- Home

- Double Entry Bookkeeping

- Accounting Equation

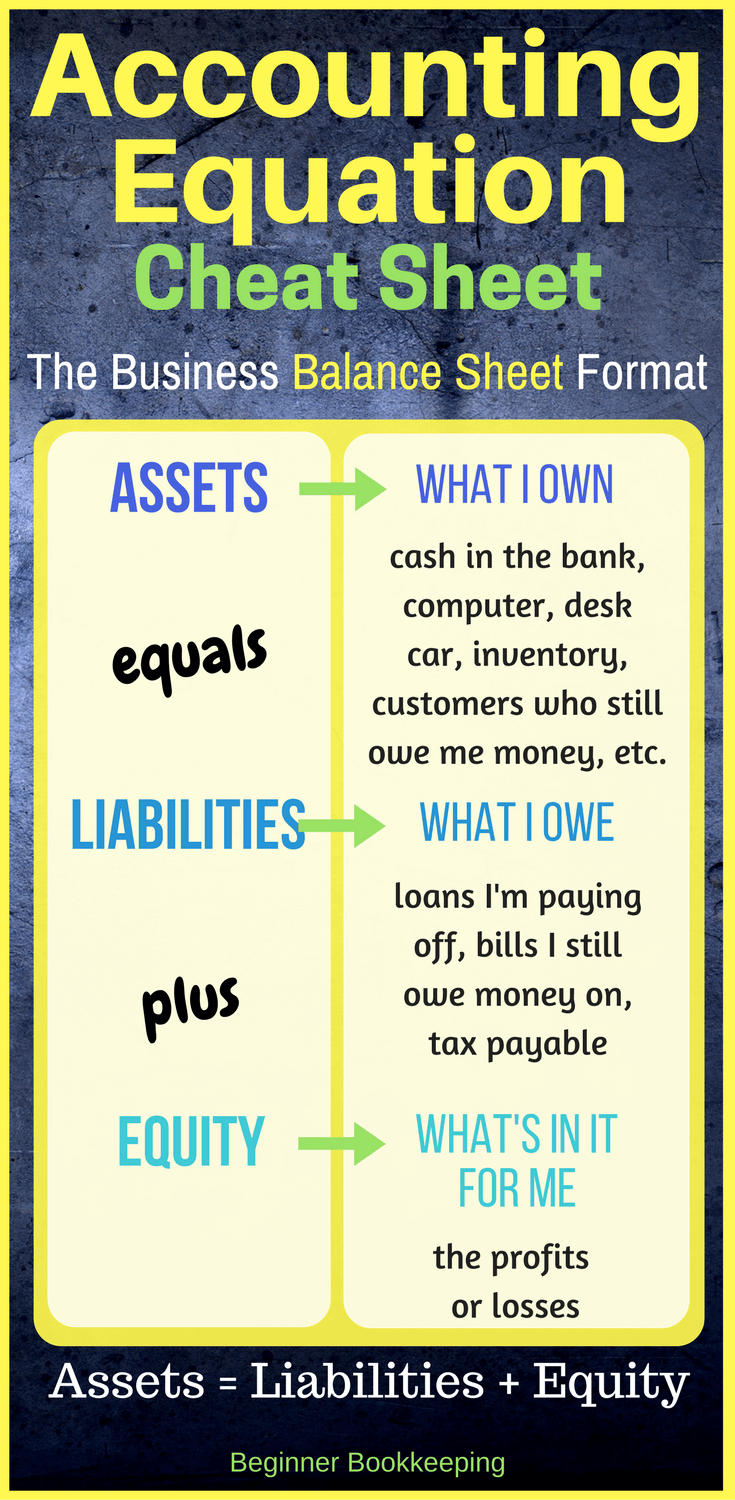

The Accounting Equation

The mathematical principle for double entry bookkeeping is the Accounting Equation.

