- Home

- Single Entry Bookkeeping

- Bank Recon Exercises

Bank Reconciliation Exercises and Answers

Here are bank reconciliation exercises and answers in printable PDF format and in Excel.

These are free to use by individuals, teachers and students, small business owners and bookkeepers, and anyone else who is interested.

Use these exercises to practice working on bank reconciliation problems and solutions.

These are based on manual bookkeeping, not on bookkeeping software.

Click above button to get our most popular Excel Template for easy bookkeeping! It's free.

Bank Reconciliation Exercises and Answers

Step-by-Step Tutorial Exercise

The first bank reconciliation exercise is a step-by-step tutorial - see what to do at each step.

It brings to light common problems and the solutions to fix them.

You will learn:

- How to match the transactions on the bank statement to the cash book

- How to make a note of any bank reconciliation problems

- What to do to solve the problems

- When and how to adjust the Cashbook

- When and how to use a Bank Reconciliation Worksheet

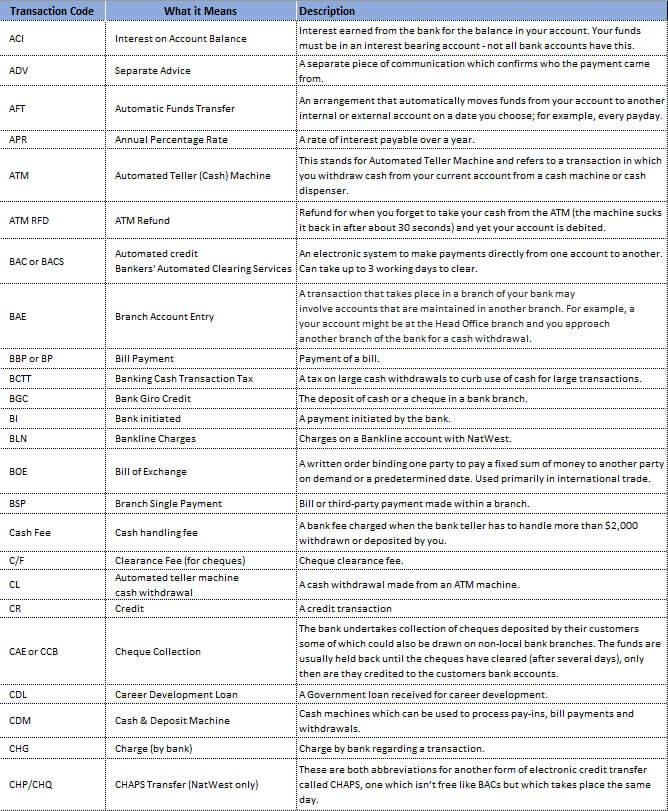

Here is a free printable list of bank abbreviations and codes that can be found on bank statements. This covers a range of different codes used by different banks in different countries.

This is not an exhaustive list but it will familiarize you with how banks use abbreviations to identify each type of transaction on a bank statement.

Bank Reconciliation Exercises and Answers - Bank Abbreviations

Bank Reconciliation Exercises and Answers - Bank AbbreviationsBank Reconciliation Exercise One - The rose and flower shop

Download this exercise in PDF format

Download this exercise in Microsoft Excel

All names of people and businesses in these exercises are fictitious and made up from my imagination. They do not depict real names, businesses or places known by me.

The Rose and Flower is a new floral shop started by Rose Green on April 1st.

Rose opened a business account with a bank called A Major Bank (AMB). She gets the following with her bank account:

- A debit card which she can use to purchase things in store or online

- Internet banking access, so she can go into her bank account online and set up payments and print transactions

- A check/cheque book to pay for expenses

Rose also has a business Visa card with AMB.

The Rose and Flower shop operated throughout April.

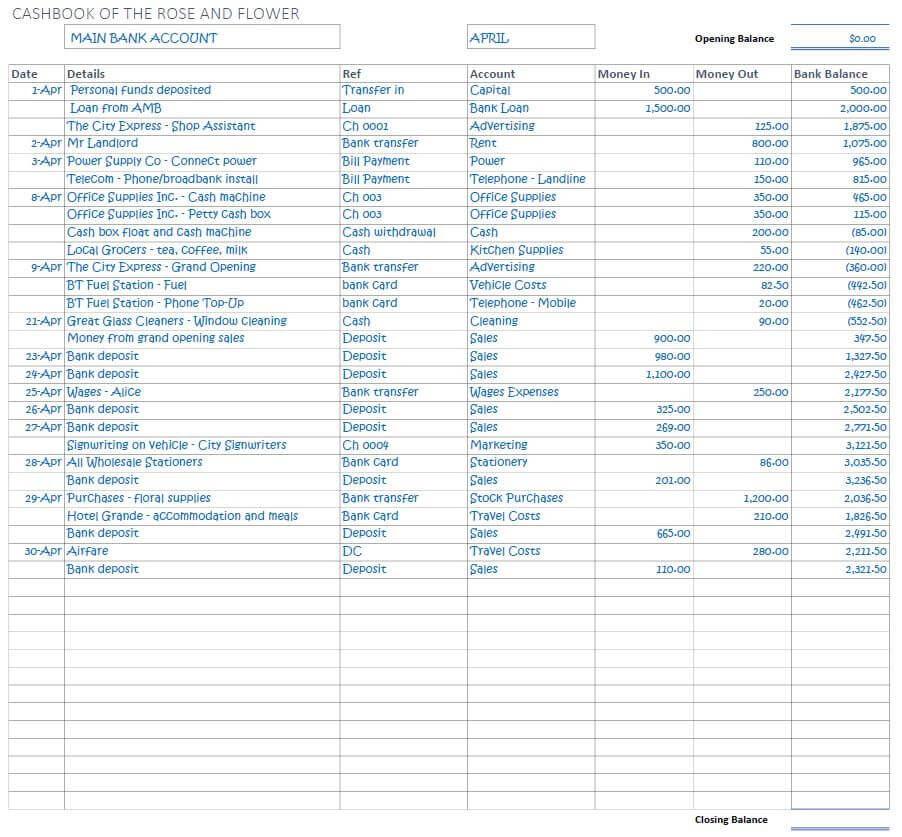

Rose occasionally updated her Cashbook for April.

