- Home

- Double Entry Bookkeeping

- Accounting Journal Entries

Accounting Journal Entries

Journal Entries Examples

The accounting journal entries on this page will show you what journal entries look like, how they affect the business bookkeeping and how you can use them for your benefit.

The examples further down this page represent the typical types of transactions that most small businesses carry out.

Our examples are based on a flower shop called Rose and Flower, owned by Rose (purely fictional).

Every time Rose does something for the business - like buying stock or paying for advertising - the transaction is recorded into the bookkeeping software.

On the front-end of the software, she will probably be looking at the bank transactions page, where she will enter a transaction and allocate it to the correct account on the chart of accounts.

What she doesn't see is the software making a journal out of this entry in order to get the books to balance (double-entry bookkeeping).

You will see from the list of accounting journal entries examples how journals work with debits and credits.

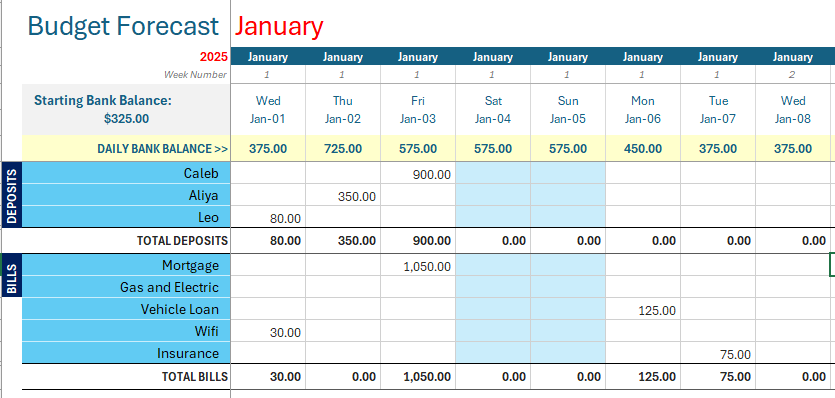

Click above button to get our most popular Excel Template for easy bookkeeping! It's free.

To view a full list of the example transactions and their related journals in date order, tap the download button.

This opens a pdf document which you can save to your computer and print out.

How Accounting Journal Entries benefit small business owners

If you buy something for your business using personal money, you can bring it into the books with a journal.

- This by-passes the business bank account (because you don't want the bank balance in the software to be affected when you enter this transaction that comes from a completely different source of funds).

- You can ensure that when you spend money on your business from your personal funds, you are accounting for these expenses, which reduces your profit, which reduces how much tax you have to pay to the government. It also gives a true reflection of how much is being spent on business expenses.

Recommended: Go here to practice your own journal entries in our on-screen software, or download the practice templates to practice on your computer or device.

The bookkeeping software that you use might already have a specific way to deal with these types of transactions so check the help documentation.

If you can't find a specific method, then look for anything that mentions journals...

...such as 'accounting journal transactions' or 'journal entries'.

You will add a new journal entry/transaction.

The details of a journal entry

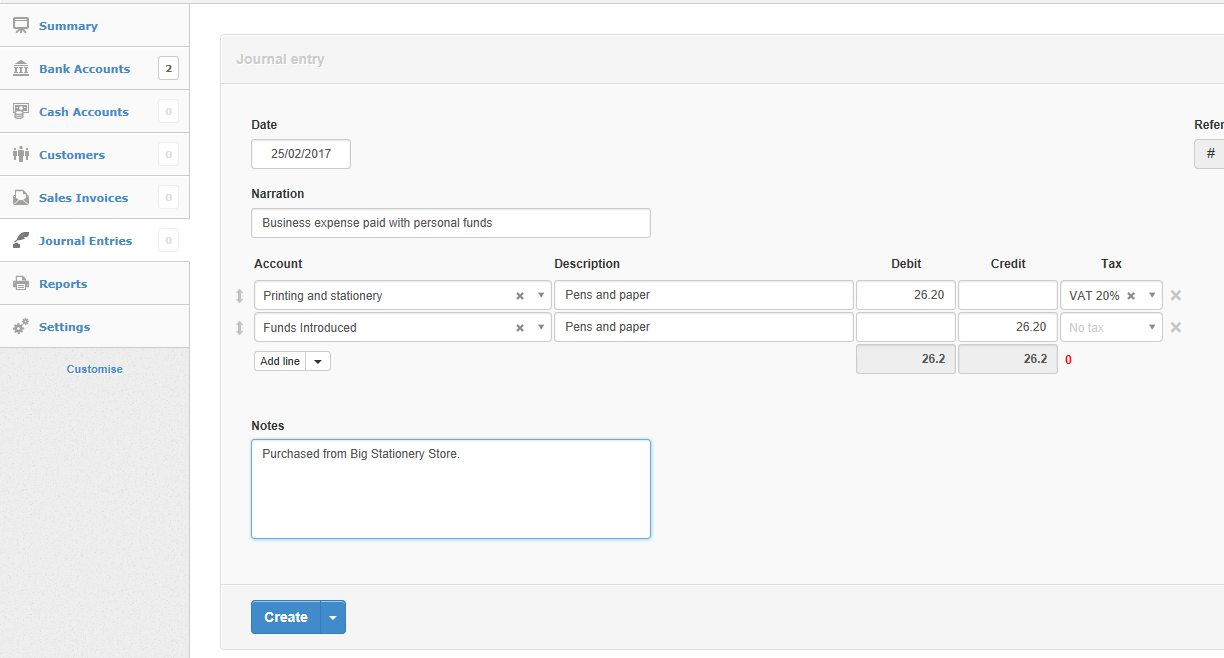

The journal transaction window will include:

