Fiscal Year Definition

The fiscal year definition: A fiscal year is a financial year made up of 12 consecutive months that can begin with any month – it doesn’t have to be January.

During this time period a business will up-date their bookkeeping records.

At the end of the fiscal year, income tax will be calculated on the results of those 12 months of trading.

Click above button to get our most popular Excel Template for easy bookkeeping! It's free.

What is the Fiscal Year?

No business can operate (by law) for more than one fiscal year without calculating and paying their taxes to the government (unless they get a special extension of time).

All countries have a common fiscal year set by their own tax authorities.

Most countries run from 1 January to 31 December for tax purposes (see which ones below).

Some countries run from 1 April to 31 March (see which ones below).

Then there are others like the UK which start with an odd date like 6 April and in South Africa individual taxes start from 1 February.

Fiscal Year 1 January to 31 December

- USA

- Canada

- China

- most (maybe all) South American and European countries

Fiscal Year 1 April to 31 March

- Australia

- India

- Japan

- New Zealand

- United Kingdom

See a complete chart of countries here.

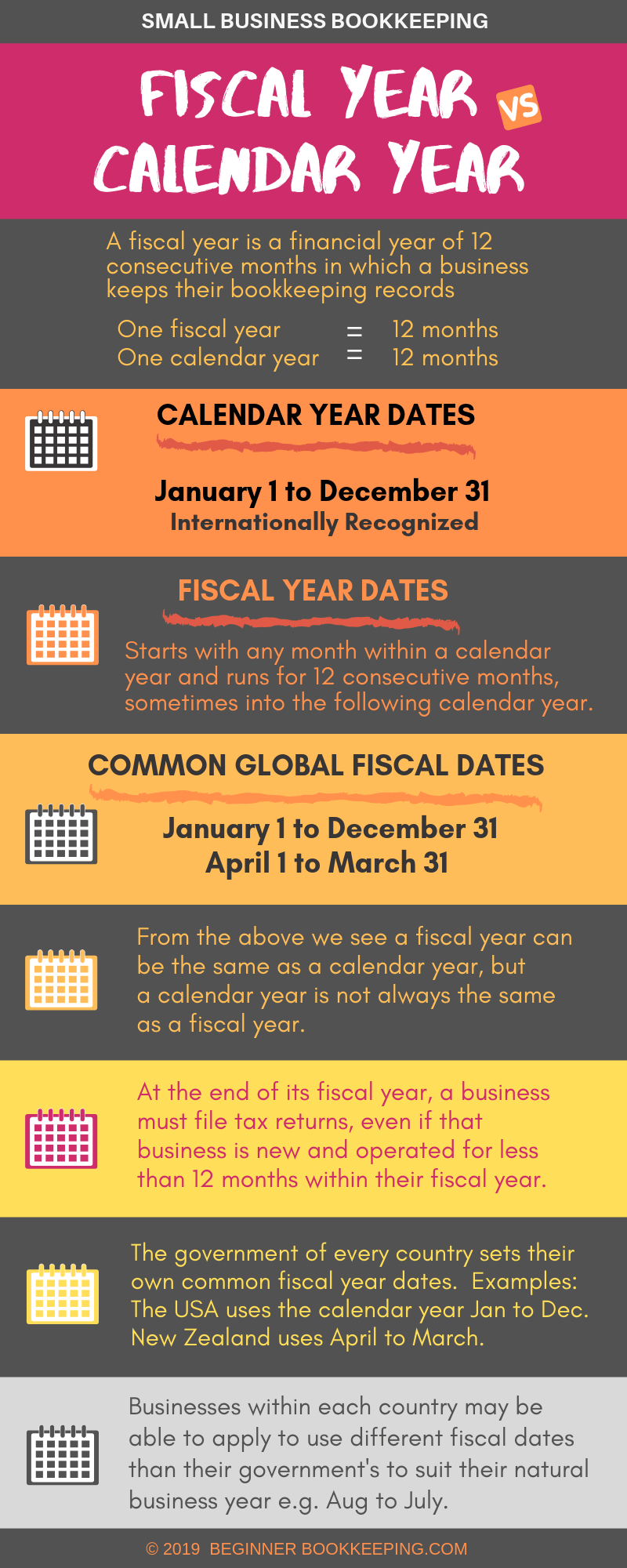

Fiscal Year vs Calendar Year

The common calendar year is:

Calendar Year 1 January to 31 December

By this we see that a fiscal year can be different to a calendar year for tax and financial purposes.

