- Home

- Bookkeeping Questions

- Expenses Questions

Expenses Questions

Find answers to expenses questions specifically for business bookkeeping purposes.

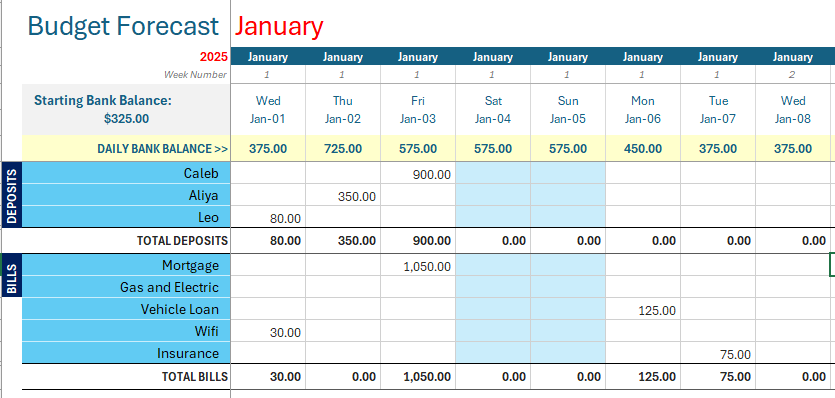

Click above button to get our most popular Excel Template for easy bookkeeping! It's free.

Q1 Business Expenses Paid with Personal Money

The business owner has made purchases from his own personal cash and credit & debit cards. What is the best way to post these paid receipts?

He has also used company checks to reimburse himself for some of these receipts, but never wrote on the check stub which invoices the reimbursements were for.

Answer: There are two ways to approach this. The first way is through a journal. The second way is through the accounts payable section of the bookkeeping program.

bringing in expenses with a journal

Step One:

Split the receipts into month order. You will enter a journal for each month into the bookkeeping program.

In the journal you will debit the relevant expenses, listing them out one after the other with the amounts next to each and code them to the relevant expense accounts in the bookkeeping software, and on the last line credit 'Owners Drawings'.

For the description write 'to bring in business expenses paid for with owners personal funds'. Date the journal at the last day of the month.

This journal will increase the expenses (which is what you want) and decrease the drawings. Why? Because the owner has used his own funds for a business expense and we need to show in the accounts 1. the introduction of his money, and 2. the business expense items.

Some bookkeepers will use the Capital account (also known as Funds Introduced) to introduce the owner's personal money. However, for incidental expenses like this it is perfectly acceptable to use the Drawings account, which decreases the drawings. (Too much drawings is not good for the business so decreasing it is a good thing).

The Funds Introduced account can be kept specifically for larger amounts of cash that the owner is deliberately injecting into the business for whatever reason.

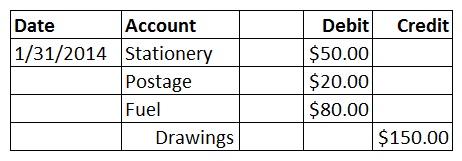

Say the owner used his personal credit card to buy $50 stationery, $20 postage stamps and $80 fuel.

Here is what the journal would look like:-

To bring in business expenses paid for with owner's personal funds

Step Two

So now we need to show in the accounts, the amounts that the owner has reimbursed himself.

Enter the checks into the bookkeeping system as a spend money item in the cashbook, at the dates the checks were issued and put them to the Drawings Account. This will offset the entries made above i.e. increase the Drawings Account as now the owner has taken money out for himself.

In this question, the owner has not made a record of what invoices he was reimbursing himself for. This is not really a problem and I wouldn't waste time trying to figure it out.

Business owners have every right to withdraw funds from their own business for their own personal use without having to explain what it is for. So we don't need to itemize or explain these reimbursements. We only need to do so if the owner wants to keep a detailed record.

Sensible business owners will not take a lot of drawings because sucking their business dry will cause it to fail! It also has a negative impact on taxes.

Bringing In Expenses through Accounts Payable

Step One

Enter bills into the purchases part of the bookkeeping software for each receipt using the date on the receipt. In the bill, use the account that each expense is for i.e. stationery, office supplies, vehicle etc.

Step Two

Enter a credit note for each receipt in the purchases part of the bookkeeping software Narrate it ‘to offset receipt [enter details] made with personal funds’ and use the Drawings account.

Apply these credits to the bills entered in Step one above to clear them out of the system.

Step Three

Enter the check reimbursements as a spend money item in the cash book of the bookkeeping software and code them to the Drawings account.

Facebook Comments

Leave me a comment in the box below.