- Home

- Business Bookkeeping Software

- Excel Cash Book

Free Excel Cashbook

This Excel Cash Book is suitable for any small business that wants an easy bookkeeping method - a simple way to track your income and expenses.

This easy version of the Cash Book is 100% free for you to download and use forever, and it is fully customizable so you can change anything in it.

There is no Balance Sheet in this version. Checkout the version with Balance Sheet here.

Requirements

- You need to have Microsoft Excel on your computer which you can get through Office 365, or you can use the free version of Excel online - just sign up for a Microsoft Account (more about that here).

- Some knowledge of how to use Excel would be beneficial but if you know nothing, Excel has a really good 'Help' link with heaps of how-to information, or

- You can watch, for free, the videos I have prepared for Excel beginners on my Excel Tutorial Videos page.

Excel Cashbook Easy Download

This Cashbook can be adjusted to suit your financial year-end and is suitable for charities, clubs, sole traders/proprietors or small businesses. It has:-

- 7 Income Accounts

- 20 Expense Accounts

- A Bank Reconciliation worksheet

- A Profit and Loss Report (also called Income Summary or Income Statement)

- An Adjustments section underneath the P&L to remove any Balance Sheet type amounts from the P&L in case you had such payments - there is a suggestion list of these type of accounts - to see your true profit

- A QuickStart guide

- An Example page so you can see how it works

- Sales tax features also available - read more about these features here.

Select your template, it will download directly to your device.

Get the Cash Book Easy Template for One

Bank Account

Get the Cash Book Easy Template for Multiple Bank Accounts/Credit Cards

This Cashbook can be adjusted to suit your financial year-end and is suitable for charities, clubs, sole traders/proprietors or small businesses. It has:-

- 7 Income Accounts

- 20 Expense Accounts

- A Bank Reconciliation worksheet

- A Profit and Loss Report (also called Income Summary or Income Statement)

- An Adjustments section underneath the P&L to remove any Balance Sheet type amounts from the P&L in case you had such payments - there is a suggestion list of these type of accounts - to see your true profit

- A QuickStart guide

- An Example page so you can see how it works

- Access to the free online course to help you get set up correctly.

- If you have to track sales tax you can select the version with sales tax.

Get the Cash Book Easy Template for Multiple Bank Accounts/Credit Cards

How to Download and Save the Excel Cash book Easy

Click on the button above - the template will download direct to your device.

Open the downloaded file in Excel and click on 'save as'. This will let you save the cash book with a different name (like the name of your business) to a folder of your choice on your device, and takes it out of read only mode so you can edit it - in other words use it.

On downloading this cash book Excel may pop up with a yellow bar at the top advising the book is in Protected Mode. You will need to click on 'Enable Editing' to be able to use the book.

Here is a basic course to help you set up and use the template, which includes bookkeeping tips.

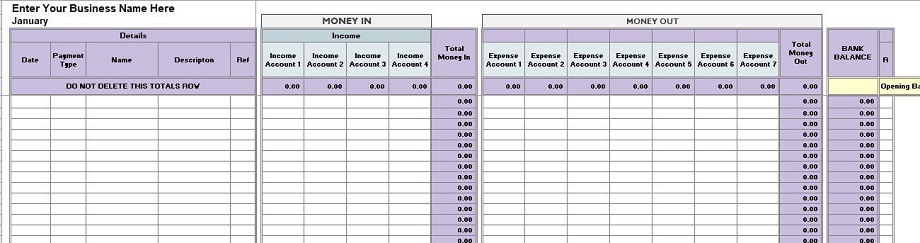

Excel Cash book Easy Overview Layout and Theme

Here is an overview of a monthly sheet where you will enter your business transactions.

The shades and fonts of the whole Cash Book can be changed instantly by clicking on Themes under the Page Layout menu.

Benefits of this Excel Cash Book

- Instantly see how much is being spent on each expense type every month

- Instantly see how much is being earned every month

- Process bank reconciliations for each month to ensure the cash book balance equals the bank account balance

- View a Profit & Loss Report (Income Statement or Income Summary); this is linked to each month and provides month-to-date and year-to-date (YTD) totals for each income and expense type and the resulting profit or loss total

- No bookkeeping experience necessary

- Free and easy to format to suit your business/personal requirements

- Access and edit this excel document from your mobile phone - any time, any place using Microsoft Excel mobile app.

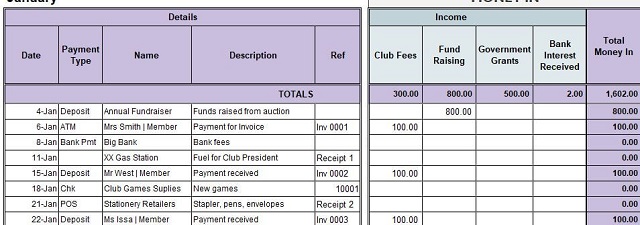

Excel Cash book Examples Page

This is a page of example transactions and gives you an idea of how it will look when you enter information into the cashbook.