The cashbook is a pre-printed book from the stationery shop. Rose just writes down her transactions into it when she remembers.

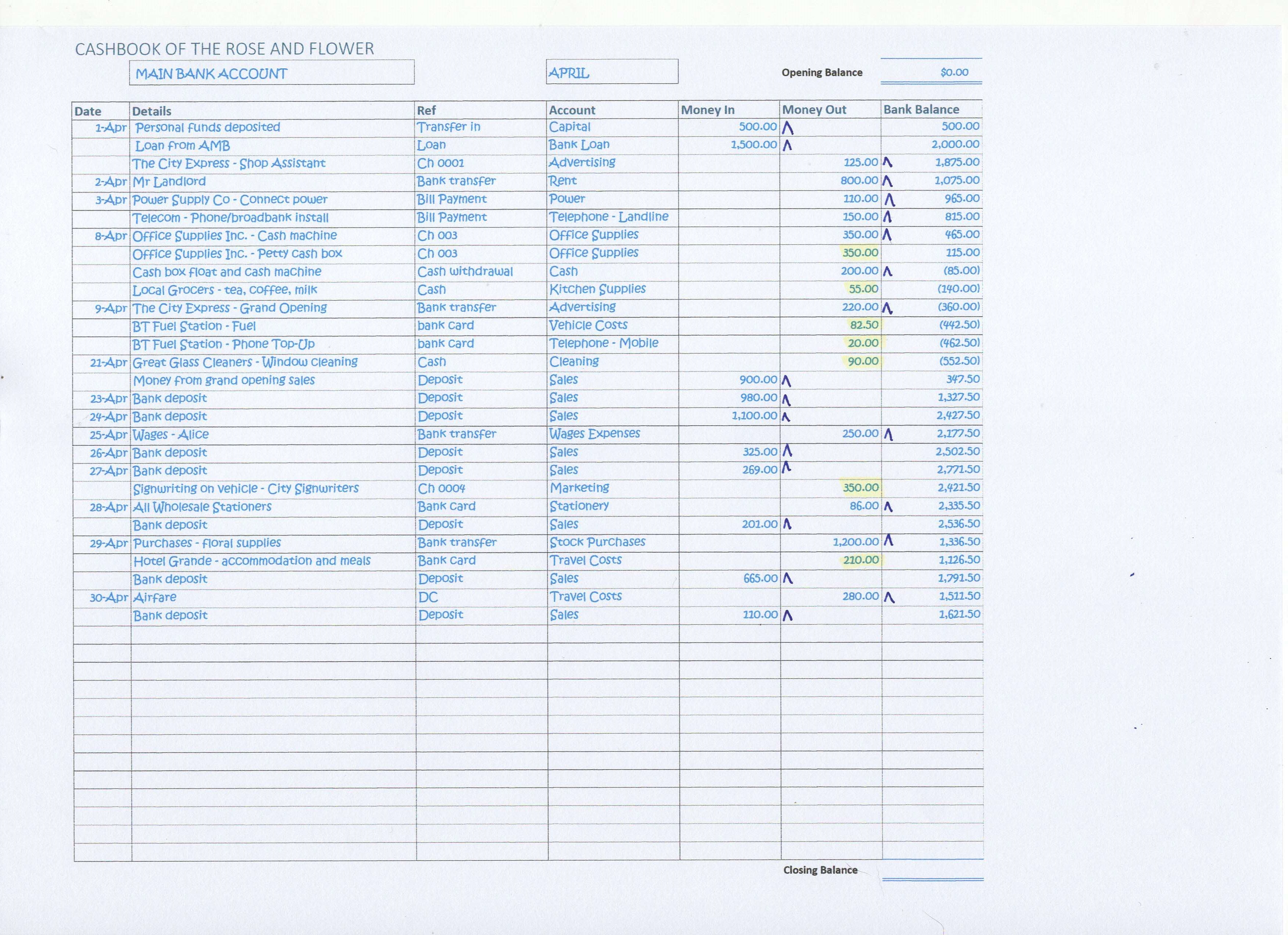

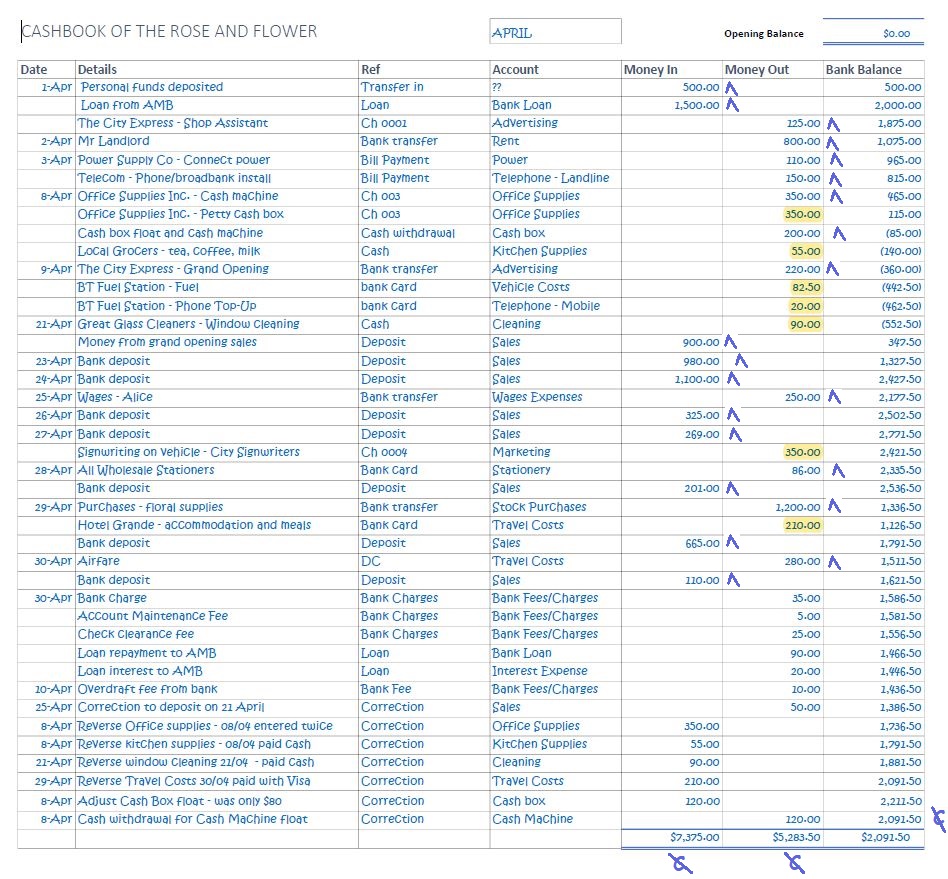

Here is an image of the April page in the Cashbook at the end of April.

The closing balance is left blank until Rose checks the Bank Statement.

Bank Reconciliation Exercises and Answers - Cashbook of the Rose and Flower Shop

Bank Reconciliation Exercises and Answers - Cashbook of the Rose and Flower ShopYou will notice that there are no currency symbols in the Cashbook, except for the opening balance.

This is because Rose does not operate foreign currency accounts and she and the bank know that her account is in the currency of their country, therefore, there is no need to go through the tediousness of entering a currency symbol with every transaction.

