- Home

- Double Entry Bookkeeping

- Loan Journal Entry

Loan Journal Entry

How to do Journal Entries for Loan Transactions

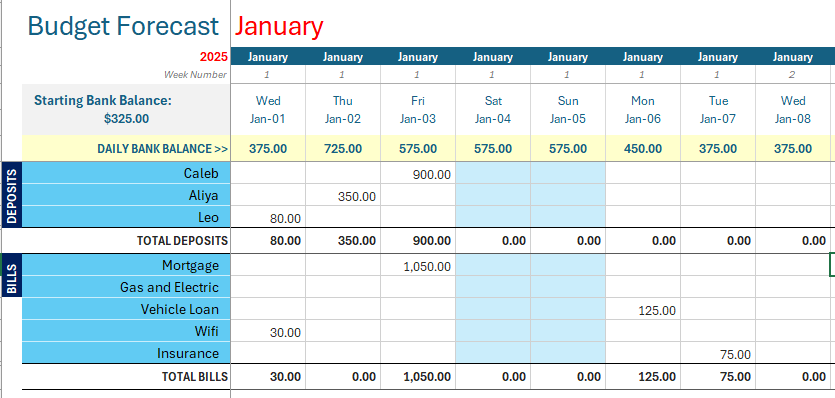

A loan journal entry can be recorded in different ways in bookkeeping software, here are three of them:

Click above button to get our most popular Excel Template for easy bookkeeping! It's free.

- A direct entry: where your software or bookkeeping system allows you to add a loan journal entry.

- Through a bank transaction reconciliation: where you allocate the bank transaction fed into your software to the loan account and the double-entry journal is processed in the “background” of the software.

- Using the invoicing/billing features of bookkeeping software: to record the acquiring of the loan itself, or the purchase of the asset and once again the journal entry is processed in the “background”.

What does a loan journal entry do?

When you use bookkeeping software you don't usually see the automatic journal entries that happen in the "background" when reconciling your bank accounts.

Entering a manual journal is handy for adjusting your books without affecting the bank accounts, like when you need to move a transaction from one account category to another like with the loan forgiveness.

The examples on this page are for both automatic journals involving the bank account and for manual entering of journals.

Every loan journal entry adjusts the value of a few account categories on the general ledger.

The account categories are found in the chart of accounts.

Depending on the type of ledger account the bookkeeping journal will increase or decrease the total value of each account category using the debit or credit process.

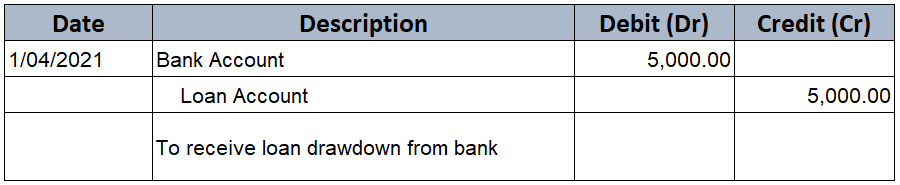

bank loan Received journal entry

Bank loans enable a business to get an injection of cash into the business.

This is usually the easiest loan journal entry to record because it is simply receiving cash, then later adding in the monthly interest and making a regular repayment.

bank loan received journal entry

Debit: Bank Account (asset account) Credit: Loan (liability account)

Bank Loan Received Journal Entry Example

Bank Loan Received Journal Entry Example

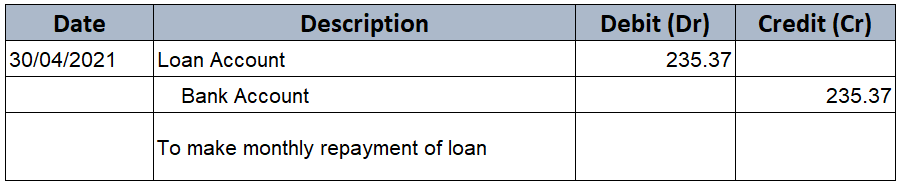

Bank loan repayment journal Entry

Debit: Loan (liability account) Credit: Bank (asset account)

Bank Loan Repayment Journal Entry Example

Bank Loan Repayment Journal Entry ExampleTo learn more about assets and liabilities go to accounting balance sheet.