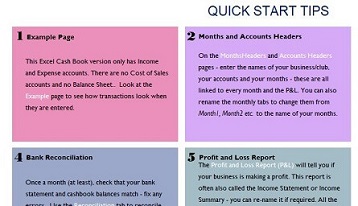

Quick Start Tips

There is a page of quick tips notes to get you started fast with your bookkeeping.

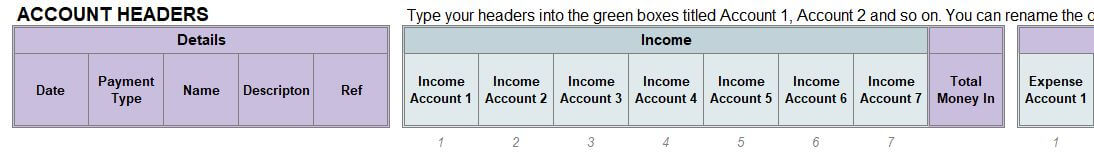

Accounts|Headers Page

The Accounts|Headers page of the Excel Cash Book is where you can enter in the business name, your income and expense header names (account headings) and month names.

All other monthly tabs are connected to this Accounts|Headers page and will automatically pick up the header names you enter here.

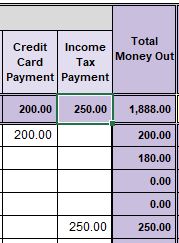

Total Columns

The Total columns have formulas in them, so they update automatically.

Beware! If you manually type anything into the Totals or Bank Balance columns you will over-type the formulas and the totals will be messed up.

You can fix it by copying a formula from a row above or below that is working.

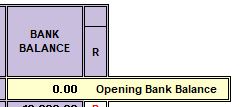

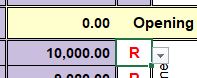

Opening Balance

In the first monthly worksheet, in the yellow cell, you must enter the opening balance for the first day of the month (before that day's transactions start ) which you can get off your bank statement.

If your opening balance is 0.00, you can type in 0.00 or just leave it blank.

Note: This opening balance will be the same amount as the closing balance of the previous month.

Bank Reconciliation

When reconciling the cash book to the bank statement you can select different red letters from a drop-down list.

Select your choice.

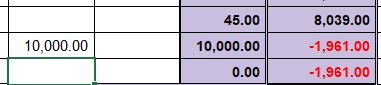

Excel cash Book in the Red

When there

is not enough funds in the account, in other words, when it goes into

overdraft, the cash book shows the number in red as in the example

here where it is -$1,961.00

Wow! I hope this business has an arranged overdraft facility with their bank!

Cash Book Income Statement

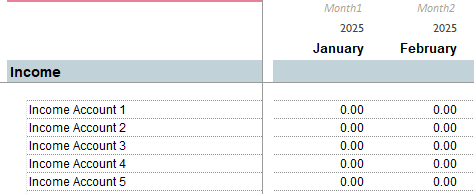

Profit and Loss / Income Summary

The Profit and Loss Report is linked to all the monthly sheets.

The rows with the "Account 1" etc are the account headings and are linked to the Accounts|Headers sheet

The 0.00 amounts under the months are the totals from each monthly worksheet. The 0.00 amount means no transactions have been entered into those months for the Cash Book.

This is the same throughout the profit and loss report for each section Income, COGS and Expenses.

What about a Balance Sheet?

This Excel Cash Book does not have a balance sheet, which helps to keep it easy.

However, you might have certain types of income or expenses that you have to record in this cashbook to keep your bank account in balance, but which need to be kept out of the profit and loss calculations, and are usually the type of transactions that go on to a Balance Sheet.

These might include personal expenses, or loans to name a few.

This easy cashbook has a section at the bottom of the P&L to help you remove these balance sheet type amounts from the profit calculations.

Or, you can take a look at the version that includes a Balance Sheet.

Sales Tax Features in the Excel Cash book

Each transaction per row can only have one sales tax rate applied to it.

The cash books with sales tax features have these extra

sheets:

Sales Tax Rates – where you enter the percentage rates that are applicable to you

Sales Tax Columns – four for the income columns and four for the expense columns

Sales Tax Summary – a simple display of the total sales tax for each month

Sales Tax Report – an interactive report allowing you to select any month or group of months to see sales tax totals

Sales Tax Data – a spreadsheet containing all the data supporting the Sales Tax Report – this is the “data source” of the report.

Note: the Profit and Loss report displays income and expenses excluding sales tax

This excel cash book is a great way to keep simple bookkeeping records.