Checking the Bank Statement Against the Cashbook

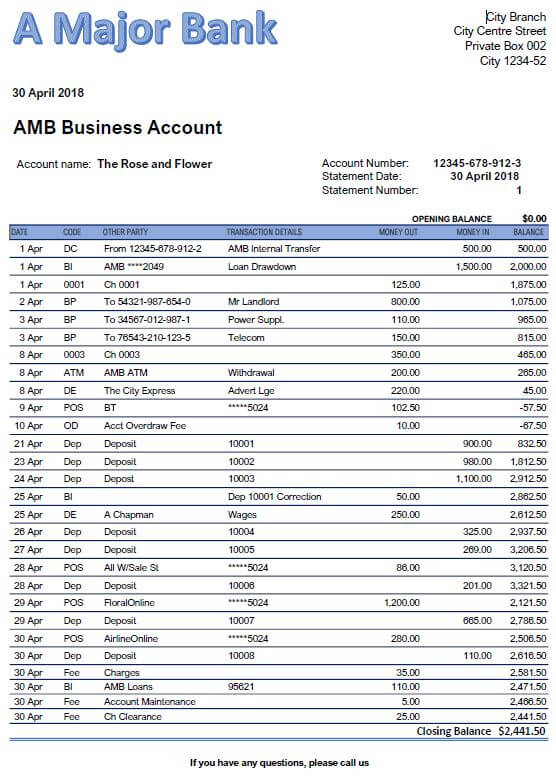

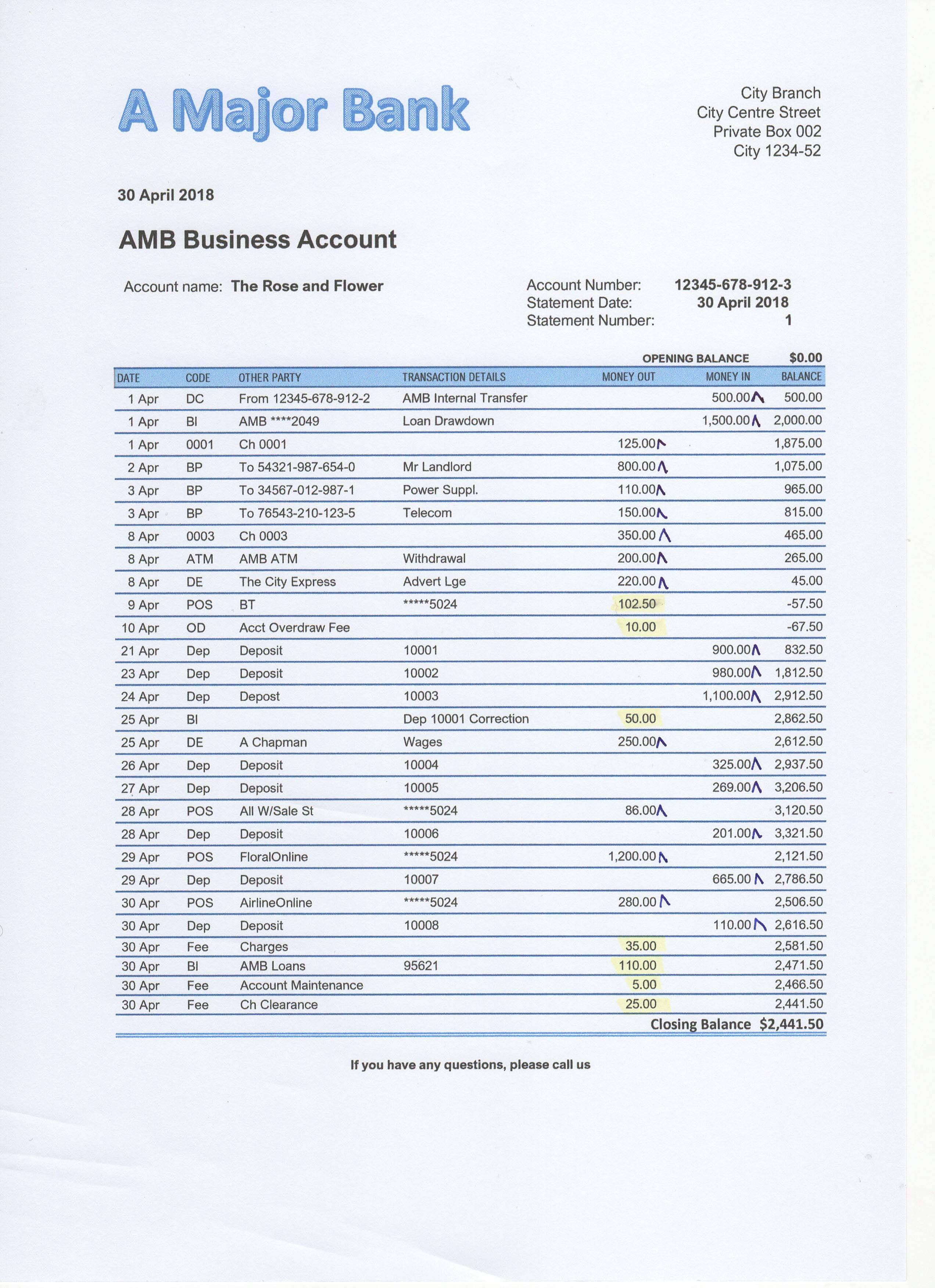

At the beginning of May, Rose received a Bank Statement from AMB. Here it is: -

Bank Reconciliation Exercises and Answers - Bank Statement of the Rose and Flower Shop

