- Home

- Profit and Loss

- Accounting Profit

Accounting Profit and Loss

Calculating an accounting profit or loss has to be done by all businesses of any size, from the small solopreneur blogger to the large enterprises and corporations. Why?

It shows if the business is making money or losing money..

..this is kind of important!

A profit and loss report is also known as an income statement - they mean the same thing and show the same information but the wording is different depending where in the world you are.

The profit and loss report | income statement is the most important and basic of reports that any business should produce, and is not very difficult to do.

How to Calculate Account Profit

A business cannot show a profit at the same time as a loss. It can only be one or the other.

To calculate the accounting profit or loss you will:

- add up all your income for the month

- add up all your expenses for the month

- calculate the difference by subtracting total expenses away from total income

- and the result is your profit or loss

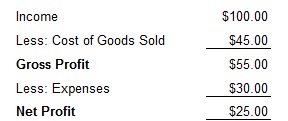

See these examples:

See how the loss is shown with a negative sign. Another method is showing the numbers in red -$25, or in brackets like this ($25).

What kinds of accounting profit are there?

There are two kinds of accounting profit. They are:

- Gross profit

- Net profit

Gross if the result of deducting the cost of goods sold from the income.

Net is the total after deducting expenses from the gross profit.

Here is a quick example that includes cost of goods sold:

Income and expenses

Having a loss to avoid paying taxes might sound appealing but it's not so good for the financial well-being of the business.

Income

The income on the profit and loss report includes money derived from:

- the sale of services

- the sale of products

- or funds from other income such as interest earned on savings at the bank

Expenses

The profit and loss statement shows only deductible expenses.

Deductible expenses (overheads) are those expenses that your tax department has approved the use of to reduce the net profit.

The amount of tax your business pays is calculated on the net profit.

The higher the profit, the higher the tax.

Non Deductible expenses are not included on your profit and loss.

They are instead shown on the balance sheet and include things like:

- loan repayments

- inventory

- tax

- owner's drawings

- investments

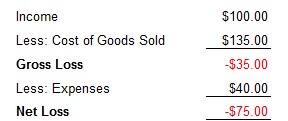

Here is an example profit and loss report showing the Gross and Net losses

If the report shows a gross loss as in the example above, this means there is not enough money to cover the overheads of the business and that the following could have occurred:-

- The mark up on the sales price is too low

- There are too many discounts being given to customers

- Not all direct costs have been on-charged to the customer as they should have been

A review of the systems in place will be necessary to correct these problems and save the business from financial ruin.

How often to calculate the accounting profit

A profit and loss report | income statement should be prepared regularly during the financial year for the business owner to analyze.

A minimum of once a month is recommended.

If you struggle with this, then outsource your reporting to a bookkeeping expert who can prepare the report and also give you an explanation of what is happening with your business financials.

Note also, these monthly reports won't show expenses such as depreciation of fixed assets (unless you use accounting software such as Xero that allows you to process the deduction every month) but it can be left to be calculated by an accountant at the end of a financial year.

Depreciation is inserted underneath the Net Profit and deducted to show the Taxable Profit.

Terminology

Here are some alternatives to the various terms used:-

Profit and Loss Report = Income Statement

Income = Revenue

Cost of Goods Sold = Cost of Sales or Direct Costs

Loss = Deficit

Expenses = Overheads

Profit = Surplus