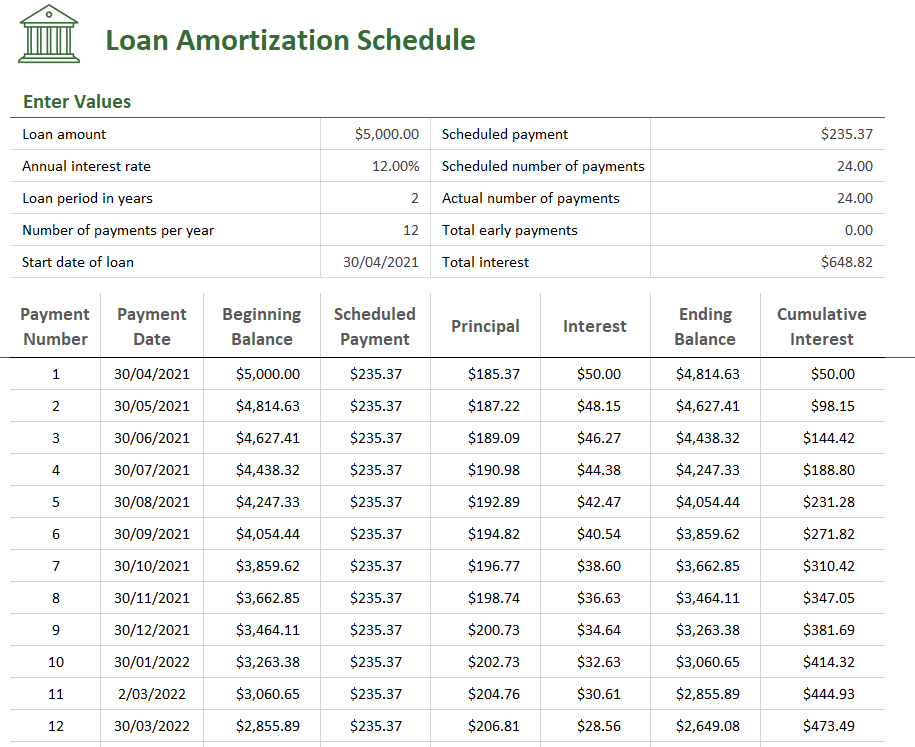

The figures from the above examples are based on the figures in the Loan Amortization image in the next

section about loan interest.

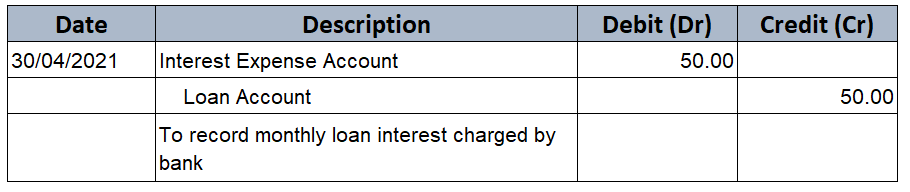

loan interest payable journal entry

Adding interest to the loan account

Debit: Loan Interest (expense account) Credit: Loan (liability account)

Interest on Bank Loan Journal Entry Example

Interest on Bank Loan Journal Entry ExampleThe bank may be able to provide a schedule listing all expected repayment dates and amounts for the life of the loan.

If you are unable to get a schedule from the bank you may be able to see the amount of interest in the online bank transactions or off your loan statement for the current or previous months.

You can also find a Loan Amortization template in Microsoft Excel templates and enter the loan details from the bank to calculate your own schedule as in this example:

Bank Loan Amortization Schedule Example

Bank Loan Amortization Schedule ExampleIf you use a schedule like this, compare it to your loan account each month to ensure it is tracking as expected.

car loan journal entry

A car is an asset so the journal entry for it will be similar for the purchase-via-loan of other assets like workshop equipment.

The difference between bank loans and vehicle loans is that:

- with bank loans the business receives actual money into the bank account and

- with the vehicle loan the money is usually paid directly to the car sales company so the business doesn’t handle the money.

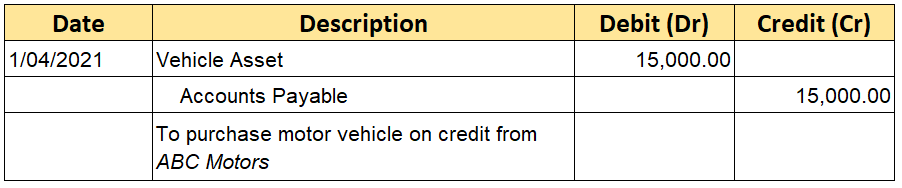

These car journal entries are for a vehicle costing $15,000 and for a loan of 5 years at 12% with fortnightly payments – calculated using the same Loan Amortization template mentioned above.