Fiscal Year Definition Info-graphic

Does a fiscal year start when a business starts operating?

No, a fiscal year does not start on the date a business starts operating (unless the business starts on the first date of the fiscal year).

For example:

If your business starts operating on – let’s pick a random date - 11 July, but your tax obligated fiscal year is 1 January to 31 December, your business year is 1 January to 31 December not 11 July to 10 June.

Now, having started on 11 July means you will be operating for nearly six months in that fiscal year, up to the end of December...

…and you must process your end of year bookkeeping when December is finished, and file and pay your income taxes on those six months of trading.

The cycle starts again with your new fiscal year on 1 January. Your second year of operating will be for a full 12 months.

Example 2:

- If your business started on 1 December

- and your fiscal year is 1 January to 31 December

- you must still do your end of year bookkeeping and pay your income tax on just that one month of trading

- from the date business started (1 December) to the end of the fiscal year (31 December).

- After that, your second fiscal year will be for the full 12 months.

Natural Business Year

A business can apply to the tax authorities to have their business fiscal year start and end with months that are different to the set fiscal year because of the timing of their busiest season and to suit their natural business year.

This way the business doesn’t have to process their year-end procedures right in the middle of their busy season, and it will enable the year-end reporting to include the full financial results from the busy season within that one fiscal year, rather than having it spread over two fiscal years.

An example is New Zealand.

Their common fiscal year runs from April to March but vineyards and wineries, and all related contractors, are very busy during that time period because of the grape harvest season, so the best fiscal year for them could start with July.

This way, their natural trading period is July to June and the busy February to May season can be included in that year’s fiscal results.

fiscal quarter and year

A fiscal quarter is made up of 3 months of the year.

There are four quarters in a fiscal year.

Some businesses elect to publish all their important bookkeeping reports every quarter, and then they can compare quarters for the same period in the following year to see if trading has improved.

The quarters for a calendar year would be:

- Q1 January to March

- Q2 April to June

- Q3 July to September

- Q4 October to December

If your fiscal year starts in July, these will be your quarters:

- Q1 July to September

- Q2 October to December

- Q3 January to March

- Q4 April to June

If your fiscal year starts in February, these will be your quarters:

- Q1 February to April

- Q2 May to July

- Q3 August to October

- Q4 November to January

fiscal year end

Once a fiscal year has ended the bookkeeping records can be finalized and income tax calculated.

See End of Year Bookkeeping Tips

You don't have to hold off starting your bookkeeping records for the new financial year just because you haven't finalized your previous fiscal year.

The bookkeeping process allows for the month to month carry over from the old year to the new year no matter what stage of finishing up the old year you are in.

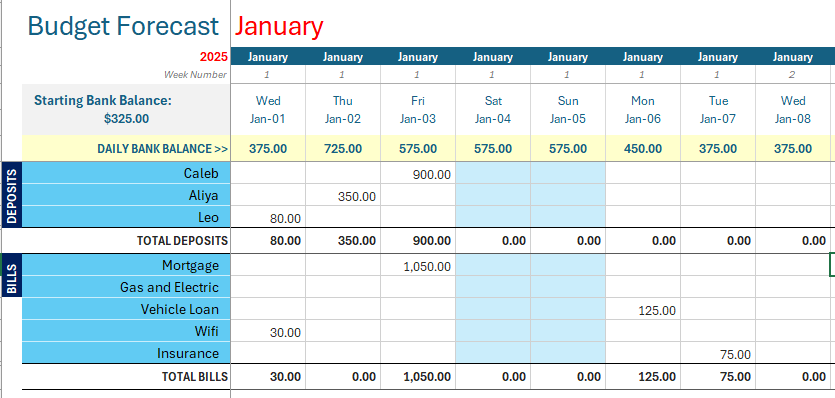

Producing Financial Reports in a fiscal year

The fiscal year, and its months and quarters, form a good structure in which to produce financial reports out of the business bookkeeping records.

