- Home

- Bookkeeping Basics

- Accounts Receivable Procedures

Accounts Receivable Procedures

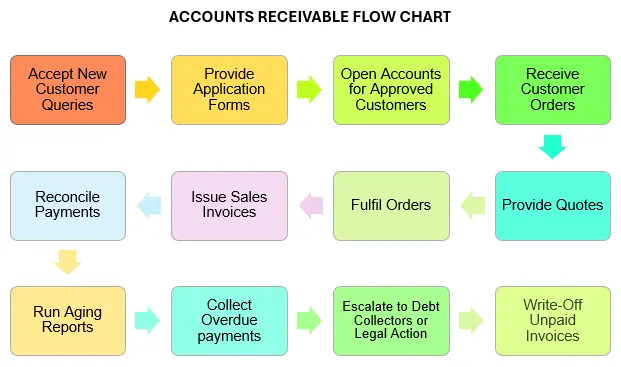

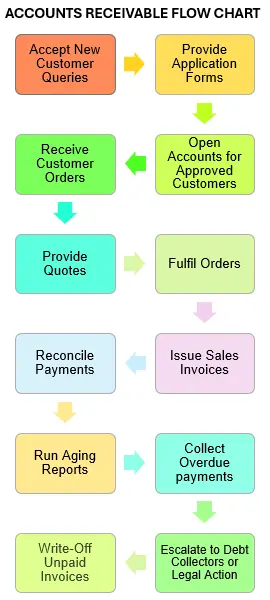

These accounts receivable procedures are designed to assist you with managing sales to customers on credit, starting from the time you engage a customer through to final payment.

A streamlined process contributes to a healthy cash flow, fewer debtors and stability for your business.

A healthy cash flow means you can pay your bills and grow the business, so it makes sense to invest time in establishing these known steps to navigate the somewhat complex cycle of receivables, whilst fostering happy customers.

You can avoid some of these steps by only selling to customers who pay upfront, but your business type or industry may not afford you this option.

Accounts Receivable Procedures

Table of Contents

- Effectively manage accounts receivable (AR) customers

- Setup a good accounts receivable software system

- Establish easy to follow invoicing processes

- Accurately record payments received

- Stay on top of collecting overdue payments

- Regularly monitor your receivables: use key metrics

- Write-up receivables policies and procedures

1. effectively manage accounts receivables customers

Here are the steps to take when receiving a query from a new customer who is interested in buying your goods or services on account:

customer accounts

Send them an application form to open an account with you, together with a copy of your terms and conditions.

account application forms

The customer must complete, sign and return this form to you. It will include questions like:-

- Their business name and address

- Contact details of their accountant or bookkeeping manager.

- The names and telephone numbers of three trade referees whom you will call to check your new customer’s payment history.

- The full names of the business directors.

- A paragraph indicating they should read the attached terms and conditions of sale.

- A place for them to sign their acknowledgement of such.

terms and conditions of sale

This document details the terms and conditions relating to the sale of your products or services, including:-

- What date you expect payments to be made by, such as 1st of the month following date of invoice, or with seven days.

- Acceptable payment methods: cash, check, credit card, bank transfer.

- How much interest you will charge on late payments - a reasonable amount is 1% to 2% of the outstanding balance, or a flat fee of about $15, but research your industry.

- The fact your customer will be responsible for any debt collection fees if you have to use an agency to recover overdue payments.

This makes it plain to the customer what to expect and gives you good footing if you have to hand them over to a collection agency.

Keep the terms consistent across the board with all customers, although you can be flexible with long-term, good paying customers.

Contact an attorney for a suitable template or get some detailed help from online places such as iubenda.

This makes it plain to the customer what to expect and gives you good footing if you have to hand them over to a collection agency.

Keep the terms consistent across the board with all customers, although you can be flexible with long-term, good paying customers.

Contact an attorney for a suitable template or get some detailed help from online places such as iubenda.

What to do after approving the receivables customer

Once you have approved their application, you can allocate them a unique ID number from your CRM (customer relationship management) system or your spreadsheet of ID numbers, but this is optional. ID numbers are useful to large companies with hundreds of customers.

Finally, enter the new and approved customer’s name, delivery and billing addresses, email address and phone numbers into your receivables software along with their ID number. Most of these details will be inserted to the sales invoices automatically by your system.

Accounts Receivable Procedures

Accounts Receivable Procedures

2. setup a good aR software and system

Choose the right software: You need a system that makes it simple to:

- Setup a basic customer database

- Prepare and send quotes or orders or sales invoices

- Provide easy payment links

- Apply payments received to the invoices

- Run aging reports and monitor outstanding balances

Customer Database: the software will build your customer list as you enter their names and allocate email addresses, physical addresses, contact numbers and more. You will be able to select names from the list as you do your invoicing.

Invoicing Template: the settings will provide a place you customize an invoicing template to suit your branding colors, fonts and logo together with your contact details to show on all sales invoices.

