- Home

- Bookkeeping Articles

- Invoicing Best Practices

Invoicing Best Practices

by Erika Rykun

use your invoicing power to protect your cash flow

Invoicing Best Practices

So, your business just had its best month ever. Word is spreading, and you're booked solid for the next few months. All your hard work is finally paying off!

Well, except for one thing: There's hardly any money in your bank account. So, instead of celebrating your success, you're lying awake at night wondering how you're going to make payroll or pay the rent. How can you be so busy and yet so broke?

Often, there's a simple answer: You were working so hard you never got around to asking your customers to pay you.

When you don't send invoices, you can run into cash flow trouble in no time.

Here's how these invoicing best practices can keep the money coming in month after month.

Click above button to get our most popular Excel Template for easy bookkeeping! It's free.

Four Invoicing Best Practices

1. prompt and regular invoicing

The Secret To Steady Cash Flow

Imagine you own a house painting company.

A couple hires you to paint the outside of their house, and they pay half of your fee up front. You paint the house, but you never send them an invoice for the rest of your fee.

Because you never sent that bill, you only got paid half as much as you should have.

This kind of thing can cause big problems for your cash flow.

The simple solution is to send invoices promptly and regularly.

Among the benefits of this first invoicing best practice are that:

- You'll always have money coming in, assuming most of your invoices are paid on time.

- You'll spend less time creating invoices, because you won't have to reconstruct what you did several weeks ago.

- You'll be less likely to miss out on getting paid because you forgot to send an invoice.

- It's more likely you'll be paid on time. If you're not in a hurry to send out bills, your customers may think it's not important to pay you right away either.

Depending on the kind of work you do, you may need to invoice weekly, monthly, at the start of a project or job, when deliverables are completed, or at the end of a project or job.

2. Create invoices that promote healthy cash flow

The best invoices are easy to read, and they clearly communicate the information needed to pay you.

Payment gets delayed when customers don't understand your invoice, need additional information or have to forward it to someone in a different department.

Fortunately, you don't have to make up your own invoices from scratch — there are excellent invoicing templates that can create professional-looking invoices for you.

Here are some tips for making your invoices more customer-friendly:

- Send your invoice to the right person. The person you've been working with may not be the one who pays the bills. When you start work, get the name and contact information for the person who should receive your invoices.

- Find out if your customer has any specific invoicing requirements.

- If there's an account number, project number or other information that your customer or client uses to identify you or your work, include that on the invoice.

- Number your invoices - some companies require this.

- Include your contact information on the invoice.

- Give them a deadline for payment. Some small businesses offer a discount for paying on time, or impose a penalty for paying late.

- If you're in the business of selling unique, expensive or titled items like cars, boats, antiques or animals, be sure to provide a bill of sale, as well as an invoice.

Also remember to explain what you did or sold, so your customers know what they're paying you for.

3. make it easy to pay

Payment methods are critically important, but some businesses don’t even tell you how to pay them on their websites!

It's hard to pay an invoice if you don't know how.

So, in addition to providing your contact information, this third invoicing best practice is to tell your customers how they can pay you.

If you want to get paid quickly, make it as easy as possible. Some people will put off paying you just because they have to write and mail a check or call you with a credit card number. (Please note: These older payment methods are costly and slow to process. It’s much more cost-efficient to use online payment options.)

If you’re not sure how to manage your payments, it’s much easier than it seems.

You can enable just about any type of payment system through your website.

There are many choices, including all major credit cards, Google, Apple, and other leading companies.

Easy, simple payment using popular payment options like direct deposit or cards through a secure portal are definitely the way to go.

PayPal is an easy alternative that anyone can use.

PayPal also offers buyer and seller protection, a unique and useful feature of their many services.

They can also take payments in a large range of foreign currencies if your clients are overseas.

Processing fees for currency conversion are minimal, and PayPal provides a full list of transactions for your accounts.

When you pay for services or go shopping online, what’s your personal preferred method of payment?

Think like a customer and offer payment options that are as quick and easy as possible.

4. Manage your payments

Invoicing Best Practices

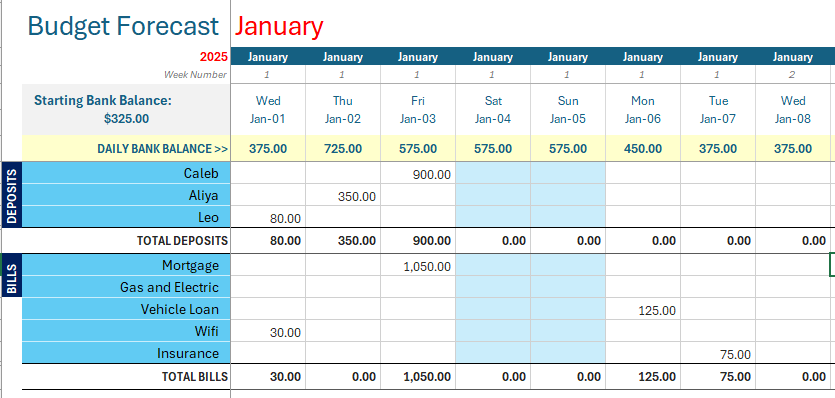

Invoicing Best PracticesRegular and timely invoicing is critical if you want to protect your business cash flow.

Standard business practice is to issue your invoices on a monthly basis. This is a basic accounting and bookkeeping practice.

The monthly books also allow you to issue invoices in context with your book entries, and cross-reference your invoices with your account balance(s) for each client.

It’s a very efficient, simple way of managing payments.

This method also allows you to track late or missed payments, or delinquent overdue payments of your accounts, very easily.

You should have a follow-up procedure for recovery of overdue payments in place which you can use to start recovery procedures.

Your accounts will act as your record of payment should you need to conduct formal court or debt collection processes.

Neglect your invoices and you may end up with the most successful company that ever went broke.

Facebook Comments

Leave me a comment in the box below.