Bank Reconciliation Exercises and Answers - Bank Statement of the Rose and Flower ShopNow Rose is ready to reconcile the bank statement and cashbook.

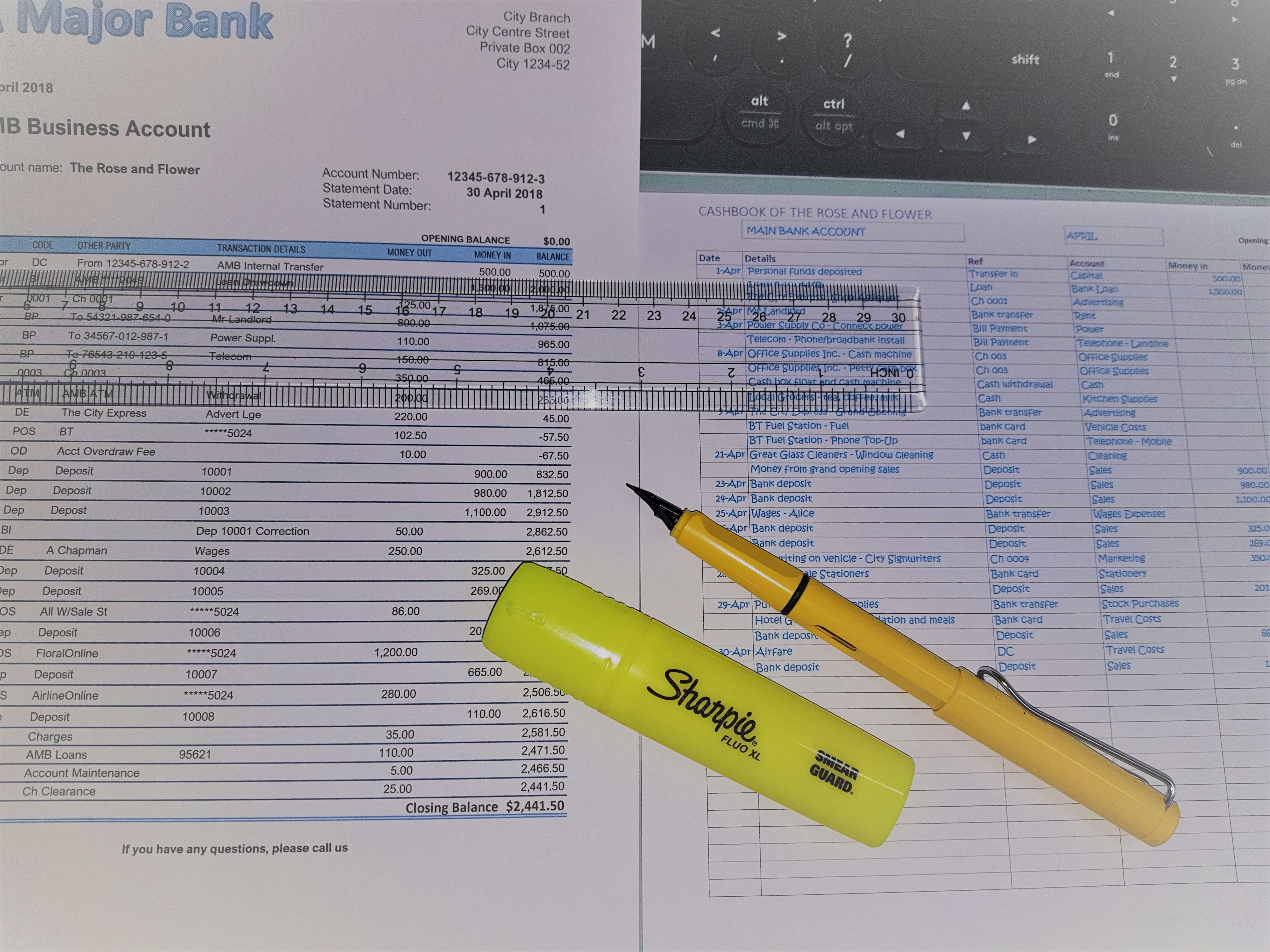

She lays them side by side on her table.