It helps the small business owner or the bookkeeper to pull the data together into time periods that can be compared with one another to track if the operating results are improving or declining.

A good example are the Profit and Loss Report (Income Statement) and Balance Sheet.

Every time a month of data has been updated, the above two reports can be produced, and a lot of bookkeeping programs provide the capability of making all sorts of different reports.

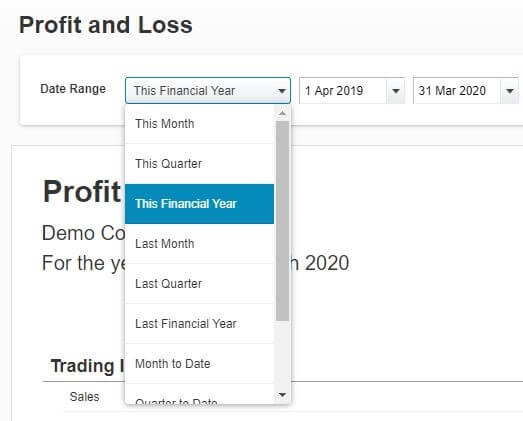

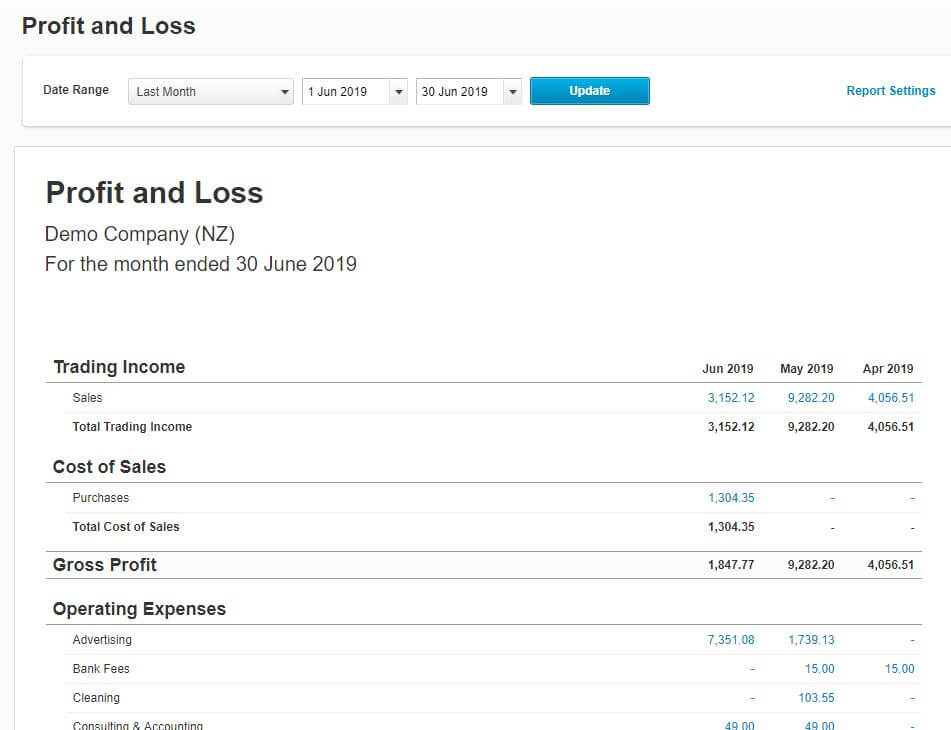

Here are some examples from Xero Accounting using their Demo account.