Purchase of Car Journal Entry

This example is based on the purchase of a car from a car sales business, which business signs you up with a loan provider. They will give you an invoice for the car and documents for the loan so you can get the information you need from those documents.

- The first journal is to record the invoice for the purchase of the car.

- The second journal is to pay off the invoice with the loan.

- The third journal adds the loan interest to the loan.

- The fourth journal records a repayment of the loan.

Debit: Vehicle (asset account) Credit: Accounts Payable (liability account)

Motor Vehicle with Loan Journal Entry Example

Motor Vehicle with Loan Journal Entry ExampleUsing the Accounts Payable account in the above journal entry means that the invoice has not been paid with your bank funds.

The loan will offset the Accounts Payable and you will monitor the balance owing through the loan liability account, not through the accounts payable account.

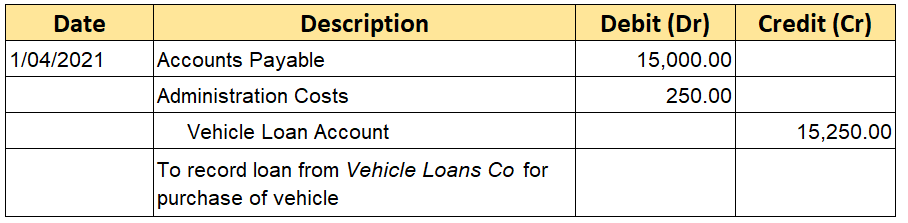

car loan Journal Entry

Two accounts are debited on this loan journal entry:

Debit: Accounts Payable (asset account) ,

Debit: Administration Costs (expense account) - shows on the Profit and Loss report

Credit: Vehicle Loan Account (liability account)

Loans usually come with some kind of administration cost so this has been included in the journal. This type of cost is a deductible business expense.

Vehicle Loan Interest Payable and Repayment of Loan

Debit: Loan Interest Expense (expense account) Credit: Vehicle Loan(liability account)

Car Loan Interest Journal Entry Example

Car Loan Interest Journal Entry ExampleDebit: Vehicle Loan(liability account) Credit: Bank (asset account)

intercompany Loan Journal Entry

These journals occur when two or more businesses are owned by the same owner/s.

If one business is low on funds the owner might use funds from the other business bank account to pay bills due to stakeholders (vendors) or for other expenses.

Sometimes, the owner might transfer a lump sum from one business to the other for the same purpose - there may be a loan agreement drawn up or there may not be.

I am working with two types of transactions:

- The first intercompany journals are for everyday expenses paid for one business by the other business.

- The second intercompany journals are for a cash loan from one business to the other.

The two companies in this example are:

- Designer Doors

- Best Boots

These are purely fictional names not based on any real business that I know about.

1. Intercompany Everyday Expenses

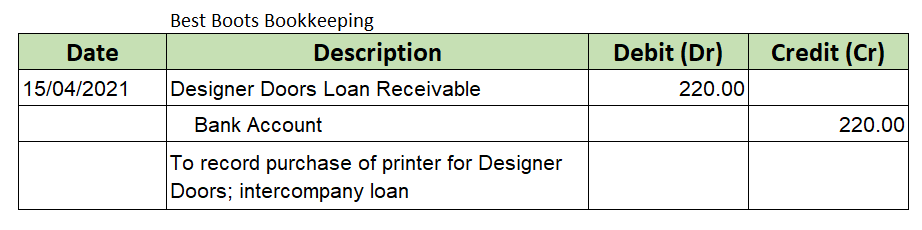

Best Boots buys an office printer for Designer Doors for $220.00.

a. The loan journal entry in best boots is:

Debit: Designer Doors Loan Receivable(asset * account) Credit: Bank (asset account)

*This loan entry goes to assets because cash is expected to be received into the bank.

Intercompany Loan Journal Entry for Expenses - Best Boots

Intercompany Loan Journal Entry for Expenses - Best Boots

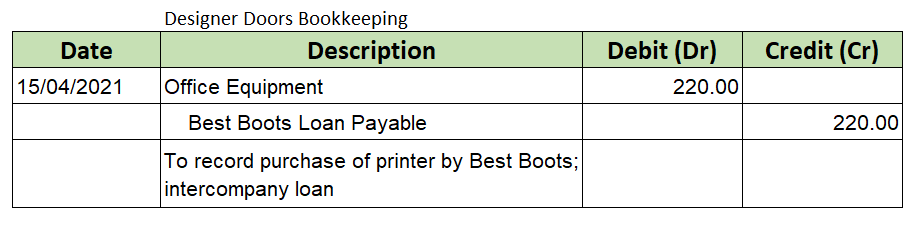

b. The loan journal entry in Designer doors is:

This journal puts the printer into the Profit and Loss Report of Designer Doors but shows that it was paid for by Best Boots.