She has a ruler, a pen and a highlighter.

Bank Reconciliation Exercises and Answers - Cashbook and Bank Statement Side by Side

Bank Reconciliation Exercises and Answers - Cashbook and Bank Statement Side by Side

Ticking the correct transactions

You may notice the tick marks on my examples in the images below look like little, pointy hats.

This type of tick mark can be quicker to write, and neater than a standard tick mark on which the upward stroke can end up being very long, depending on a person’s handwriting, and look messy!

You can use any tick symbol that you are comfortable with – there is no hard rule about this.

You can use a pen or a pencil.

Pencil marks can be erased afterwards if you don't want them to remain on the documents.

- Rose puts the ruler under the first transaction on the Bank Statement - it shows an internal transfer of $500 in the Money In column

- She looks across to her Cashbook and sees the $500 in the Money In Column

- Both transactions are correct, so Rose puts a small tick mark next to each

- Then Rose moves the ruler down to the next transaction on the bank statement

- It is for a loan amount of $1,500 which Rose had applied for from the bank

- She looks across to her Cashbook and sees that she had entered the $1,500 into the Money In column

- Both transactions are correct, so Rose puts a small tick mark next to each

- She continues to work down the Bank Statement and looking across to the Cashbook and ticking off the correct transactions.

Highlighting missing or different transactions

- On 8 April Rose sees that she has entered $350 twice into the Cashbook in error

- One entry says Cash Machine and the other says Petty cash box

- She highlights the transaction on the bank statement with her yellow highlighter because she wants to check the invoice/receipt from Office Supplies, after which she will know what she must do in the Cashbook

- She also highlights the error in the cashbook

- Rose starts a list on a separate piece of paper noting each error or difference that she needs to investigate and correct

Here are the ticked and highlighted documents - Bank Statement first then the Cashbook

Bank Reconciliation Exercises and Answers - Checked Bank Statement

Bank Reconciliation Exercises and Answers - Checked Bank Statement Bank Reconciliation Exercises and Answers - Checked Cashbook

Bank Reconciliation Exercises and Answers - Checked Cashbook

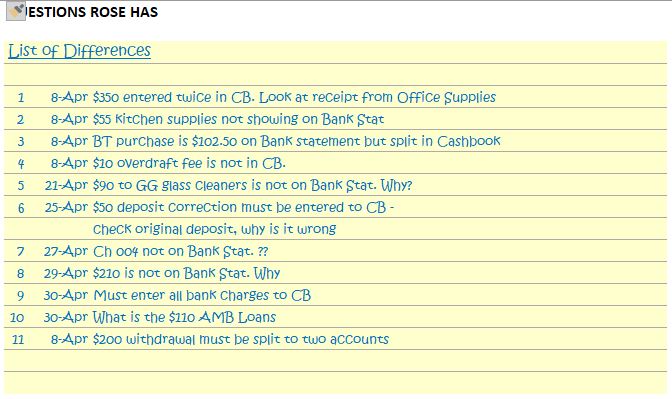

List of all Bank Reconciliation errors or differences

Professional Bookkeepers would probably skip this step of writing a list of questions.

Instead, as soon as they come to the first problem, they will look it up, figure out how to fix it and sort it out right away.

Why?

To save time by not double-handling the same problem, that is, they are not highlighting and writing down the problem (first handling) and then later on going to investigate why the problem occurred and then fixing it (second or even third handling).

- Rose continues to move down through the Bank Statement with her ruler and ticking the matching transactions, or highlighting transactions on the Bank Statement that do not match.

- With each highlighted entry, Rose continues to write the differences on her queries list.

Here is the final list:

Bank Reconciliation Exercises and Answers - Questions

Bank Reconciliation Exercises and Answers - Questions

Bank Reconciliation Exercises and Answers:

List of Questions, Answers and Solutions

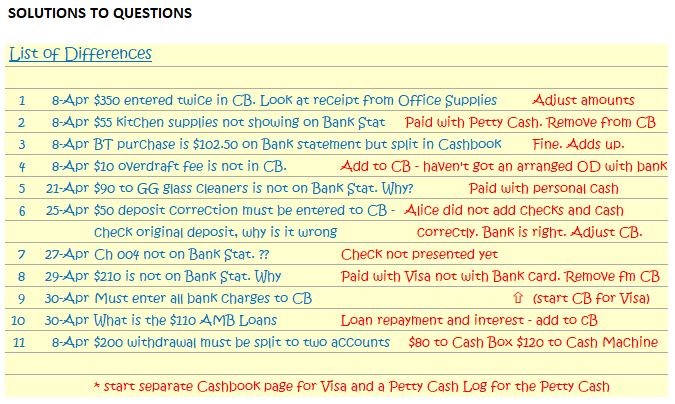

Query One

Why is $350 entered twice?