- a narration where you can enter something like 'Business expense paid with personal funds'

- a date - use either the date of the transaction or the last day of the month in which the transaction occurred

- a debit account - select the account that reflects the type of expense, put a description of the item purchased, and enter the cost into the debit field

- a credit account - select Owner's Capital (also known as Funds Introduced), put the same description, and enter the exact same cost into the credit field

- the debit value and credit value must be the same; the software won't let you close out if they don't balance

- if you have to account for sales tax, make sure it is included on the expense, but not the Capital (sales tax on Capital is not required) - your software will either let you select the relevant sales tax, or you will have to enter two debit lines, one for the expense cost before sales tax and one for the amount of sales tax

Here is a screenshot of an accounting journal entry using Manager accounting software (a free software that can be used no matter what country you live in; you can set up the sales tax specific to your country).

Examples of Accounting Journal Entries

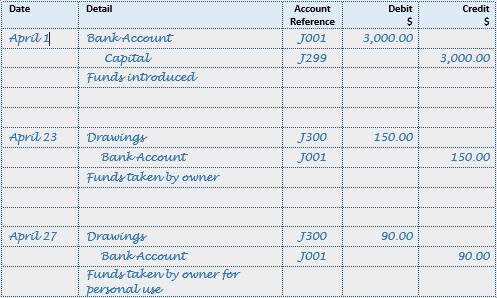

Capital and Drawings

On April 1st Rose deposited $3,000 of her personal funds into the business bank account to help get the business up and running.

On April 23 Rose took $150.00 to buy groceries for home.

On April 27 Rose took $90.00 to pay the vet for her cat’s vaccination.

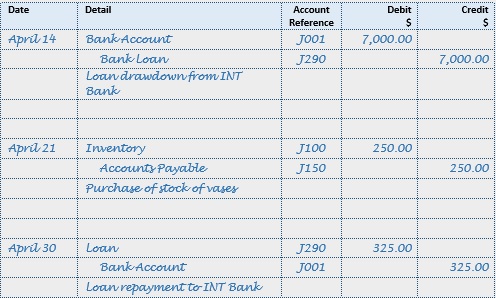

Liabilities

On April 15 Rose secured a business loan from her bank for the business for $7,000.

On April 21 Rose had to purchase more vases from Vase Co. these were bought on credit to the value of $250.00.

Also on 30 April the bank took their first loan re-payment of $325.

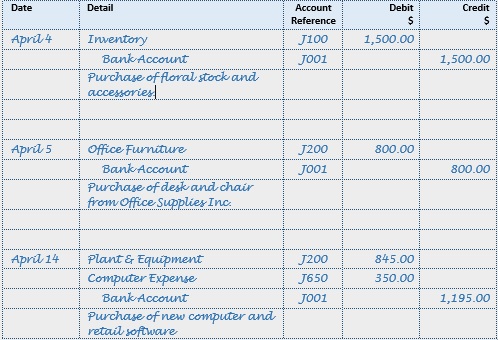

Assets

On April 4 $1,500 was paid to Flowers Wholesale for initial stock of various flowers and vases.

On April 5 a desk was brought from Office Supplies Inc. for $800.00

IT Experts was paid $845.00 for set up of new computer and retail sales software of $350 on April 14. (The asset here is the computer, not the software).

Income

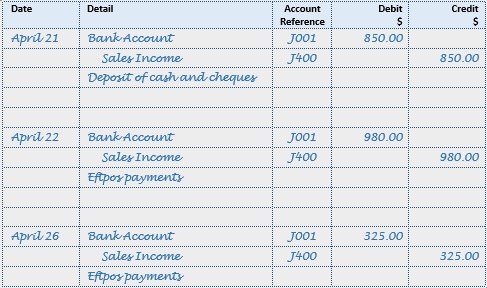

$850 of cash and checks/cheques was deposited into the bank.

More sales on April 22 for $980.00.

and on April 26 more sales/income paid into the bank for $325.00.

Expenses

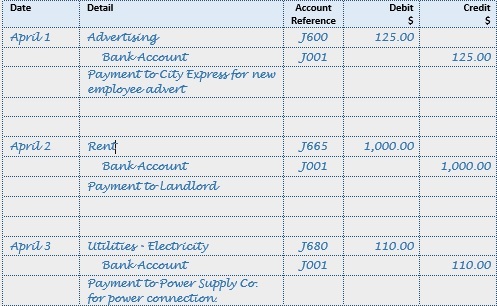

The City Express was paid for an advert placed in their paper on April 1 for a shop assistant.

On April 2 a rent deposit was paid to the landlord for $1,000.00

On April 3 $110 was paid to the power supply company for power connection.

Petty Cash

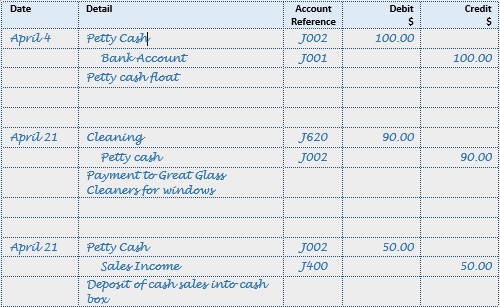

On April 8 Rose got $100 from the bank for the petty cash float.

On April 21 was shop opening day. Great Glass Cleaners were paid $90 for sprucing up the windows the day before (20 April).

$50 of sales was placed into Petty Cash

Facebook Comments

Leave me a comment in the box below.