Debit: Office Equipment (expense account) Credit: Best Boots Loan Payable (liability account)

There is no bank account involved in this journal.

Intercompany Expense Loan Journal Entry Designer Doors Example

Intercompany Expense Loan Journal Entry Designer Doors ExampleRepaying the Intercompany Expenses Loan

Whether this is paid in full or only partly paid, the journal is the same:

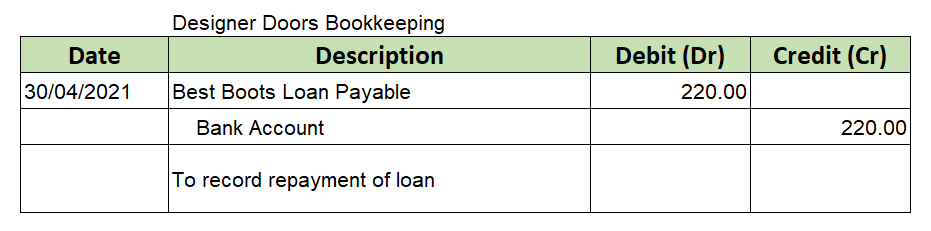

The repayment of the expense loan by Designer Doors out of their bank account to Best Boots:

Debit: Best Boots Loan Payable (liability account) Credit: Bank (asset account)

Repay Intercompany Loan Journal Entry Expense Designer Doors Bookkeeping Example

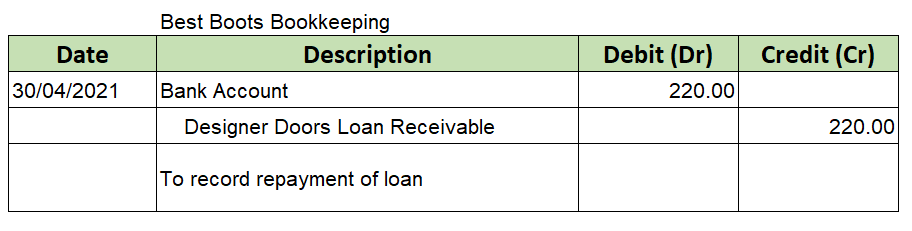

Repay Intercompany Loan Journal Entry Expense Designer Doors Bookkeeping ExampleThe repayment of the expense loan into Best Boot's bank account:

Debit: Bank (asset account) Credit: Designer Doors Loan Receivable (asset account)

Intercompany Repay Expense Loan Journal Entry Best Boots Bookkeeping Example

Intercompany Repay Expense Loan Journal Entry Best Boots Bookkeeping Example

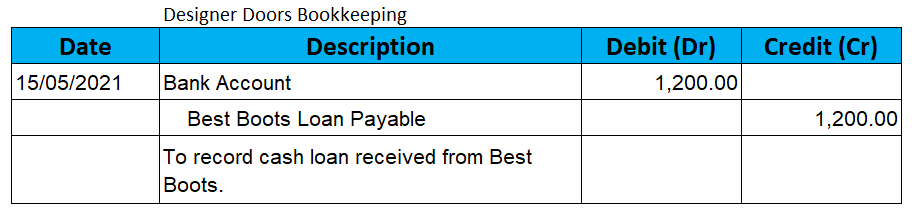

2. Intercompany Cash Loan

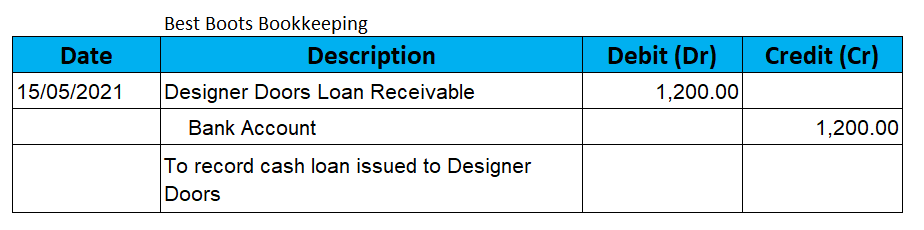

This is for a straight transfer of cash of $1,200 to from Best Boots to Designer Doors without a loan agreement and without interest; the business owner decides to repay it with $300 per month for 4 months.