Answer:

The receipt from Office Supplies shows her that the Cash Machine (also known as a Cash Till) was $300 and the Petty Cash Box was $50.

Solution:

One of the $350 entries must be reversed ('removed' from the Cashbook).

Query Two

Why are the kitchen supplies $55 not on the bank statement?

Answer:

The Cashbook Reference column indicates ‘Cash’ was used. Rose looks in the Petty Cash box and finds the receipts in there. The items were brought with money from the Petty cash box and so they should not be in the Cashbook for the bank account.

Solution:

This entry must be ‘removed’ from the bank Cashbook page, and a new record must be started for the transactions in and out of the Petty Cash box. This can be done with a Petty Cash Log.

Query Three

Why is BT payment of $102.50 split

in the Cashbook?

Answer:

It is split because two different

types of expenses were purchased and so they needed to go to different accounts

(vehicle costs and telephone)

Solution:

The split in the Cashbook is fine. Leave as is.

Query Four

Why is there an OD fee of $10?

Answer:

The bank account went into overdraft. Rose does not have an arranged overdraft facility with the bank, so they charged her $10.

Solution:

Enter it into the Cashbook.

Query Five

Why is $90 to glass cleaners not on the Bank Statement?

Answer:

Cash was used to pay for this. Rose checked the Petty Cash box but it was not taken from there. She remembers using her own cash to pay.

Solution:

Keep receipt and give to Accountant to enter into the bookkeeping system using a journal.

Query Six

Why has the bank done a deposit correction of $50.

Answer:

Rose checks the original deposit paperwork and calculations and sees that her assistant Alice did not add up the receipts correctly. The bank is correct to make this adjustment.

Solution:

Include the adjustment in the Cashbook.

Query Seven

Why is Ch 0004 not on Bank Statement?

Answer:

Rose checks the check/cheque book and she looks at her bills. She knows she posted the check to the sign writers and so they probably did not get it deposited before the month end.

Solution:

This will be adjusted using the Bank Reconciliation Worksheet.

Query Eight

Why are the travel costs of $210 not on the Bank Statement?

Answer:

The Cashbook reference is ‘Bank Card’. Rose remembers that she used the business Visa Card, not the bank card. However, she is still waiting for the Visa card statement which the bank will only send out in the middle of May.

Solution:

‘Remove’ this transaction from the bank account Cashbook and start a separate Cashbook page for the Visa card transactions.

Query Nine

Why are none of the bank fees not in the Cashbook?

Answer:

Rose wasn’t aware of them until she got the bank statement, although if she had checked her bank account online more closely she would have seen them.

Solution:

Enter them into the Cashbook.

Query Ten

What is the $110 AMB Loans?

Answer:

Rose checks her loan paperwork and sees that this is the regular monthly repayment. It is for $90 principal and $20 interest.

Solution:

Enter to the Cashbook.

Query Eleven

$200 withdrawal must be split to two Accounts

Answer:

Rose only discovered this after checking the deposit to the Petty Cash Log sheet against the entry in the Cash Book.

Solution:

Show that the Cash Box amount was $80, and the Cash Machine amount was $120.

Here is the list of Rose with her answers

Bank Reconciliation Exercises and Answers - Solutions/Answers to Questions

Bank Reconciliation Exercises and Answers - Solutions/Answers to QuestionsCashbook adjustments

Rose works through her list of solutions to adjust the Cashbook at the bottom.

If she did not have enough room at the bottom, she would simply turn the page and do it there because she is using a pre-printed Cashbook which has lots of lined pages.

If she was using lined pages printed off her computer she would just print more pages as she needs them.

First Group of Adjustments:

Transactions on Bank Statement Missing from cashbook

The first thing Rose does is to enter into the Cashbook the transactions from the Bank Statement that were missing from the Cashbook, which were:-

- Difference No. 4 – the overdraft fee of $10

- Difference No. 6 – the Deposit correction of $50

- Difference No. 9 – the three different types of bank charges

- Difference No. 10 – the loan repayment

These are all straight forward entries.

She dates them at the date showing on the Bank Statement even though entering them after the transactions dated April 30th in the Cashbook – a mixed date order within the same month is not a huge problem.

Second Group of Adjustments:

Transactions in Cashbook that were entered incorrectly

The second thing Rose does is to enter adjusting entries for the transactions that were wrong in the Cashbook, which were:

Difference No. 1 – The double entered $350.00.

How: The adjustment is entered to the Money In column in the Cashbook to put the Cashbook back up to a correct balance. Look at the balance before the entry was made and look at it after this entry was made.

Difference No. 2 – The kitchen supplies entry of $55

How: This adjustment is also entered to the Money In column, same reason as difference no. 1

Difference No. 3 – The Split purchase of $102.50

How: Nothing is done here because the split amount still adds up to $102.50 and so the Cashbook bank balance is correct.

Difference No. 5 – The $90 for the window cleaners.

How: This adjustment is also entered to the Money In column, same reason as difference no. 1 and 2 above.

Difference No. 8 – The hotel payment of $210.

How: This adjustment is also entered to the Money In column, same reason as difference no. 1,2 and 5 above.

Difference No. 11 - Split the Cash Withdrawal to two accounts.

How: Enter $120 into the Money In Column, which leaves $80 against the Cash Box account. Then do a second entry of $120 into the Money Out column against the Cash Machine account.

Rose dates them all at April 30th (except for No 6. Cash withdrawal) but indicates in the Details column the date of the original transaction entry in the Cashbook.

At this stage Rose could also go back to the Bank Statement and tick off the highlighted transactions to show that they have now all been dealt with.

Below is the adjusted Cashbook.

