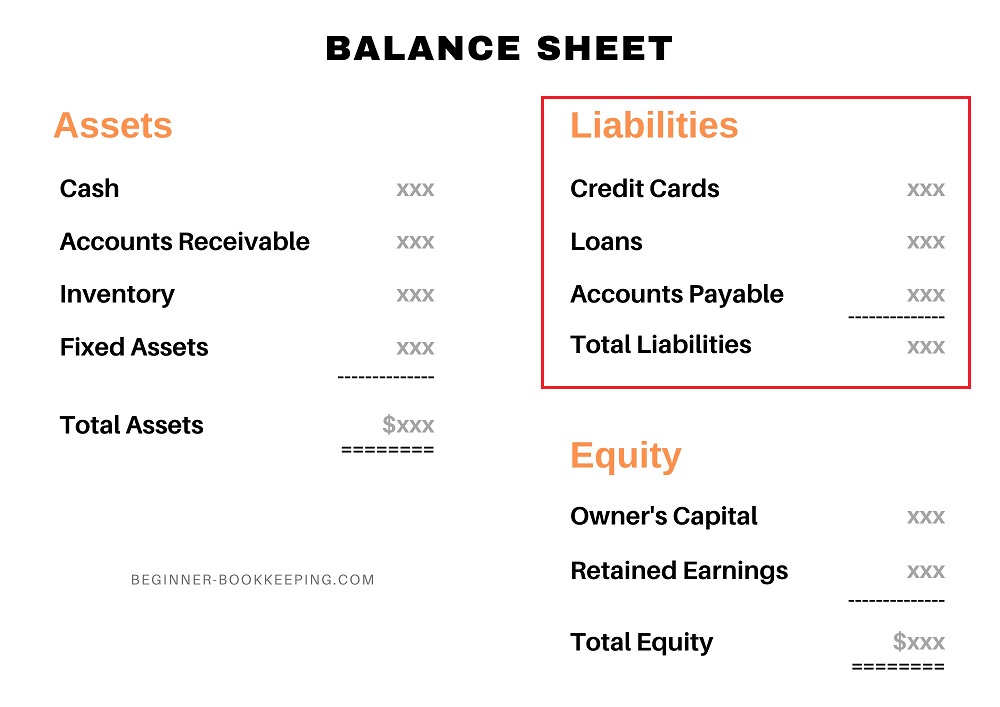

Asset Types of Bookkeeping Accountsliability accounts

Liabilities, on the other hand, are what your business owes and is obligated to pay for. Examples include:

Accounts Payable: Money you owe to suppliers.

Credit card debts: Any outstanding credit card balances.

Loans: Any money borrowed from banks or other institutions.

Overdrafts: Any outstanding balance you owe to your bank.

Your liability accounts are crucial for understanding what needs to be paid off and when.

Liability Types of Bookkeeping Accounts

Liability Types of Bookkeeping Accountsequity accounts

Equity is a bit more complex.

In short, it’s your residual interest in the assets of your business after deducting liabilities.

Think of it as what's left over for the business owner after the business has paid off all its debts (liabilities).

These equity accounts include:

Retained earnings: The accrued profit or loss results from every year you operate.

Capital: Money you introduced to start your business or boost cashflow.

Drawings: Business money you spent on personal expenses.

Equity plays a significant role in assessing your business’ overall financial health.

Equity Types of Bookkeeping Accounts

Equity Types of Bookkeeping AccountsRevenue accounts

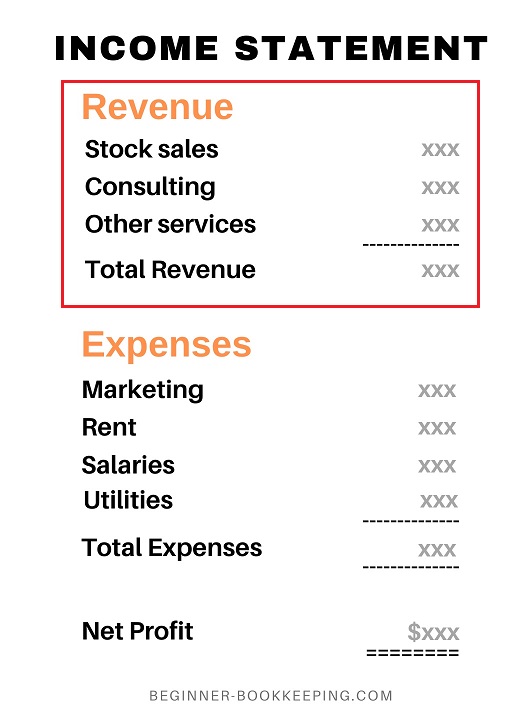

These showcase the income your business earns from selling goods and services.