Fiscal Year Definition:

Date Settings

First, you can select the period of time you want to look at, below I've selected This Financial Year, which also means This Fiscal Year.

Fiscal year definition: Settings in Xero for selecting a fiscal year

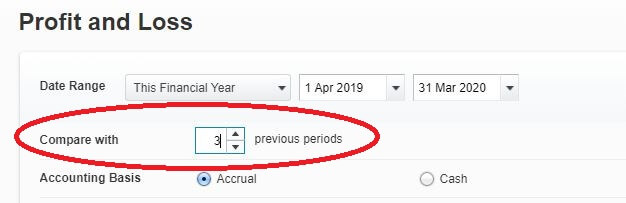

Fiscal year definition: Settings in Xero for selecting a fiscal yearFiscal Year Definition:

Compare Settings

Then you will select how many of similar previous time periods to compare with. Here I have selected 3 previous periods - and because I've selected This Financial Year, the previous 3 periods will be the previous Financial Years.

Fiscal year definition: Settings in Xero for comparing fiscal years

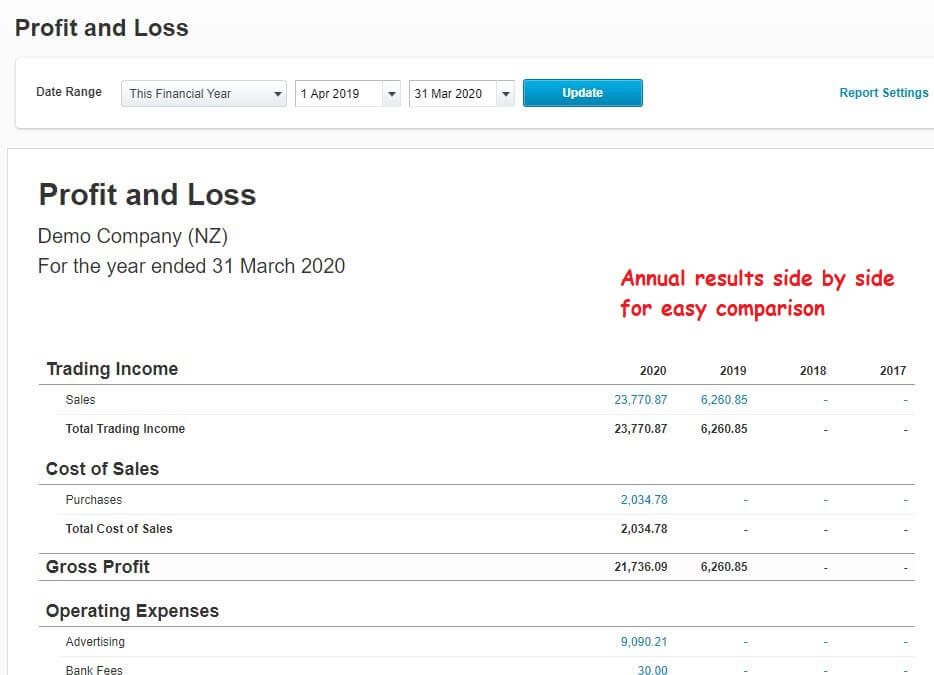

Fiscal year definition: Settings in Xero for comparing fiscal yearsFiscal Year Definition:

Financial Year Comparison Report

Here is what the report looks like for the financial year comparisons

Fiscal year definition: Comparison of 4 fiscal years.

Fiscal year definition: Comparison of 4 fiscal years.Fiscal Year Definition:

Monthly Comparison Report

If I had selected Last Month within this fiscal year, and ticked the box to compare with the previous 3 Periods, below is what the report looks like. This report compares June, May and April. We can see that the Demo company did not do well in sales in June compared with May!

Fiscal year definition: Monthly Comparison

Fiscal year definition: Monthly ComparisonHome > Bookkeeping Terms > Fiscal Year Definition

Facebook Comments

Leave me a comment in the box below.