You can see that Rose :

- updated the Bank Balance column

- totalled the Money In and Money Out columns

- updated the bank balance column

- double-checked her calculations and ticked the totals with a different kind of 'checked' mark - a C with a line through it.

There is still a difference in the Cashbook of $350 which is due to the unpresented check/cheque from Query No. 7.

The next step will be to make a bank reconciliation worksheet to include this $350 in the calculations.

Bank Reconciliation Exercises and Answers - Updated Cashbook

Bank Reconciliation Exercises and Answers - Updated CashbookHow to know when to use a reconciliation worksheet vs adjusting the cashbook

There are always two main steps to get the bank account and cashbook balanced to each other if they are unbalanced.

First Step: Adjust the cashbook

Second Step: Use a bank reconciliation worksheet template

Sometimes it will only be necessary to process just the first step, or just the second step, depending on what transactions are missing or wrong.

If you deal with purely modern online banking and do not issue or receive checks/cheques, you will not have to use a Bank Reconciliation Template.

This list will help you decide if you should adjust the Cashbook or use a Bank Reconciliation Worksheet or to do both.

- If you know that a transaction in the Cashbook this month will be on next month’s Bank Statement, don’t adjust the Cashbook. Use the Bank Reconciliation worksheet.

- If a transaction is on this month’s Bank Statement but not in the Cashbook, then you must adjust the Cashbook by entering the transaction into the Cashbook this month. Don’t use the Bank Reconciliation Worksheet.

- Any deposits that are showing in your Cashbook but not on the Bank Statement, use the Bank Reconciliation Worksheet

- Any checks/cheques issued by you in your Cashbook but not on the Bank Statement, use the Bank Reconciliation Worksheet

- Any deposits on the *Bank Statement but not in your Cashbook, adjust the Cashbook by entering the deposit in to the Money In column.

- Any withdrawals on the *Bank Statement but not in your Cashbook, adjust the Cashbook by entering the withdrawal in the Money Out column.

*Even if the bank has made an error on their Statement, because you will let the bank know and they will adjust their system next month so that it shows on the Bank Statement next month; then next month you can adjust your Cashbook to match.

Bank Reconciliation Exercises and Answers:

How to use a bank reconciliation worksheet

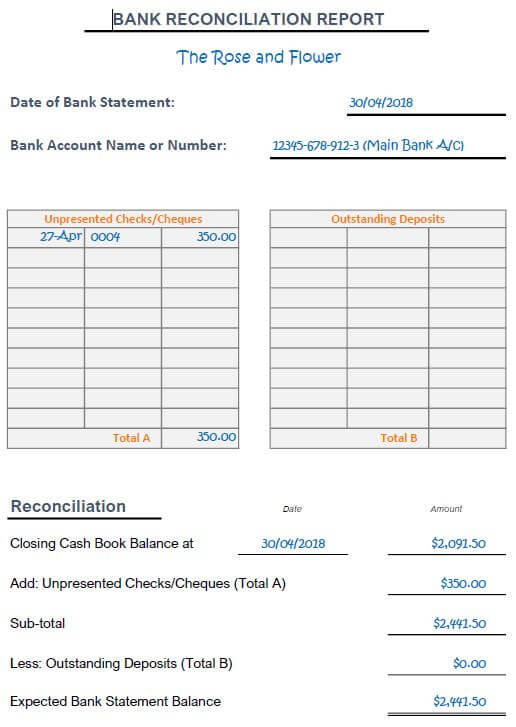

Here is the example of Rose’s reconciliation template which shows you how to get the bank reconciliation format correct.

Unpresented checks/cheques and unpresented deposits must all be calculated into the mix using a Bank Reconciliation Worksheet (not entered as adjustments in the Cashbook as previously mentioned).

Unpresented Checks / Cheques - Unpresented checks/cheques are those that you issue to your suppliers or vendors or any other business or person but which they did not deposit to their bank before the month ended.

These will show up on your next month’s Bank Statement, so they will not be entered as adjustments in the Cashbook, they will instead be added to the Bank Reconciliation Worksheet to take the Bank Balance back up (as if these expenses were never entered).

Outstanding Deposits - Outstanding deposits are payments you receive into your Cashbook on say the last few days of the month, but which you don’t drop off at the bank until say the first day of the next month.

These will be on next month’s Bank Statement; therefore, they will not be entered as adjustments in the Cashbook but will instead be deducted on the Bank Reconciliation Worksheet to reduce the Bank Balance down (as if these deposits were never entered).

Bank Reconciliation Exercises and Answers - Bank Reconciliation Format

Bank Reconciliation Exercises and Answers - Bank Reconciliation Format

The check/cheque number 0004 dated 27th April is not on the Bank Statement so Rose writes it down in the Unpresented Checks/Cheques box of the Bank Reconciliation Worksheet.

Rose then enters the amounts into the Reconciliation section of the worksheet.

The Expected Bank Statement Balance of $2,441.50 is the closing Bank Statement balance so it is good and correct.

If it did not come to that on the Bank Reconciliation Worksheet, it would mean either:

- Rose had not done her Cashbook

adjustments correctly making the Closing Bank Balance wrong or

- Entered or calculated the Un-presented checks/cheques or Outstanding Deposits incorrectly in the boxes on the worksheet

...and would have to go back to check them all.

The Cashbook closing balance for the last day of April will remain as $2,091.50.

There are no further adjustments to be made.

The information from the Bank Reconciliation Worksheet is not transferred into the Cashbook because the un-presented check/cheque will be on next month’s Bank Statement.

So next month the Cashbook balance and Bank Statement balance will align with each other without having to do another Reconciliation form (unless of course next month there are new unpresented checks/cheques or deposits).