They are usually broken up into different categories based on your particular business operations and include stock sales, consulting, and more.

Tracking these can give you a solid sense of how well your business is doing.

Revenue Types of Bookkeeping Accounts

Revenue Types of Bookkeeping AccountsExpense accounts

As you’d imagine, these cover all the costs incurred doing business and generating your income.

This could be utilities, salaries, rent, marketing expenses, and more.

Though these reduce your income, you get some relief in that they are also used to reduce your income tax obligation. For this reason, they are also called deductible expenses.

Keeping your eye on these helps you know where your funds are going.

Expense Types of Bookkeeping Accounts

Expense Types of Bookkeeping Accounts

real and nominal types of bookkeeping accounts

These are not extra accounts to the ones discussed above.

These are simply a further way to classify or categorize all the accounts.

real accounts

These are known as permanent accounts or balance sheet accounts.

The real "permanent" accounts are assets, liabilities, and equity.

They are known as “permanent" accounts because they are not closed at the end of each accounting period, the same as nominal accounts are (see below).

Instead, they maintain their balances from one period to the next, and their purpose is to provide a cumulative record of a company’s financial position over time.

Their balances increase (or decrease as appropriate) each financial year.

Real accounts provide:

- a long-term view of the business’ financial position and

- overall financial health as a snapshot at a particular date on the balance sheet.

nominal accounts

These are known as temporary accounts or income statement accounts.

The nominal "temporary" accounts are revenue and expenses.

They are called “temporary" accounts because they are closed off at the end of each financial year.

The purpose of nominal accounts is to track revenues, expenses, gains, and losses over a specific accounting period. These accounts help in determining the company’s net profit or net loss for that period.

Closing Accounts: At the end of an accounting period, the balances in the nominal accounts are transferred to the balance sheet. This process is known as “closing the books”. What this does is leave a zero balance in each nominal account ready to be filled up again in the following accounting year with financial transactions. The balancemoney.com has some more information on "closing entries".

Nominal accounts are used for:

- analyzing a business’ performance over specific periods and for

- preparing profit and loss reports.

example of these types of bookkeeping accounts in action

To help illustrate this, let’s use a simple scenario. Let’s say you own a coffee shop.

The money in your bank account is an asset.

Your coffee machine is an asset.

Your rent is a liability.

Your investment into the business is an equity (capital).

These are all parts of your real accounts on the balance sheet.

When you sell a cup of coffee, the revenue is recorded in your nominal accounts.

At the same time, the cost of the coffee beans, the electricity to make the coffee, and the employee’s wages are also recorded into your nominal accounts on the income statement (also called a profit and loss report).

To further explain this, here’s a description of what happens in the accounts with just two financial transactions:

When purchasing a coffee machine there are two accounts affected:

- the bank account – which decreases because money goes out of it.

- and the fixed asset* account - which increases due to the value of the new coffee machine.

*If you are in the USA you may be able to allocate the purchase cost of equipment to an expense account for qualifying equipment as per Section 179, rather than to a fixed asset account.

When a cup of coffee is sold there are two accounts affected:

- the bank account - which increases because money is received from a customer.

- and the revenue account – which increases to indicate a new sale has been made.

This bookkeeping method is called double entry, which can seem complex when you’re new to it but bookkeeping software simplifies the process.

In summary

There are five main account categories in which all the accounts on a chart of accounts are grouped. They are classified as either permanent or temporary which controls which report they go on. This structure keeps all the revenue and expenses well organized and easy to find.

Your knowledge of the different types of bookkeeping accounts is not only going to help you manage your finances with clarity but will boost your confidence in conversations with financial advisors, and strengthen your analysis of your own bookkeeping reports enabling you to help your business thrive.