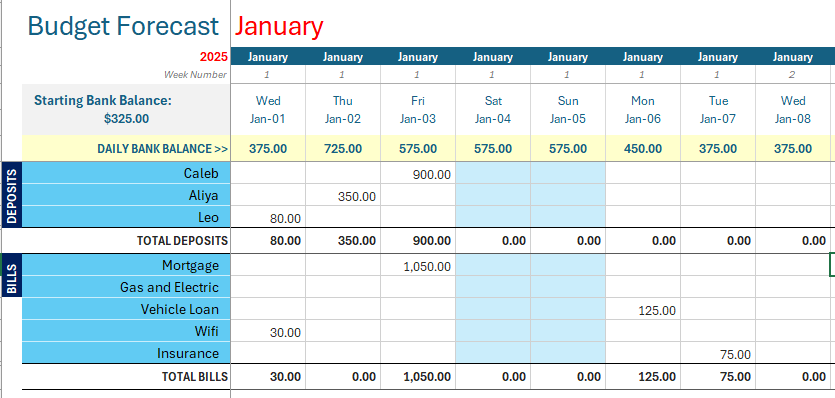

Click above button to get our most popular Excel Template for easy bookkeeping! It's free.

If about now you want to run a mile because math isn’t your thing... don’t worry! You don’t have to be a mathematical genius to do bookkeeping.

Bookkeeping is about organizing numbers into categories which are then totaled.

You can use a calculator for that...!

...and the Accounting Equation is about classifying the values from business transactions into separate bookkeeping accounts.

Each value is entered twice in such a way that keeps the equation balanced.

Here is the Accounting Equation:-

Assets = Liabilities + Equity

You can memorize it by shortening it to ALE.

A assets ............ are what the business owns.

L liabilities ......... are what the business owes.

E equity .. ......... represents the ownership of the business (the profits or losses).

Lets break it down....

Equity

When starting a business the owner introduces assets such as cash and office equipment used within the business to generate more assets... such as cash and office equipment.

Equity is the ownership of the assets of the business by the owner.

So the start of the accounting equation is :

assets = equity

Alya introduces personal cash to her business

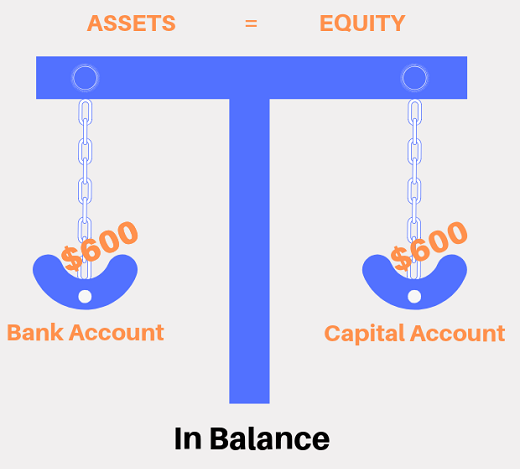

If Alya contributes $600 of her personal cash to her business so that it can operate, the entry in the accounting books would change both the asset account and the equity account, increasing each account by $600.

The asset account is the business part (the cash it now has in the Bank Account) and the equity account is Alya's part (the personal cash she has given to the business which is recorded in the Capital account).

These two accounts are on the opposite side of the accounting equation to each other so it keeps the ledgers balanced.

Alya may at any time introduce more cash in which case the asset and equity accounts will equally increase, thus maintaining the accounting equation balance.

Alya may also chose to withdraw cash for personal use in which case assets and equity will decrease equally.