Applying Payments: involves reconciling the bank accounts to allocate payments to the appropriate invoices.

Aging Options: Aging means grouping unpaid invoices based on how long they are overdue. Your software system will let you select aging periods for your aged receivables report, such as 1 Month, 2 Months, 3 Months and Older, or 1 Week, 2 Weeks, 3 Weeks and Older, in separate columns with the total due in each column/aging period. This makes it easy to see right away which invoices need priority for chasing up payments.

Your selected software can make it easy to send your invoices by email or directly to your customers’ bookkeeping software (they will receive them as bills) so long as they have the same software and are signed in to the network for this to happen. For example:

Notes Receivable vs Accounts Receivable

Notes receivable: are formal promises noted on legally binding documents for paying off long-term debts such as finance loans and will indicate the payment details such as expected amounts, due dates and interest.

Accounts receivable: amounts become due for payment after the issuing of sales invoices, which are not as formal as notes receivable and come with an expectation of payment over a short-term. The conditions of payment are usually agreed to in prior arrangements between the business and customers.

3. establish sales invoicing processes

The sales invoicing process is a core feature of your accounts receivable procedures. The process can include some or all of the following depending upon your expectations:

Provide Quotes: If a customer asks for a quote to do a job you can issue the quote from your receivables system, which, if accepted can then be turned into an invoice.

Receive Customer Orders: Customers may give you written orders with unique numbers every time they buy a product or request a service. Enter the order into your software with their unique order number as a sales order. This can then be later turned into a sales invoice. Or, enter it as a draft invoice if your software doesn't have an Orders feature.

Track Chargeable time and products: You can enter your work-in-progress (WIP) into “time-billing” if your software has that option. The hours can be pulled onto sales invoices. Otherwise, track the in a spreadsheet or your diary and type into the sales invoices.

When to Invoice: Usually upon completion of a job or straight after a product has been delivered. If you have a lot of customers you can set one day of the month to work through all the invoicing to send them all out at the same time. You may be able to send work-in-progress invoices for jobs that take more than a month.

Payment Terms: Your sales invoices must clearly show the date you expect to be paid by and the methods of payment acceptable to you including your bank account number.

Important Notes: Put a note at the bottom of the invoices letting your customers know the reference number that you want quoted when payment is made, usually your Invoice numbers, and that interest will be charged on overdue invoices (if that’s what you do).

Manage Credits: if a customer returns goods for a credit or they have overpaid, or you have given them a credit for some other reason, apply the credit to any new invoice in your bookkeeping software to reduce the balance the customer owes.

Invoice Approval: If an employee prepares the invoices, a manager or the owner should look them over to approve before giving the go ahead to send to the customers.

Invoice Delivery: The most obvious method is by email, but as mentioned previously, you can also use the system-to-system method or physically posting. Your goal is to email invoices out several days ahead of the date you expect payment, or if posting, send them out a week before. This gives customers time to process the invoices in their payables system.

Some businesses have a cut-off date for receiving invoices every month so if your invoice is late according to them, you probably won’t be paid until much later. Be prepared for negotiating an arrangement that is acceptable to you both.

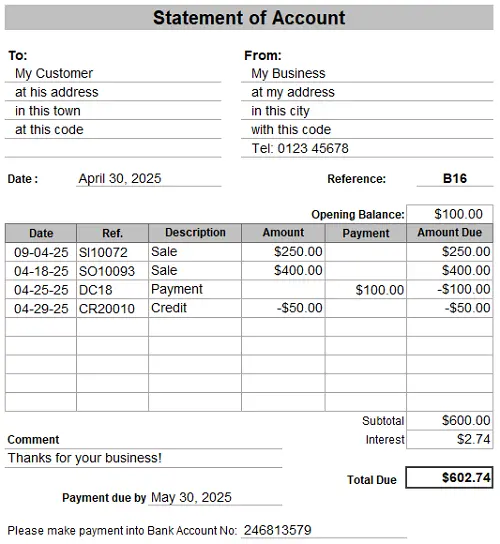

Statements of Account: If a customer has several invoices to pay, send them a statement of account at the end of the month (or whatever date is relevant for your industry) listing all the invoices awaiting payment. The customer will check the Statement and ask you for any invoices they might be missing, though you could actually email through all the invoices again with the Statement to avoid delays.

Awaiting Payments: Finally, you will apply payments received to the invoices to ‘close’ them off. Part-paid and unpaid invoices will remain in an ‘open’ state in your system and will be shown on the Aged Receivables Report.

Calculate and Apply Interest: if you have warned a customer about applying interest to invoices that are overdue for payment, calculate that and enter it to your software.

If you are keeping records manually, download and use the free Accounts Receivable Ledger in Excel to record your list of sales invoices and payments.

4. accurately record payments received

No matter what your accepted methods of payment are, you must apply all payments received to the correct invoices in your system to close them off.

