- Home

- Bookkeeping Articles

- Cloud Bookkeeping

Cloud Bookkeeping

This article explains what cloud bookkeeping is and the benefits a business can gain from it.

Bookkeeping has changed a bunch from the old days when pen and paper were the norms.

And don't forget the trusty old calculator bookkeepers had by their sides!

Today, however, pen and paper have become mice and keyboards.

The benefit of the “cloud” means bookkeeping for many small businesses has become much easier and it's far more advanced.

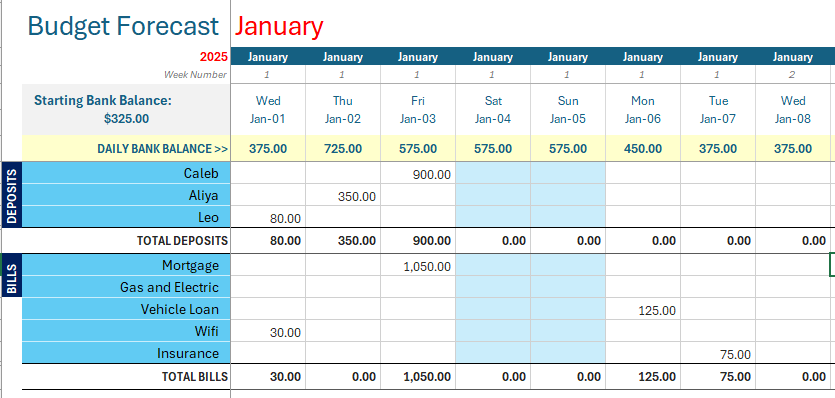

Click above button to get our most popular Excel Template for easy bookkeeping! It's free.

What is the Cloud?

Before we can begin to understand the benefits of this new way of bookkeeping, we must define the “cloud”.

By now, you'll have probably assumed that it has something to do with the internet; and you're right!

Cloud software is simply an application that is not tied down to or dependent on your computer.

Example: Have you ever used Spotify? Not a single song has to be on your computer, yet you can still have access to thousands of them just by streaming. All you have to do is log in! Spotify is an application that works in the cloud.

Many bookkeepers and small business owners alike already know the wonders working online can do.

There's a wide array of available software options devoted to making the process of bookkeeping in the cloud a snap.

The benefits of cloud bookkeeping include ease of access to bookkeeping data as well as not having to purchase and install programs, and the online software is always kept up-to-date.

How much easier can it get than opening a web page and just logging in to view everything?

With that said, there are some not-so-obvious benefits of bookkeeping in the cloud that you should know about.

Here are three common ones.

1. Easier Audit Protection

Audits are terrible! If you ever have to go through one, cloud accounting applications tend to offer subtle, but useful features to make them less stressful.

- Attach source documents to transactions

Let's say I went on a stationery run today to purchase some office supplies for my business. I buy what I need and the cashier gives me my receipt.

That receipt is a source document! This means the IRS views it as something that can validate $40 of supplies expense in my books.

I can easily snap a photo of that receipt, open whatever cloud accounting app I use on my phone, and then attach the photo to the journal entry detailing the purchase. Or I could just mail the receipt to my bookkeeper so he/she can do that for me. - A more comprehensive audit trail

With more than one person working on a company's books, it's best to know who makes changes to your books, what they were, and when they were made. Many accounting programs come with what's known as an “audit trail”.

In the case of the $40 supplies expense from earlier, I could look for this journal entry in the audit trail. It would show something similar to this; User “[my_name]” created an expense at 1:03 PM on 8/14/20xx.

It's pretty hard to hide anything with that level of detail. This feature is really crucial with cloud accounting programs because one file can have many, many users!

2. Near Real-Time Reports

Bookkeeping in the Cloud - Reporting

Bookkeeping in the Cloud - ReportingI can't even begin to tell you how important financial reports are. Whether it's an income statement or a balance sheet, the numbers can be so rich and informative.

Unfortunately, they can only be of use if they're not outdated.

A balance sheet that was last updated in 2005 is not timely. Wouldn't you rather use statements that were updated 3 hours ago?

Real time reports are those that are current at any point in time. Realistically, this is impossible, but bookkeeping in the cloud can get fairly close.

As an example, let's say Tina owns a bookstore and that she also has an online bookkeeper.

Sometimes she has time to work on keeping her bank account balances up to date but even if she doesn't, Tina's bookkeeper just does it from home every morning.

Why is this important?

If Tina was doing everything alone, she would most likely fall a few days behind on keeping her balances current.

If her checking account showed that she had $100 in it 3 days ago and she bought something for $50, there's a chance that her balance could have been less than that $50 since a few days have passed and other expenses might have come out of the account. That would mean hefty overdraft charges. Not good!

However, Tina's bookkeeper keeps the books up to date when she can't! This means her balance sheet would correctly show how much money she had in her checking account that day.

She would most likely hold off making the purchase to avoid the overdraft charge.

The cloud allows Tina's bookkeeper to work on her books from anywhere with internet access!

If her accounting program was tied to her computer in her bookstore, do you really think her books would be as current as they are?

These near-real time reports are critical to any business.

It's the only way owners can make effective and logical decisions.

3. All-in-one Processing Centers

Many cloud accounting applications tend to do more than just keep track of financial records.

Xero or QuickBooks allow you to send invoices by email to your customers directly from within the software and you can set up automatically recurring invoices for ultimate convenience.

A nice thing to remember is that each account on a balance sheet is its own kind of management.

Many cloud accounting apps have features tailored to specific accounts.

For example: Xero and QuickBooks' invoicing features is part of accounts receivable management.

Another example would be inventory tracking in the online software - this is inventory management.

An all-in-one processing center is one program that gives you the capability to handle every aspect of management.

Cloud accounting software generally provides this by leveraging the power of the internet so you can link to it all kinds of different applications to tailor your business' requirements and your software and apps will remain synchronized.

In essence, one program is enough to support an entire business! You'll have all that information at your fingertips which you can access from anywhere that you have internet access.

Final Thoughts

Small business owners tend to not have a lot of time on their hands. Today, a lot of accounting and bookkeeping processes are performed online because it's more convenient for everybody. With that said, working in the cloud is not right for everybody. The complexity of a business and its financial records may warrant an on-site bookkeeper or accountant.

Nevertheless, it makes a lot of sense to become familiar with what the cloud has to offer.

Facebook Comments

Leave me a comment in the box below.