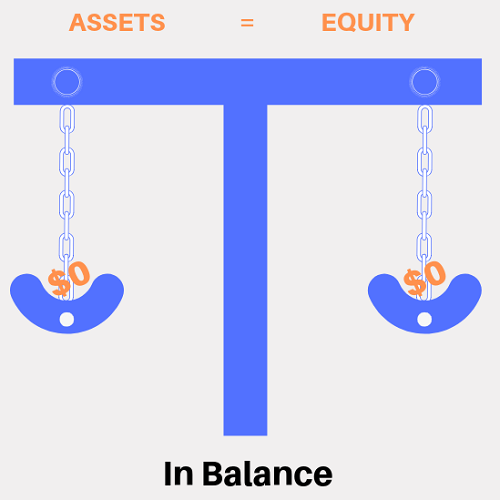

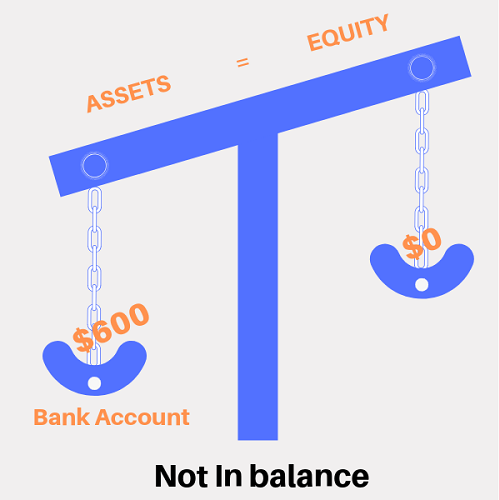

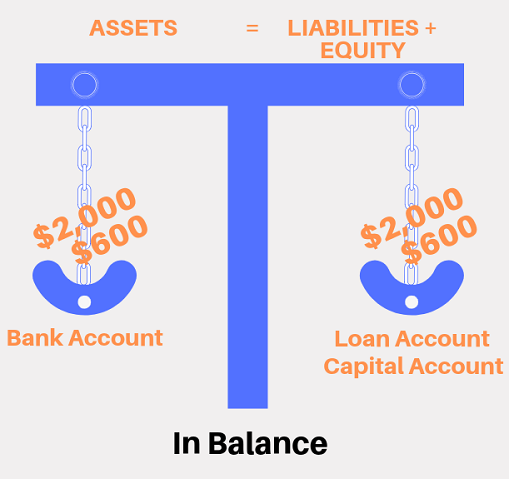

Here are two diagrams to explain it a bit further.

1. accounting equation starting balance

The first diagram shows our scale with no balances in it. It is in balance because both sides have a nil balance ($0).

2. The first Entry: Increasing the Asset

This second diagram shows just the Asset entry, which is the money in the business Bank Account. See what has happened to the scale - it has tipped upward. This is the only entry so it is out of balance, because in double-entry bookkeeping there should be a second entry which will go on the other side of the equation where the Equity is.

3. the second entry: Increasing the Equity

Now we see what happens to the scale when we enter the $600 the second time on the other side of the accounting equation into the Capital Account increasing this account. It now balances.

Now let's look at what happens if we introduce a Liability into the equation.

Liabilities

The dictionary definition of liable is ‘responsible by law: legally answerable’ (Oxford University Press).

A liability is a financial obligation. The business is legally responsible for the financial obligation.

The obligation could be:-

- Money owed to suppliers/vendors for goods and services purchased (accounts payable).

- A loan that the business is paying back. A loan that takes more than a year to pay back is called a long term liability.

Alya gets a bank loan

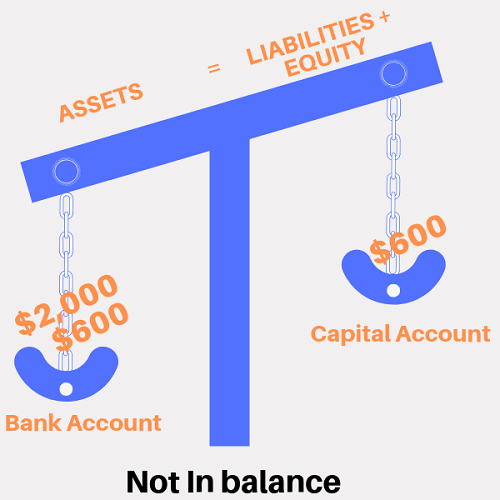

Let's see how the accounting equation is kept in balance if Alya gets a loan from the bank of $2,000 so she can buy equipment.

The two accounts affected by this loan transaction are Bank Account and Bank Loan.

The Bank Account is the Asset.

The Bank Loan is the Liability.

Because Assets and Liabilities are on different sides of the equation to each other the books will balance when the values are entered into the bookkeeping ledgers.

Here are the diagrams to demonstrate this.

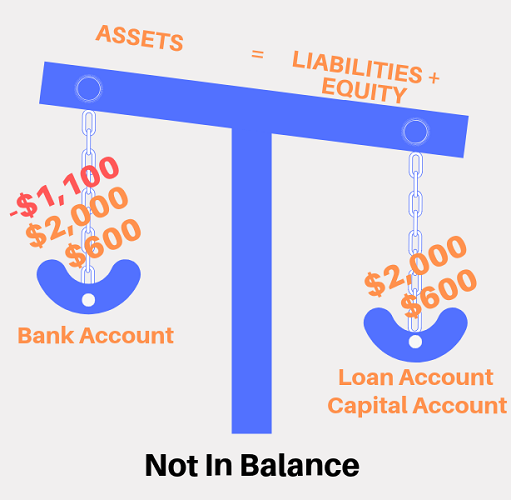

1. The first entry: increasing the asset

Here we see what happens to the equation when Alya receives the $2,000 cash loan into her business Bank Account from the bank. However, it doesn't balance yet because we have only made one entry. This is double-entry bookkeeping so we need to make a second entry of the same amount.