At the end of the day Rose will file the April Bank Reconciliation Worksheet with the April Bank Statement so that if some months later someone were to look back at April they will see from the Reconciliation worksheet why the Cashbook balance was not the same as the Bank Statement balance.

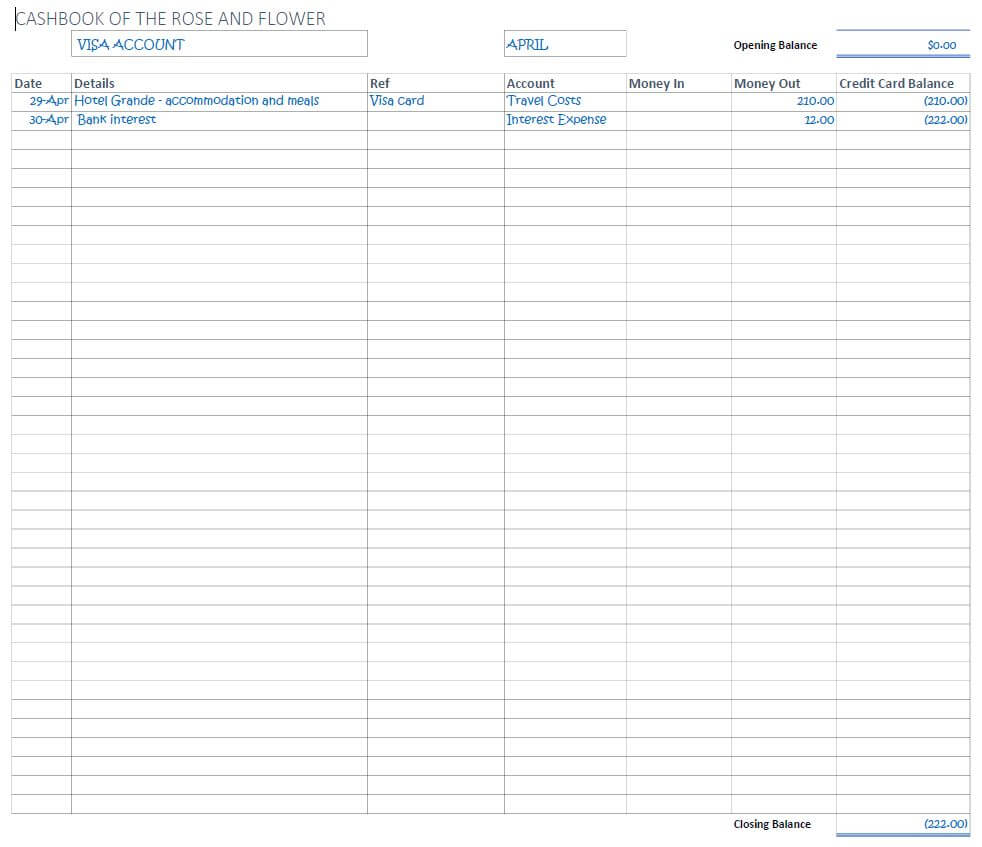

Cashbook for visa

Here is the image of the Cashbook for the Visa Credit Card which Rose started half way through her pre-printed Cashbook (rather than paying for a whole separate Cashbook from the stationers).

She will match and reconcile this in the same way she matched and reconciled the Main Bank Account, once she receives her Visa Credit Card statement.

Bank Reconciliation Exercises and Answers - Cashbook for Visa Account

Bank Reconciliation Exercises and Answers - Cashbook for Visa AccountPetty Cash Log Example

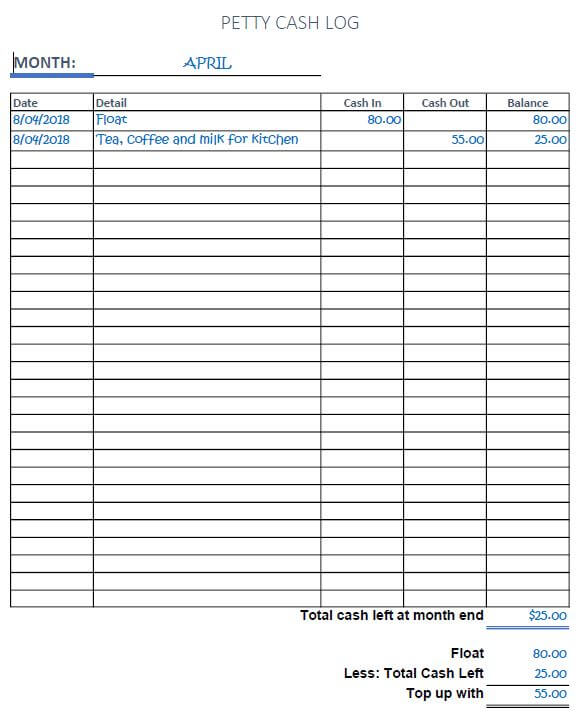

Here is the image of the Petty Cash Log.

This is based on my petty cash log form, but there is no reason not to use the Cashbook layout.

For example, Rose could start a Cashbook for the cash box at the back of her Main Cashbook (just like she started the Visa Cashbook half way through the Main Cashbook pre-printed book.

Bank Reconciliation Exercises and Answers - Petty Cash Log

Bank Reconciliation Exercises and Answers - Petty Cash LogAfter this exercise Rose decides she must check her bank account online more often, every day even, to make sure the Cashbook is as close to agreement as possible with what it says at the bank so that there are less adjustments to make at the end of the month.

Facebook Comments

Leave me a comment in the box below.