A. The Cash Loan Journal Entry In Best Boots Is:

Debit: Designer Doors Loan Receivable (asset account) Credit: Bank (asset account)

Intercompany Cash Loan Journal Entry Best Boots

Intercompany Cash Loan Journal Entry Best BootsA. The Cash Loan Journal Entry In Designer Doors Is:

Debit: Bank (asset account) Credit: Best Boots Loan Payable(asset account)

Intercompany Cash Loan Journal Entry Designer Doors

Intercompany Cash Loan Journal Entry Designer Doors

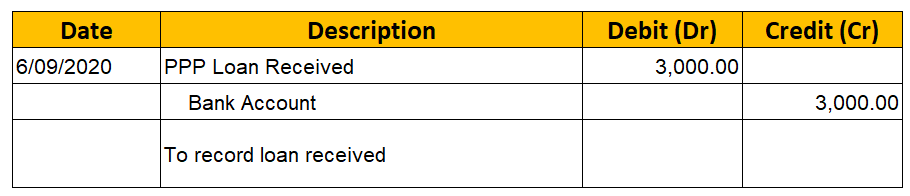

Loan forgiveness journal entry

This was a question that was emailed to me on how to account for a PPP Loan Forgiveness.

I am using this article by Stambaughness.Com for the basis of a PPP loan forgiveness, but these examples will work with most any type of loan forgiveness.

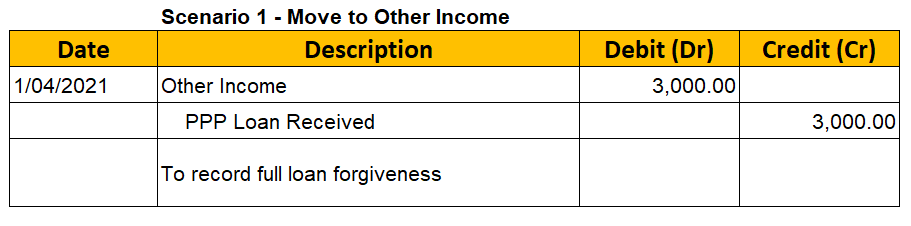

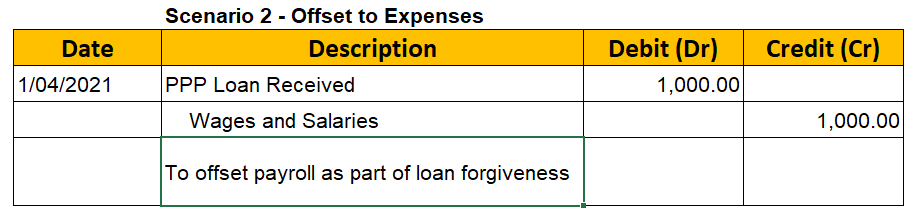

There are two different scenarios - you must chose one:

- putting the full amount to Other Income (which increases your profit by increasing Income)

- offsetting the loan to Expenses (which increases your profit by reducing expenses gradually over time).

My example is for a loan of $3,000 which was originally allocated to the Loan liability account.

PPP Loan Received Journal Entry Example

PPP Loan Received Journal Entry ExampleScenario 1: allocating the amount to Other Income

The aim here is to move the loan away for the full $3,000 from the balance sheet liability to Other Income on the Profit and Loss.

Result: This will show an extra profit of $3,000 in the month you have chosen to record the loan forgiveness.

Loan Forgiveness Journal Entry Other Income Example

Loan Forgiveness Journal Entry Other Income ExampleScenario 2: offsetting the amount to Expenses

The aim here is to move the loan away gradually from the Balance Sheet liability to the Profit and Loss Report by offsetting the cost of relevant expenses as they occur.

This does two things:

- Decreases the loan owing on the balance sheet

- Decreases the expense on the profit and loss report – which increases the overall profit

PPP Loan Forgiveness Journal Entry Expense Offset

PPP Loan Forgiveness Journal Entry Expense OffsetEvery time you pay for an expense in whatever month that the loan is allowed to offset, do the above steps until the loan is back down to 0.00.

In the example journal, $1,000 has been offset to wages. For this fictitious business it may be that another $1,000 is offset in the next month, and then again in a third month, finally showing a nil loan balance on the balance sheet.

Result: this provides a more balanced approach to increasing monthly profit results rather than a wham of $3,000 in one month like Scenario 1.

Facebook Comments

Leave me a comment in the box below.