2. The second entry: increasing the Liability

We make the second entry of $2,000 onto the other side of the equation into the Liability account which increases it, which is the Loan Account.

Now there is $2,600 on the left and $2,600 on the right, so the ledgers balance.

Alya uses the cash loan from the bank to buy a computer for the office. Let's see what happens next.

Assets

These are items that have a money value and belong to the business.

What items can a business own?

There are five common divisions:-

1. Current assets

Cash - in the cash box or the bank

Money owed to the business (accounts receivable) by its customers

Short term investments such as a term deposit that matures within a year.

2. Fixed Assets

These are all tangible assets that have a physical, touchable form and can also be grouped under the heading plant:-

- Workshop equipment

- Buildings

- Land

- Vehicles

- Office equipment

- Furniture and fittings

Fixed assets are used in the operation of the business for more than 12 months, and usually for several years.

3. Intangible Assets

These assets have a value to the owner but are not a physical or touchable item. They include:

- Trademarks

- Goodwill

- Copyrights

- Patents

4. Inventory

This represents the items in stock that you buy and sell.

5. Long Term Investments

Typically money belonging to the business that is not used in the running of the business but is invested elsewhere, and is not expected to be converted to cash within a year. For example:-

- Stocks

- Bonds

- Investment in another business

alya gets a computer

Alya uses the money in her Bank Account to buy a computer - this is an Asset.

1. the first entry: decreasing the asset

Alya spends $1,100 from her business Bank Account; as this is money going out of the bank, the Asset (Bank Account) must decrease.

In this diagram you can see the amount entered in red with a minus sign in front of it to show it is money leaving the Asset side of the Equation - so the total is $1,500, which causes the Accounting Equation to go out of balance because the other side of it still has $2,600.

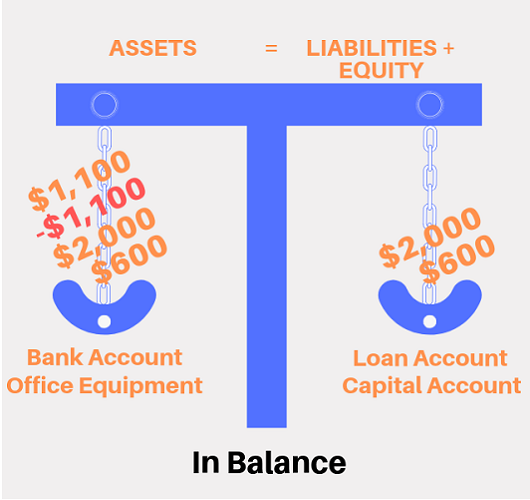

2. the second entry: increasing the asset

This is double entry bookkeeping! We must enter the $1,100 a second time. But wait! Office equipment is also an Asset, so the $1,100 will be entered again onto the Asset side but into a different Account - the Office Equipment account. This takes the total back up to $2,600 and brings the Equation back into balance.

All we've done is shift the amount from one Account to another Account on the same side of the Equation.

Revenue and Expenses

There are two other important bookkeeping accounts that are not represented in the accounting equation because they are temporary accounts:-

- the revenue account

- the expenses account

At the end of a financial year the difference between the revenue and expenses will be assigned to the equity account. The difference might be a profit or a loss.

The revenue and expense accounts will then be cleared with a special adjustment to start fresh with no balances in the new financial year, which is why they are called temporary accounts.

The equity, assets and liability accounts are not cleared at the end of a financial year and so are called permanent accounts.

However, the equity account will change as a result of the special adjustment which moves the profit or loss into it.

The accounting equation is the basis upon which the financial condition of a business is presented through means of a bookkeeping balance sheet.

The accounting equation is a fundamental part of business bookkeeping.

Take the Quiz!

Test your knowledge on what you have read here about the Accounting Equation.

Take the Quiz!

Test your knowledge on what you have read here about the Accounting Equation.

Facebook Comments

Leave me a comment in the box below.