This is achieved by frequently depositing cash or checks to your bank and regularly reconciling your bank accounts and payment processors such as Stripe or Paypal.

cash or check deposits

If customers pay you checks or cash, keep a good record of which invoice numbers these cover, so that when you reconcile your bank account you won’t forget which invoices your deposits are for.

Your bookkeeping software may allow you to receive payments against the invoices into one deposit group ready for you to reconcile later.

Accounts Receivable Procedures - Customer Statement

Accounts Receivable Procedures - Customer Statementreconciling Accounts receivable

This involves checking your bank and updating your system with payments received.

Your receivables software will let you select the correct invoice for each payment you see on your bank statement or in your online banking, instantly closing off those invoices.

If any customer pays an amount that doesn’t match the invoice they owe, apply it to the invoice anyway and then contact them to find out why the difference. An overpayment will show as a credit against the customer's account ledger.

If any customers have a credit from a sales return or from an instance described above, apply the credit to an existing unpaid invoice to reduce the amount owed. Or contact the customer and ask if they want a refund to their bank account.

Once your system is up to date you can check who still owes you money and start your collections process.

5. stay on top of collecting overdue payments

The collections process is a vital feature of your accounts receivable procedures.

It should begin a few days after the due date has passed and be checked on a weekly basis.

This involves running a receivables aging report to see who hasn’t paid.

You will work down the list and contact those customers to find out why they haven’t paid and establish when they will be paying.

Keep notes of what they say and when they say they will pay and check the bank again at that time.

This process may escalate from polite emails and phone calls to letters of demand and finally handing them over to a collections agency.

Collecting overdue payments can be a frustrating exercise if you are struggling with cashflow and having to deal with “difficult” non-paying customers. Consider giving your overdue invoices to receivable specialists to manage collections.

6. regularly monitor receivables: use key metrics

As a business owner you should be looking at receivables from an executive point of view, which involves:

regular analysis of your accounts receivable data

- get an updated aging report every week

- review specific feedback about each overdue customer who has been contacted over the past week, and what the result of those conversations were (paid in full, part paid, unable to reach etc.)

- make decisions about how to move forward with these customers – i) strategic calls from the business owner or ii) blocking further sales to them or work for them iii) handing them over to debt collectors.

looking at key performance indicators

This involves calculating a few metrics with formulas to help you see how well the business is performing with collecting payments and what needs improvement. The formulas are in orange. The dash (-) means minus and the slash (/) means divide.

- Average Accounts Receivable: Is the average amount owed to your business by your customers for a selected timeframe:

Average AR = (Beginning Accounts Receivable + Ending Accounts Receivable) / 2

- Net Credit Sales: Your total sales made on credit.

Net Credit Sales = Gross Credit Sales - Returns - Allowances - Discounts

- Accounts Receivable Turnover Ratio: measures how efficiently you convert your accounts receivable into cash within a selected timeframe. A higher ration indicates better efficiency at collecting payments.

AR Turnover Ratio = Net Credit Sales / Average Accounts Receivable

- Debtor Days (Day Sales Outstanding DSO): shows the average number of days t takes your business to collect payments from its customers. The lower the number of days it takes, the better.

DSO = 365 / AR Turnover

7. writeup accounts Receivable Procedures and policies

Write down all the steps of your accounts receivable procedures and decide which person in your business will handle each aspect based upon their role in the business.

Include this in your overall Policies and Procedures file and ensure every new employee reads them and follows along as closely as possible.

Keep them in an easy to find filing system to be accessed anytime required.

These will be constantly updated as issues are addressed and improvements made.

Your receivables policy should include the following:

- What the credit criteria is for approving customers

- How to manage initial customer contact

- The process for sending application forms

- Contacting the customers’ trade referees

- Approving and adding customer details to the receivables system or

- Declining the customer and managing communication regarding this

- The steps for invoicing and collecting payments

- How to handle payment disputes

To Summarize...

Well-defined accounts receivable procedures ensure your credit sales run smoothly.

Implement a good structure to manage customer accounts, consistent invoicing processes, and efficient tracking and collecting of payments, to help your business minimize overdue receivables, maintain happy customers and positively impact cashflow.

Regularly monitor your aging report and key metrics, such as the accounts receivable turnover ratio, to assess the effectiveness of your receivables management and to help you make any necessary adjustments for improvement.

Hold it all together with written receivables policies to keep your team aligned and to maintain consistent but adaptable procedures.

By following these accounts receivable steps, you can help your business remain financially stable and contribute to its overall success.

FAQ

What is accounts receivable in simple words?

What is accounts receivable in simple words?

Accounts receivable is money owed to a business by its customers, who ordered and received goods or services, but have not yet paid.

What is accounts receivable vs payable?

What is accounts receivable vs payable?

Receivables is money owed by customers. Payables is money owed to vendors and suppliers.

Is accounts receivable an asset or liability?

Is accounts receivable an asset or liability?

It is a current asset on the balance sheet.